Qatar

Latest Qatar Research

See more >

IEEFA: Russia’s invasion of Ukraine is affecting global gas demand with LNG unable to deliver energy security

March 11, 2022

Bruce Robertson

Analysis

IEEFA Update: There is plenty of coal and gas in the world but a volatile market is nobody’s friend

October 21, 2021

Bruce Robertson

Analysis

Gas is exiting the global energy mix, providing lessons for emerging markets

September 16, 2021

Bruce Robertson

Analysis

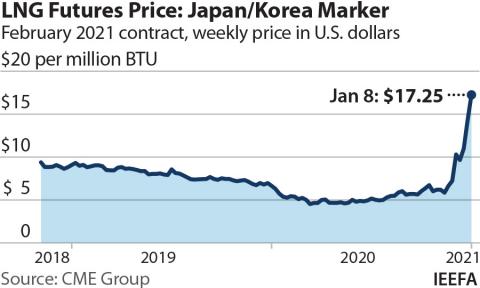

IEEFA: New U.S. LNG export projects face quartet of stiff headwinds

June 07, 2021

Clark Williams-Derry

Analysis

Latest Qatar Reports

See more >

There are two elephants in the LNG room

April 15, 2021

Bruce Robertson

Report

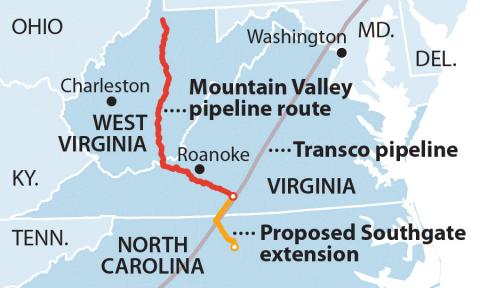

Mountain valley pipeline faces financial plunge

March 08, 2021

Cathy Kunkel, Clark Williams-Derry, Suzanne Mattei...

Report

The Australian LNG industry's growth - and the decline in greenhouse gas emissions Standards

April 01, 2020

John Robert

Report

Latest Qatar Press Releases

See more >

IEEFA Europe: Zeebrugge terminal serves as hub for transport of Russian gas to non-European markets

March 21, 2022

Press Release

IEEFA video: Are gas and LNG investments safe?

November 29, 2021

Press Release

IEEFA: Emissions and Qatar are neglected risk factors in Woodside’s Scarborough project

April 14, 2021

Press Release

IEEFA U.S.: Financial rationale for Mountain Valley Pipeline has evaporated in changing market

March 08, 2021

Press Release

IEEFA: Over US$50 billion in gas power projects and LNG import facilities at risk of cancellation in Bangladesh, Pakistan and Vietnam

January 14, 2021

Press Release

IEEFA: Why India can’t match the Gulf region’s record-low solar tariffs

August 28, 2020

Press Release

IEEFA brief: The Australian LNG industry’s growth – and the decline in greenhouse gas emissions standards

April 17, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.