Illinois

Latest Illinois Research

See more >

Delayed U.S. coal plant closures are bumps in the road, not U-turns for energy transition

July 21, 2022

Dennis Wamsted

Analysis

IEEFA U.S.: Federal appeals court tosses out FERC approval for Spire STL Pipeline

June 23, 2021

Suzanne Mattei

Analysis

IEEFA U.S.: ‘New Promise Act’ would help communities transition from coal-based economy

April 02, 2021

Tom Sanzillo, Cathy Kunkel

Analysis

IEEFA U.S.: Throwing good money after bad, Washington gives $116 million handout to coal carbon-capture backers

April 27, 2020

Dennis Wamsted, Seth Feaster, Karl Cates...

Analysis

IEEFA update: Doubling down on utility-scale renewables

April 08, 2020

Karl Cates

Analysis

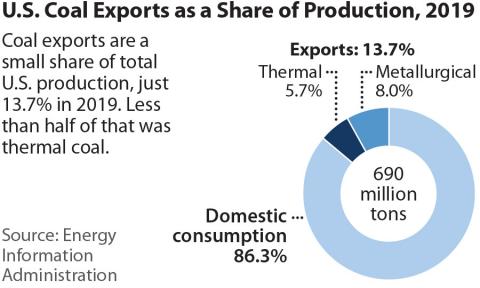

IEEFA U.S.: Why exports won’t save American coal

February 28, 2020

Seth Feaster, Karl Cates

Analysis

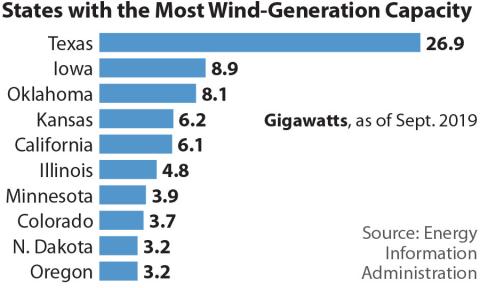

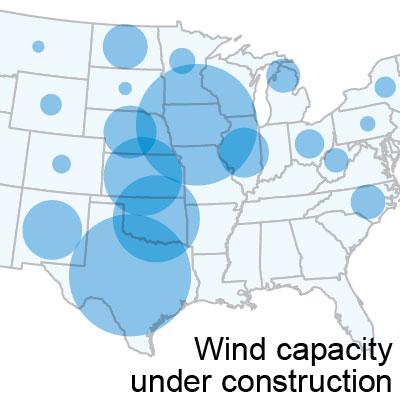

IEEFA U.S.: Wind farms are forever

January 23, 2020

Karl Cates

Analysis

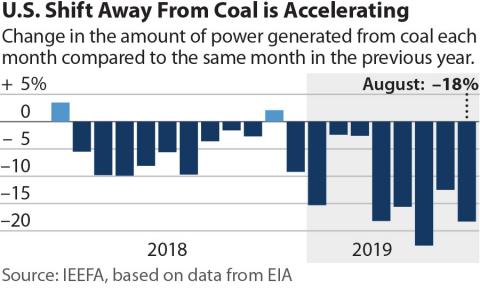

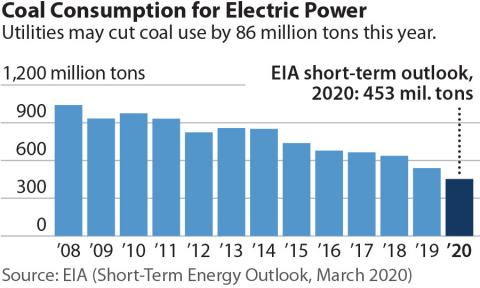

IEEFA update: Data shows U.S. shift away from coal-fired generation is intensifying

