France

Latest France Research

See more >

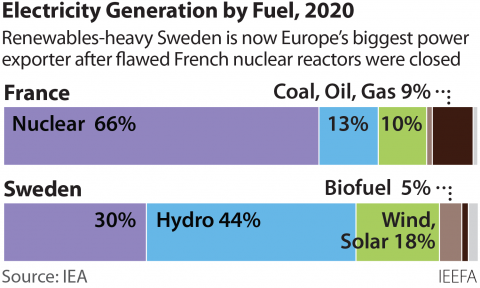

France’s nuclear buildout plan must not jeopardise renewables growth

April 18, 2024

Jonathan Bruegel

Analysis

Le plan français de développement du nucléaire ne doit pas compromettre la croissance des énergies renouvelables

April 18, 2024

Jonathan Bruegel

Analysis

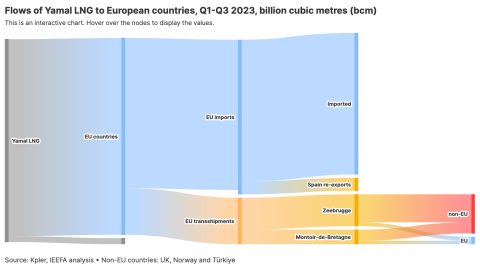

EU turns a blind eye to 21% of Russian LNG flowing through its terminals

November 29, 2023

Ana Maria Jaller-Makarewicz

Analysis

Nuclear reactor problems in France show need for diversified mix of renewables

August 30, 2022

Frank Bass

Analysis

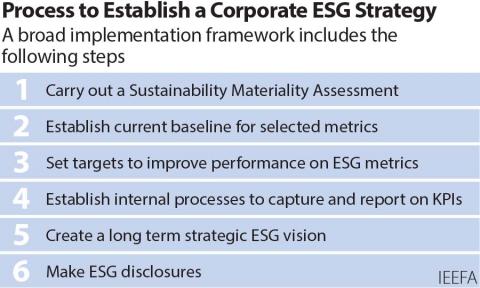

India: How companies can incorporate an ESG strategy

April 07, 2022

Shantanu Srivastava

Analysis

IEEFA Poland: PZU’s stance on coal makes no sense either for Paris Agreement or for its shareholders

November 18, 2021

Nick Holmes

Analysis

IEEFA: New U.S. LNG export projects face quartet of stiff headwinds

June 07, 2021

Clark Williams-Derry

Analysis

IEEFA: Is oil giant Total an emerging leader of the energy transition?

January 20, 2021

Gerard Kreeft

Analysis

IEEFA: As export partners pull out, Origin and Inpex keep kicking the gas can down the road

October 28, 2020

Bruce Robertson

Analysis

IEEFA: Renewable energy must play a greater role in economic recovery from COVID-19

October 27, 2020

Vibhuti Garg, Christopher Beaton

Analysis

IEEFA: Origin Energy is not facing the past or the future

October 26, 2020

Bruce Robertson

Analysis

IEEFA update: European utilities at risk from Credit Agricole’s new 2030 coal exit stance

June 07, 2019

Gerard Wynn

Analysis

Latest France Reports

See more >

Le paradoxe du GNL en France

October 10, 2023

Ana Maria Jaller-Makarewicz

Report

France's LNG paradox

October 10, 2023

Ana Maria Jaller-Makarewicz

Report

European Pressurized Reactors (EPRs): Next-generation design suffers from old problems

February 02, 2023

Frank Bass

Report

Hiding in plain sight — European gas pipeline companies’ greenhouse gas emissions

December 01, 2020

Arjun Flora, Gerard Wynn

Report

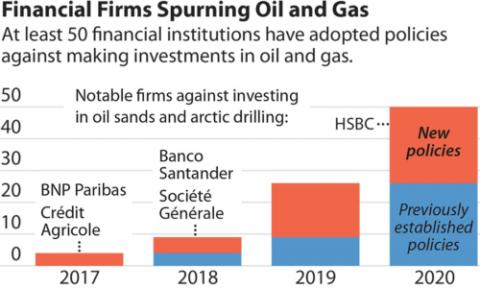

Global financial corporations get cracking on major oil/gas lending exits

October 01, 2020

Tim Buckley, Saurabh Trivedi

Report

Who Would Still Fund a New Coal Power Plant in India?

