Latest Green Bonds Research

See more >

Takeaways from Enel’s sustainability-linked bonds performance targets

March 25, 2024

Kevin Leung

Analysis

I risultati degli obiettivi di performance dei sustainability-linked bond di Enel

March 25, 2024

Kevin Leung

Analysis

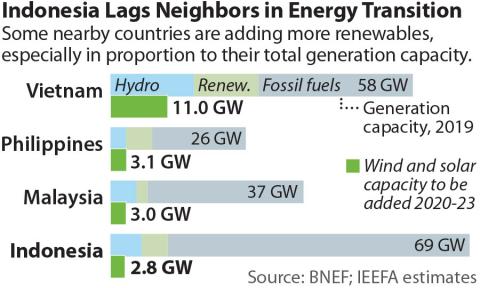

Will the new Indonesian Taxonomy for Sustainable Finance really serve its national interest?

February 27, 2024

Ramnath Iyer

Insights

Beyond COP28: Financial institutions should adopt nuanced transition finance frameworks to support net zero

February 13, 2024

Kevin Leung

Analysis

EPH’s transition plan faces heightened scrutiny after new bond issuance

December 07, 2023

Kevin Leung

Analysis

Indonesia signals it could abandon science-based taxonomy for coal power plants

September 05, 2023

Christina Ng, Putra Adhiguna

Analysis

Rating stability at risk from looming climate downgrades

August 21, 2023

Hazel Ilango

Analysis

More credit downgrades imminent under climate change but credit model overhaul yet to be seen

April 18, 2023

Hazel Ilango

Analysis

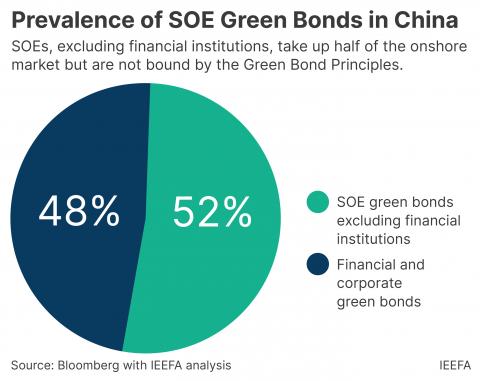

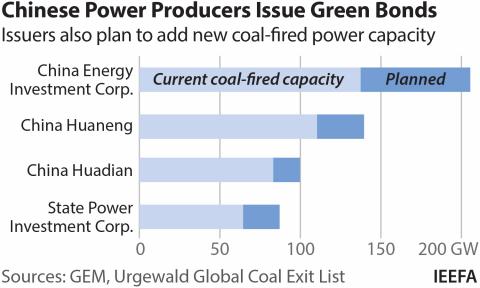

China is building a more credible green finance market but state-owned enterprises’ green bonds are in the way

November 29, 2022

Christina Ng

Analysis

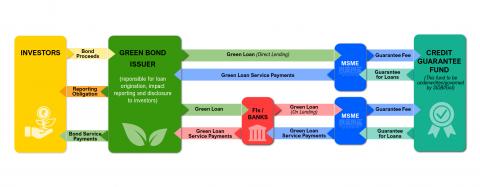

How to mobilise green finance for Indian micro, small and medium enterprises

November 24, 2022

Saurabh Trivedi, Labanya Prakash Jena

Analysis

India marks a sustainable finance milestone with release of sovereign green bonds framework

November 15, 2022

Shantanu Srivastava, Christina Ng

Analysis

A 'greenium' matters for India's first sovereign green bond issue

November 09, 2022

Shantanu Srivastava, Venkatakrishnan Srinivasan

Analysis

Latest Green Bonds Reports

See more >

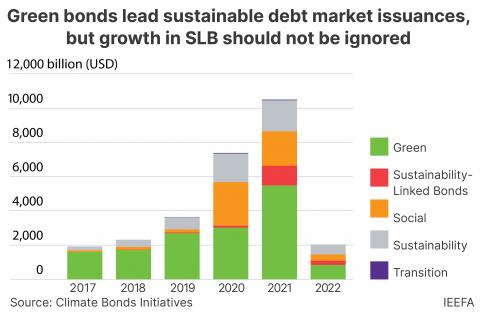

Will Europe’s new standard help or hinder green bond market growth?

February 19, 2024

Kevin Leung

Report

Issuers of sustainability-linked bonds could step up efforts to enhance investor confidence

August 18, 2022

Wai Ming Chang

Report

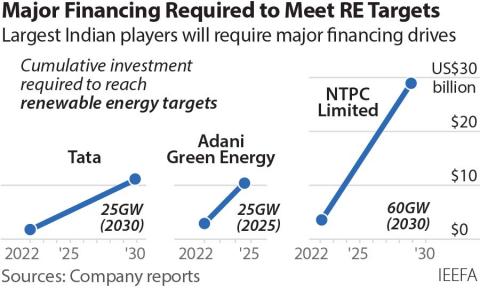

Funding requirements and avenues for three leading energy companies

October 19, 2021

Shantanu Srivastava

Report

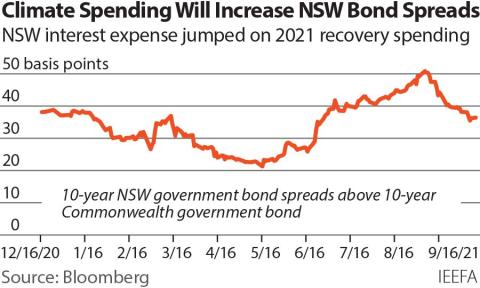

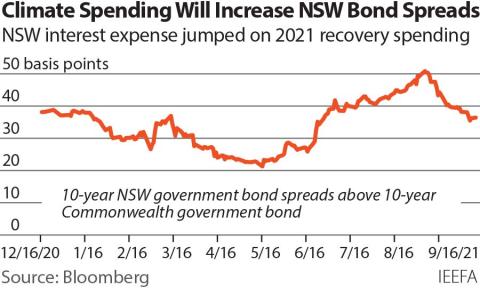

Climate risk and the cost of capital in NSW

October 01, 2021

Trista Rose

Report

Latest Green Bonds Press Releases

See more >

Europe’s new green bond standard will be a boon for issuers and investors

February 19, 2024

Press Release

Enhancing the credibility of sustainability-linked bonds is pivotal to gaining the acceptance of ESG investors

