Search

Pioneer deal: Another overpayment by ExxonMobil?

ExxonMobil’s $60 billion acquisition of Pioneer Resources …

Analysis

ExxonMobil investor note

This investor memo questions whether ExxonMobil has appropriately accounted for its recent …

Report

ExxonMobil contract leaves Guyana exposed to financial and …

… Guyana for its weak performance in overseeing a massive ExxonMobil offshore project

Analysis

ExxonMobil's U.S. upstream results underwhelm again

ExxonMobil’s U.S. upstream operations have yet to regain … second quarter of 2021 was the company’s best in years, ExxonMobil has invested $61.5 billion on U.S. upstream …

Report

ExxonMobil: Permian leader or just another fracker?

… of Permian oil production raises troubling questions about ExxonMobil’s investor disclosures

Report

A fistful of protests, as Guyana continues to rubber-stamp ExxonMobil drilling permits

A fifth case objecting to Guyana’s handling of the offshore Stabroek oilfield was filed last week.

Analysis

Red flags on ExxonMobil (XOM): A note to institutional investors

ExxonMobil (XOM) is in potentially irreversible decline.

…

Report

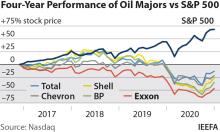

Leader To Laggard ExxonMobil's Financial Troubles Intensify

Performance metrics declined from 2017-2019 under CEO Darren Woods.

Report

IEEFA: ExxonMobil must change direction to thrive

ExxonMobil must change direction to thrive

Analysis

ExxonMobil’s climate risk report defective and unresponsive

… are deciding their next steps in the push for changes to ExxonMobil’s board as a result of the company’s weak …

Report