Latest Shareholder Activism Research

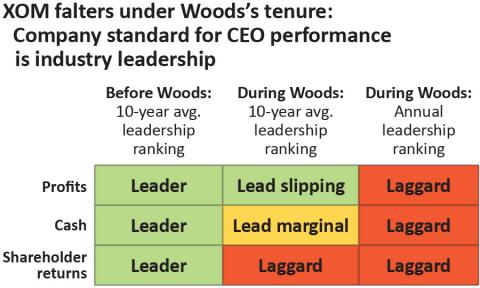

See more >IEEFA: Calls are mounting for a new direction and new chief executive for ExxonMobil

December 16, 2021

Tom Sanzillo

Analysis

IEEFA Poland: PZU’s stance on coal makes no sense either for Paris Agreement or for its shareholders

November 18, 2021

Nick Holmes

Analysis

IEEFA: Months after tumultuous ExxonMobil annual meeting, no substantial change expected

August 06, 2021

Tom Sanzillo

Analysis

IEEFA U.S.: Prices are up—but the oil industry’s return is more complicated

July 15, 2021

Tom Sanzillo, Clark Williams-Derry

Analysis

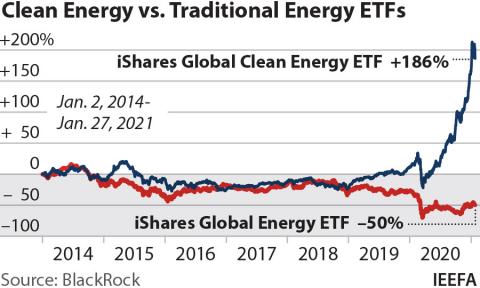

Capital markets are shifting decisively towards cleaner investments

February 09, 2021

Trey Cowan

Analysis

IEEFA: After a terrible 2020, the oil industry’s story has turned political

January 08, 2021

Clark Williams-Derry, Tom Sanzillo

Analysis

IEEFA: NYS Comptroller DiNapoli’s bold divestment plan may inspire investors to follow suit

January 07, 2021

Tom Sanzillo

Analysis

IEEFA update: Three major pipeline projects are scrapped in short order

July 08, 2020

Tom Sanzillo, Suzanne Mattei

Analysis

IEEFA update: With COVID-19, energy markets are turning towards clean energy investments

April 06, 2020

Bruce Robertson

Analysis

IEEFA update: BlackRock to investors: sustainable portfolios provide stronger risk-adjusted returns

January 30, 2020

Tom Sanzillo

Analysis

IEEFA update: How should shareholders react to New York’s ExxonMobil lawsuit?

October 29, 2018

Tom Sanzillo, Kathy Hipple

Analysis

Latest Shareholder Activism Reports

See more >Latest Shareholder Activism Press Releases

See more >IEEFA U.S.: Experts offer testimony on Maine fossil fuel divestment planning

February 28, 2022

Press Release

IEEFA U.S.: Colorado legislature considers bill to divest state pension fund from fossil fuels

April 20, 2021

Press Release

IEEFA U.S.: Fracking companies in Appalachia struggle financially

July 17, 2019

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.