Ohio

Latest Ohio Research

See more >

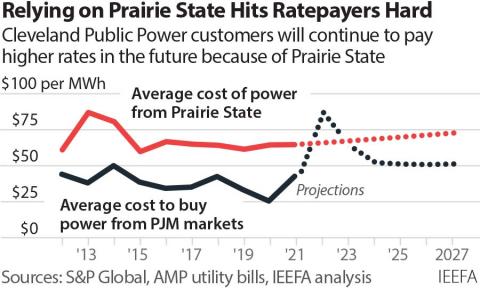

Price of buying power from Prairie State coal plant will remain a bad deal for Cleveland Public Power customers

August 09, 2022

David Schlissel

Analysis

Appeals court case underscores growing rift between automakers and oil industry

June 20, 2022

Suzanne Mattei

Analysis

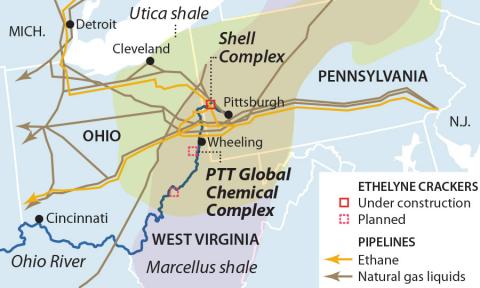

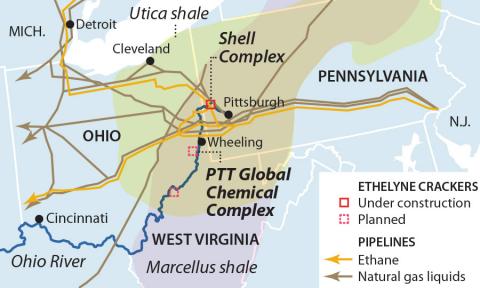

IEEFA U.S.: Ohio regulators have opportunity to do PTTGC a favor by nixing permit

February 22, 2022

Tom Sanzillo

Analysis

IEEFA: Private equity, part of the fossil fuel problem, can play a role in its solution

December 08, 2021

Tom Sanzillo, Suzanne Mattei

Analysis

IEEFA U.S.: ‘New Promise Act’ would help communities transition from coal-based economy

April 02, 2021

Tom Sanzillo, Cathy Kunkel

Analysis

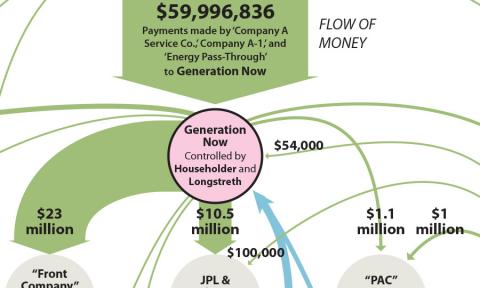

IEEFA U.S.: Follow the money, and repeal FirstEnergy’s Ohio bailout

July 22, 2020

Sandy Buchanan, Seth Feaster

Analysis

IEEFA update: Problems mount for PTTGCA petrochemical plant

July 01, 2020

Tom Sanzillo

Analysis

IEEFA update: Doubling down on utility-scale renewables

April 08, 2020

Karl Cates

Analysis

IEEFA Ohio: Mountaineer NGL storage project loses its environmental permit

March 10, 2020

Tom Sanzillo

Analysis

IEEFA update: FirstEnergy stops at nothing in its quest for an Ohio ratepayer-financed bailout

October 18, 2019

Sandy Buchanan

Analysis

IEEFA concludes first summer fellowship, applauds Environmental Fellow Cara Clase

August 23, 2019

Sandy Buchanan

Analysis

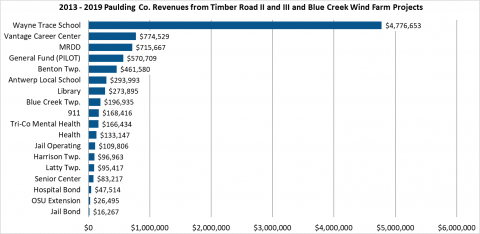

Wind projects improve county bond ratings in Ohio

August 01, 2019

Analysis

Latest Ohio Reports

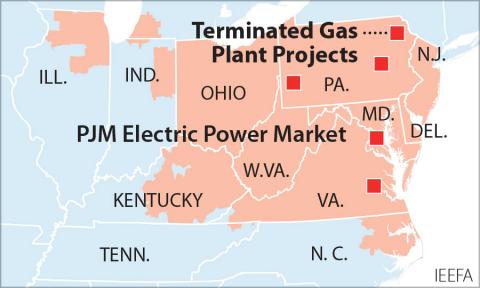

See more >Rapidly Changing Investment Climate Challenges Planned PJM Gas Plants

November 01, 2021

Dennis Wamsted

Report

Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Dennis Wamsted, Seth Feaster, Tom Sanzillo...