November 05, 2019

Seth Feaster

Analysis

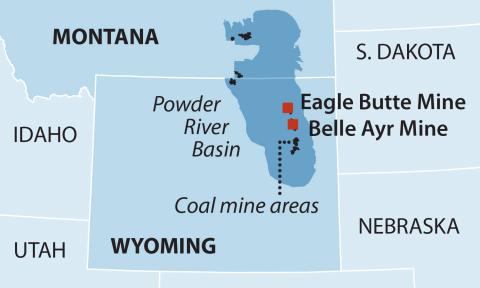

IEEFA US: Financial chaos in Powder River Basin coal country

July 03, 2019

Seth Feaster

Analysis

IEEFA Update: Electricity Auctions Across Major Swaths of U.S. Spell Further Distress for Fading Coal Plants

June 06, 2017

David Schlissel

Analysis

IEEFA Research Brief: Coal in Decline, Blow by Blow

April 21, 2017

Seth Feaster

Analysis

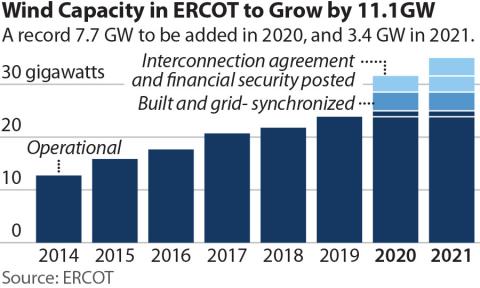

Wind in the Wires, and More on the Way

September 16, 2016

Seth Feaster

Analysis

Latest Illinois Reports

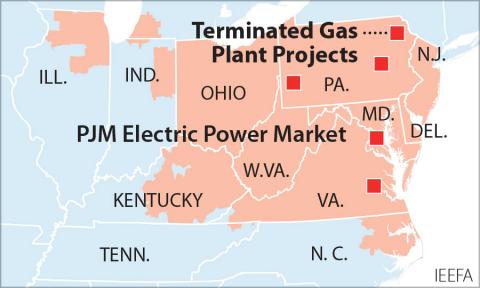

See more >Rapidly Changing Investment Climate Challenges Planned PJM Gas Plants

November 01, 2021

Dennis Wamsted

Report

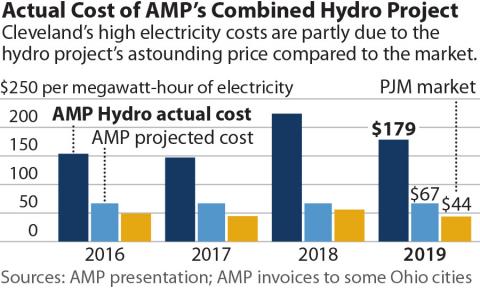

Long-term power plant contracts saddle AMP communities with high electricity prices

September 21, 2020

David Schlissel

Report

Buying power from AMP's Prairie State and combined hydro project has been a financial disaster for Cleveland Public Power and its ratepayers

