Alberta, Canada

Latest Alberta, Canada Research

See more >

IEEFA: Canada ban on shipping coal would equal scrapping as many as 3 million cars

October 27, 2021

Clark Williams-Derry

Analysis

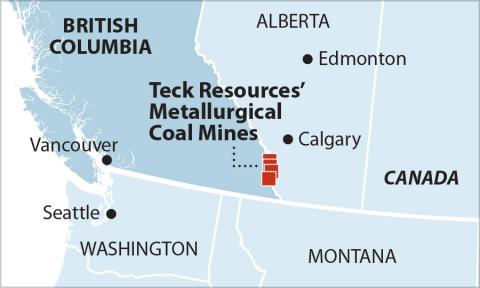

IEEFA Canada: Teck’s possible met coal exit an ominous sign for U.S. coal companies

September 21, 2021

Seth Feaster

Analysis

IEEFA: Keystone XL project became another pipeline to nowhere

June 14, 2021

Suzanne Mattei, Tom Sanzillo

Analysis

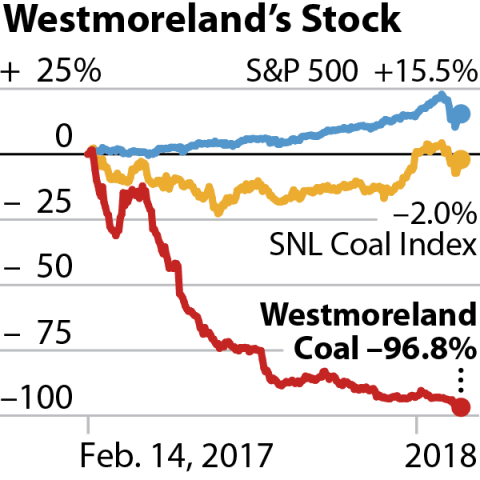

IEEFA Update: How Will Westmoreland Coal’s Deepening Spiral End?

February 16, 2018

Seth Feaster

Analysis

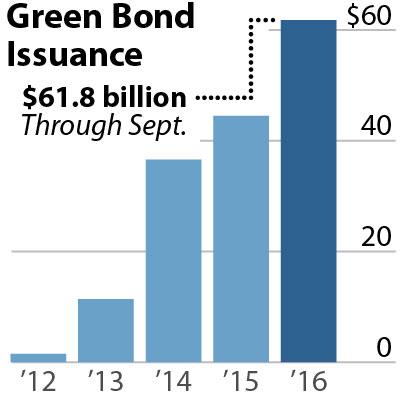

IEEFA Report: Three Timely Takeaways on 2016 Global Energy Transformation

November 05, 2016

Tim Buckley

Analysis

A Canadian Province Moves Aggressively Toward Development of a New Energy Economy

July 11, 2016

Tim Buckley

Analysis

Media Monitor: The Voodoo Economics of Coal-Industry Expansion

May 15, 2015

Karl Cates

Analysis

Media Monitor: Mitch McConnell Is Miffed

April 24, 2015

Karl Cates

Analysis

In the New Energy Economy, Public Accountability Is a Market Force

January 27, 2015

Tom Sanzillo

Analysis

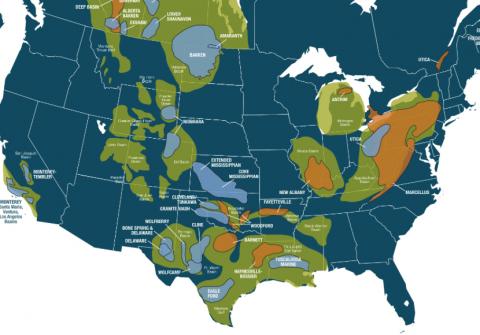

The Peril in Shale-Producer Debt (CLR, DVN, PXD, RRC)

January 23, 2015

Deborah Lawrence

Analysis

Why Smart Investors Aren’t Putting Their Money in Stranded Assets

January 13, 2015

Tim Buckley

Analysis

Keystone: The Republican Congress’s First Priority May No Longer Make Sense

December 19, 2014

David Knowles

Analysis

Latest Alberta, Canada Reports

See more >

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

Teck Resources' Frontier Oil Sands Project Shows Reckless Disregard for Financials

January 01, 2020

Tom Sanzillo, Kathy Hipple

Report

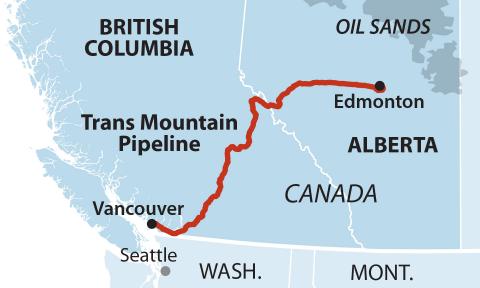

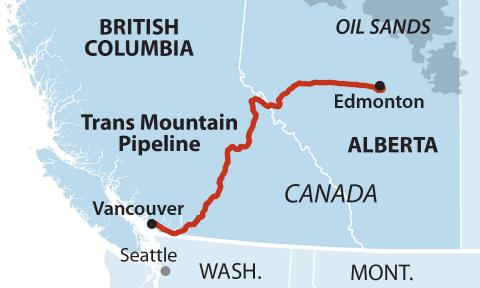

Trans Mountain Pipeline financials: Built on quicksand and clear as mud

April 01, 2019

Tom Sanzillo, Kathy Hipple

Report

Canada's folly

June 01, 2018

Tom Sanzillo, Kathy Hipple

Report

Latest Alberta, Canada Press Releases

See more >

Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

May 25, 2022

Press Release

Federal blue hydrogen incentives: No reliable past, present or future

February 08, 2022

Press Release

Press release: IEEFA statement on Teck Resources decision to withdraw Frontier Mine proposal

February 24, 2020

Press Release

IEEFA report: Teck Resources’ Frontier Oil Sands project shows reckless disregard for financials

January 16, 2020

Press Release

IEEFA report: Canada Trans Mountain Pipeline financials provide few clues on actual price tag and future costs

April 10, 2019

Press Release

IEEFA report: ‘Canada’s Folly’ could drive national budget deficit 36% higher while ensuring Houston-based Kinder Morgan a 637% gain

June 26, 2018

Press Release

IEEFA Investor Memo ExxonMobil (XOM): Company Is an ‘Outlier’ in How It Reports Write-offs on Canadian Oil Sands Assets

April 17, 2017

Press Release

Aussie Coal Advocates Solicit Global Banks; Oil-Price Drop Hurts Tar-Sands Prospects; More Coverage of IEEFA Port Report

December 01, 2014

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.