August 18, 2022

Press Release

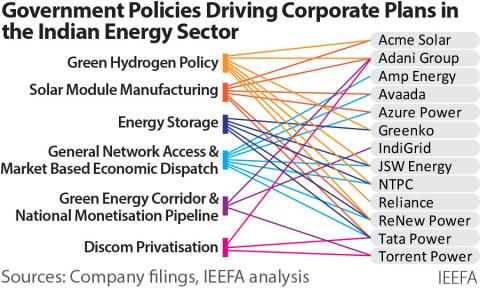

India’s lead role in the new wave of energy sector growth

May 02, 2022

Press Release

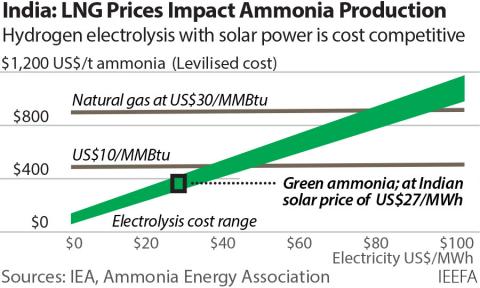

A shift to green ammonia from green hydrogen can reduce India’s fertiliser subsidy burden

April 20, 2022

Press Release

IEEFA: Innovative financing can help India achieve its renewable energy goals

October 29, 2021

Press Release

IEEFA: Australia’s climate policies could push New South Wales into a debt spiral

October 20, 2021

Press Release

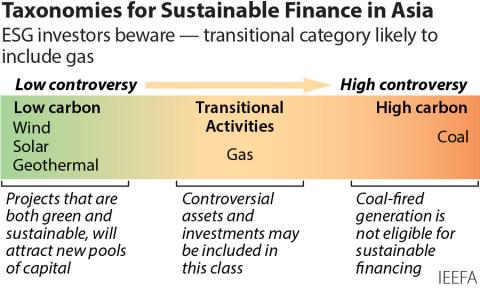

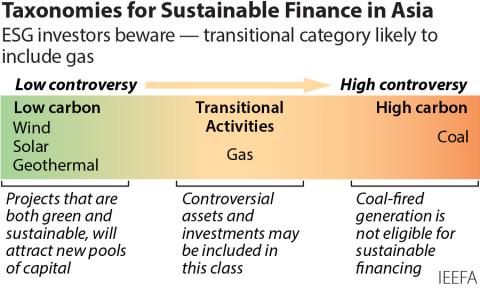

Accepting gas power plants as sustainable investments in Asian taxonomies heightens greenwash risk

September 21, 2021

Press Release

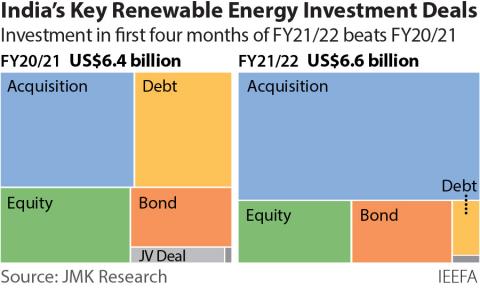

IEEFA: Renewable energy investment in India bounces back from COVID-19 slowdown

August 20, 2021

Press Release

IEEFA: Chinese regulators urged to tighten rules for carbon neutral bonds

June 01, 2021

Press Release

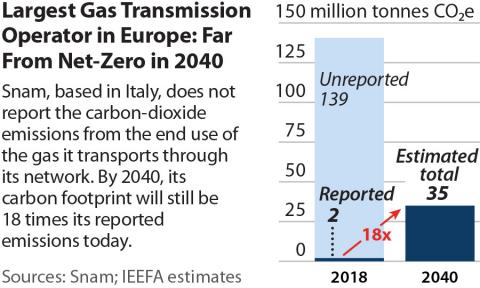

IEEFA Europe: Snam woos investors with net-zero claims, while growing its spending on fossil gas infrastructure

March 16, 2021

Press Release

IEEFA: Global capital mobilising for India’s $500bn renewable energy infrastructure opportunity

February 16, 2021

Press Release

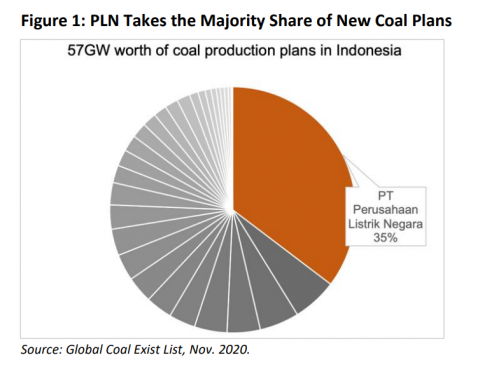

IEEFA Indonesia: PLN has ‘Green Ambition’ but is short on renewable energy credibility

December 22, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.