September 01, 2020

David Schlissel

Report

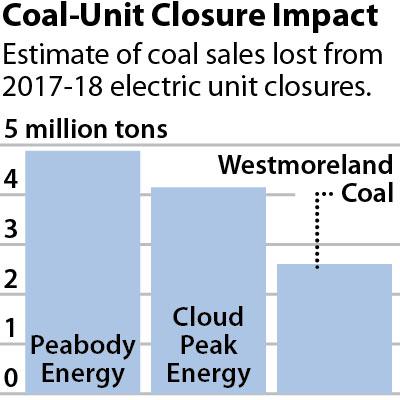

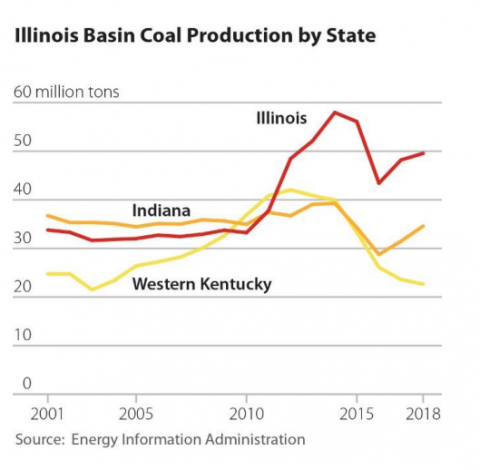

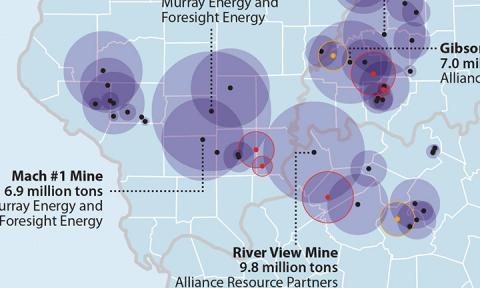

Dim future for Illinois Basin coal

December 01, 2019

Seth Feaster, Karl Cates

Report

The high-risk financing behind the Dakota Access Pipeline

November 01, 2016

Cathy Kunkel, Clark Williams-Derry

Report

Cost of coal from 'mine-mouth' Prairie State plant isn’t the bargain that was promised

April 01, 2015

Tom Sanzillo

Report

2014 - another year of unmet promises for the Prairie State Energy Campus

February 01, 2015

David Schlissel

Report

Analysis of Paducah Power System’s recent and future costs of power from the Prairie State Energy Campus

October 01, 2014

David Schlissel

Report

No evidence of a turnaround at Prairie state

September 01, 2014

David Schlissel

Report

Overpriced power: Why Batavia is paying so much for electricity

March 11, 2014

David Schlissel

Report

The Prairie State Coal Plant: The Reality vs. The Promise

August 01, 2012

Tom Sanzillo, Lisa Hamilton, David Schlissel...

Report

Latest Illinois Press Releases

See more >

IEEFA U.S.: Gas-fired power plant cancellations and delays signal investor anxiety, changing economics

November 18, 2021

Press Release

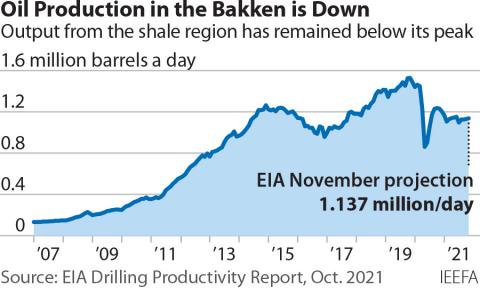

IEEFA U.S.: Shortage of high-quality sites threatens future Bakken oil and gas production

November 03, 2021

Press Release

IEEFA U.S.: Investors in gas-fired projects in largest regional power system face substantial risks

October 05, 2020

Press Release

IEEFA U.S.: Long-term contracts with American Municipal Power (AMP) saddle local communities with high prices

September 21, 2020

Press Release

IEEFA U.S.: Long-term contracts with AMP are ‘financial disaster’ for Cleveland Public Power customers

September 11, 2020

Press Release

IEEFA U.S.: As oil and gas wane, Texas wind industry ascends

August 10, 2020

Press Release

IEEFA Coal Outlook 2020: Market trends are pushing U.S. industry to a reckoning

March 30, 2020

Press Release

IEEFA report: Dim future for Illinois Basin coal

December 10, 2019

Press Release

IEEFA Report: Dakota Access Pipeline Driven by ‘High-Risk Financing’ in Overbuilt Region; Little-Known Economic Weaknesses in Controversial Project

November 15, 2016

Press Release

Divestiture Movement, Deepening Distress of Coal Industry, Emerging Battles Over Solar, Overbuilding of Shale Gas Pipelines Highlight IEEFA Energy Finance 2016 Conference in New York City

February 29, 2016

Press Release

The True Cost of Prairie State Energy Campus Coal

April 07, 2015

Press Release

Call to Action in Paducah; IEEFA Makes Page 1 of The Guardian, Coal Phaseout in Denmark

November 03, 2014

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.