Report

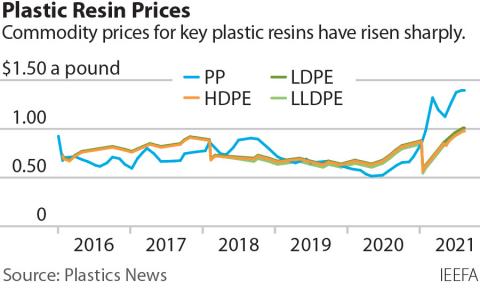

Why external review of price-setting mechanism for plastic resins is warranted

October 01, 2021

Tom Sanzillo, Suzanne Mattei

Report

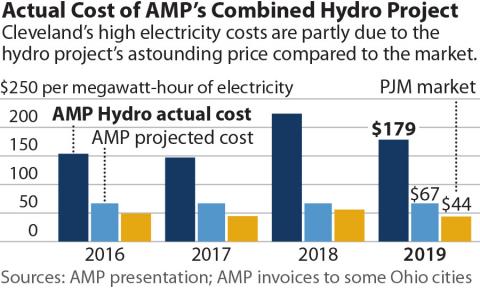

Costs of buying power from AMP's Prairie State and combined hydro project continue to mount for municipal ratepayers

September 01, 2021

David Schlissel

Report

Long-term power plant contracts saddle AMP communities with high electricity prices

September 21, 2020

David Schlissel

Report

Buying power from AMP's Prairie State and combined hydro project has been a financial disaster for Cleveland Public Power and its ratepayers

September 01, 2020

David Schlissel

Report

It's time to retire, not bail out, OVEC's ageing and expensive coal plants

April 01, 2020

David Schlissel

Report

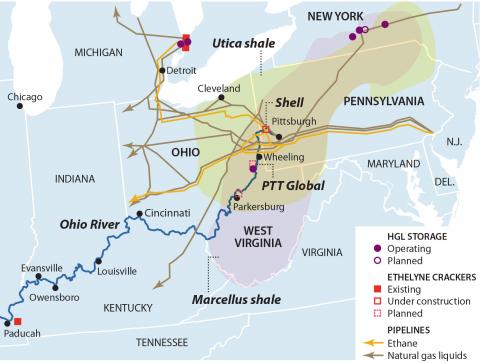

Proposed PTTGC Petrochemical Complex in Ohio Faces Significant Risks

March 01, 2020

Tom Sanzillo, Kathy Hipple, Suzanne Mattei...

Report

As coal economy collapses, imminent public budget crisis confronts Hopi-Navajo tribes

May 01, 2019

Karl Cates, Pam Eaton

Report

Bailout Bill a bonanza for FirstEnergy solutions, but a boondoggle for Ohio consumers

May 01, 2019

David Schlissel

Report

The seven technology disruptions driving the global energy transition

October 01, 2018

Seth Feaster

Report

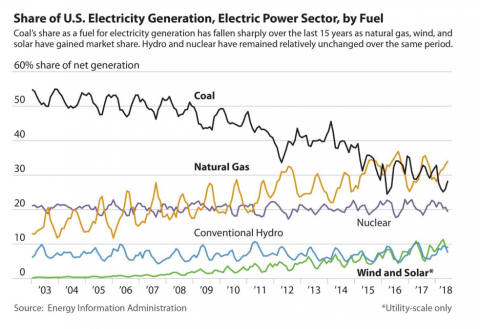

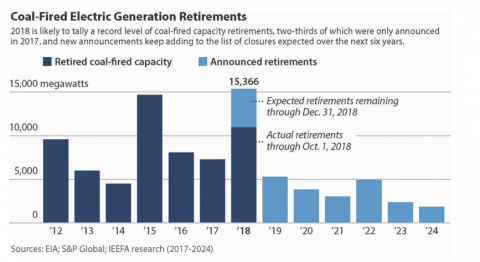

Record drop in U.S. Coal capacity likely in 2018

October 01, 2018

Seth Feaster

Report

Latest Ohio Press Releases

See more >

IEEFA U.S.: Gas-fired power plant cancellations and delays signal investor anxiety, changing economics

November 18, 2021

Press Release

IEEFA U.S.: Skyrocketing plastics prices a major concern for public health, economy

October 18, 2021

Press Release

IEEFA U.S.: Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Press Release

IEEFA U.S.: Municipal ratepayers face mounting costs from expensive American Municipal Power projects

September 09, 2021

Press Release

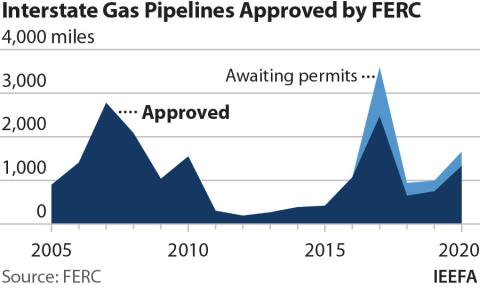

IEEFA U.S.: FERC gives blank check approval to pipeline builders, while investors and consumers pick up costs

December 17, 2020

Press Release

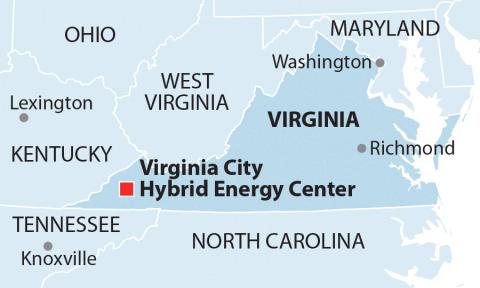

IEEFA U.S.: Virginia coal plant’s future isn’t bright: preparation for transition should commence now

December 16, 2020

Press Release

IEEFA U.S.: Investors in gas-fired projects in largest regional power system face substantial risks

October 05, 2020

Press Release

IEEFA: Ohio cancels permits for controversial Mountaineer storage facility

September 28, 2020

Press Release

IEEFA U.S.: Long-term contracts with American Municipal Power (AMP) saddle local communities with high prices

September 21, 2020

Press Release

IEEFA U.S.: Long-term contracts with AMP are ‘financial disaster’ for Cleveland Public Power customers

September 11, 2020

Press Release

IEEFA: Ohio and Indiana, Ageing and Expensive Coal Plants

April 08, 2020

Press Release

IEEFA U.S.: Ohio petrochemical project faces high risks and shaky outlook

March 23, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.