Search

Anglo American’s Capitulation Is a Sign of Things to Come

Anglo American’s surprise announcement this week of yet another …

Analysis

Don Blankenship Is an American Criminal

Don Blankenship Is an American Criminal

Analysis

IEEFA U.S.: A sea change in American offshore wind

U.S.: A sea change in American offshore wind

Analysis

IEEFA U.S.: A rough week for the American coal industry

A rough week for the American coal industry

Analysis

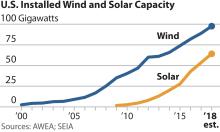

IEEFA update: Unmistakable trends in American wind and solar

Unmistakable trends in American wind and solar

Analysis

IEEFA Update: American Isolationism Will Hasten the Asian Century

American Isolationism Will Hasten the Asian Century

Analysis

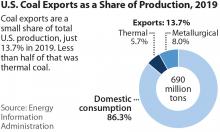

IEEFA U.S.: Why exports won’t save American coal

U.S.: Why exports won’t save American coal

Analysis

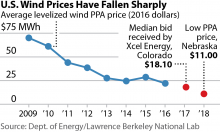

IEEFA update: The American wind-energy horse is out of the barn

The American wind-energy horse is out of the barn

Analysis

IEEFA Update: The Saudi Arabia of Solar? American Indian Country

The Saudi Arabia of Solar? American Indian Country

Analysis

IEEFA: American vulture funds prepare to feast on Australia’s …

American vulture funds prepare to feast on Australia’s …

Analysis