May 01, 2020

Tim Buckley

Report

Inquiry into the prerequisites for nuclear energy in Australia

September 10, 2019

Tim Buckley

Report

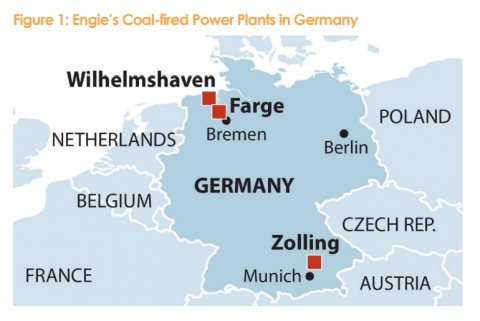

Why Engie should close, not sell, its coal-fired power plants in Germany

September 01, 2018

Gerard Wynn, Paolo Coghe

Report

Latest France Press Releases

See more >

La France poursuit son développement en matière de GNL dans un contexte de poursuite des livraisons russes et de baisse de la demande de gaz

October 10, 2023

Press Release

France maintains LNG buildout amid ongoing Russian shipments and falling gas demand

October 10, 2023

Press Release

European Pressurized Reactors: Nuclear power’s latest costly and delayed disappointments

February 02, 2023

Press Release

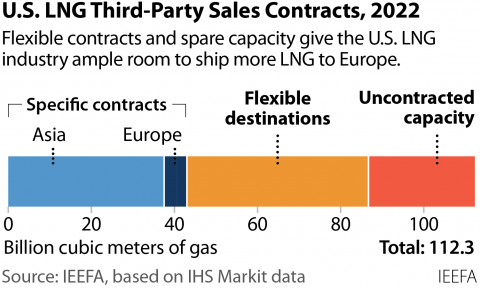

Analysis finds U.S. can increase LNG shipments to Europe without building new facilities

April 06, 2022

Press Release

IEEFA Europe: Overcapacity and investment fever push costs to Spanish consumers, yet Enagás profits

September 16, 2021

Press Release

IEEFA Europa: El exceso de capacidad y una fiebre por invertir suben las facturas de los consumidores españoles, pero Enagás se lucra

September 16, 2021

Press Release

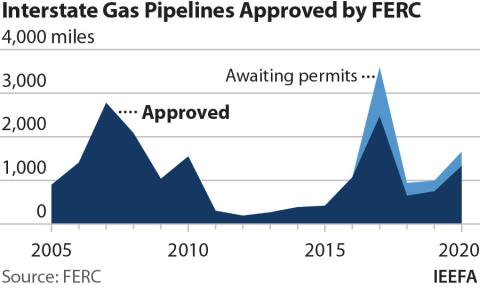

IEEFA U.S.: FERC gives blank check approval to pipeline builders, while investors and consumers pick up costs

December 17, 2020

Press Release

European gas pipeline companies mislead investors by under-reporting CO2

December 14, 2020

Press Release

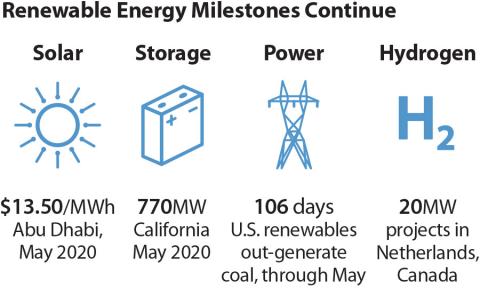

IEEFA: Renewables continue to break records despite COVID-19

June 08, 2020

Press Release

IEEFA update: Who would still fund a new coal power plant in India?

May 04, 2020

Press Release

IEEFA Australia: Nuclear is too expensive, takes too long to build, and is banned by law in Australia

September 30, 2019

Press Release

IEEFA report: Benefits to Engie from closing three German coal-fired power plants would outweigh any gains from selling them

September 04, 2018

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.