Trista Rose

Former Analyst Trista Rose has worked for investment banks in London, New York and Sydney and was part of the proprietary trading team at Macquarie bank. Trista has degrees from the University of Queensland, University of Oxford and is now pursuing a Master’s in Sustainability at University of Sydney.

Research from Trista Rose

See all Research from Trista Rose >

Climate risk and the cost of capital in NSW

October 01, 2021

Trista Rose

Report

AGL Energy's path of shareholder value (and environmental) destruction

July 01, 2021

Trista Rose

Report

Vanguard Group: Passive about climate change

June 23, 2021

Trista Rose, Tim Buckley

Report

IEEFA Australia: Port of Newcastle’s roadblock on the path away from thermal coal

March 18, 2021

Trista Rose

Analysis

IEEFA: Dalrymple Bay Infrastructure overvalued, overleveraged, over-promised, likely to under-deliver

December 07, 2020

Trista Rose

Analysis

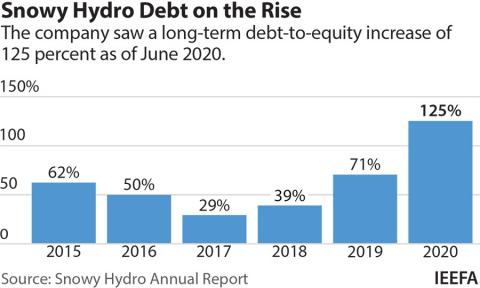

Snowy Hydro's cash drain

November 01, 2020

Tim Buckley, Trista Rose

Report

IEEFA update: Dalrymple’s potential stock market debut

October 19, 2020

Trista Rose

Analysis

IEEFA: American vulture funds prepare to feast on Australia’s Bluewaters Coal Power Station

September 04, 2020

Trista Rose

Analysis

Posts from Trista Rose

See all Posts from Trista Rose >

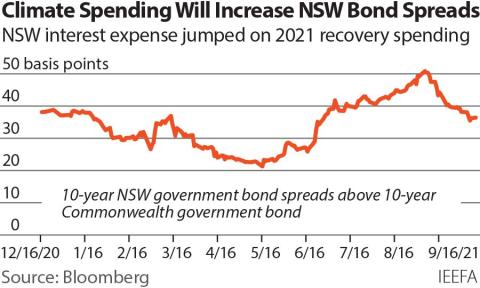

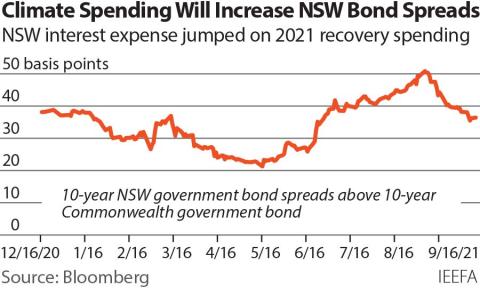

IEEFA: Australia’s climate policies could push New South Wales into a debt spiral

October 20, 2021

Press Release

IEEFA Australia: AGL Energy has lost over 70% of its market value, destroying A$12 billion in shareholder wealth

July 22, 2021

Press Release

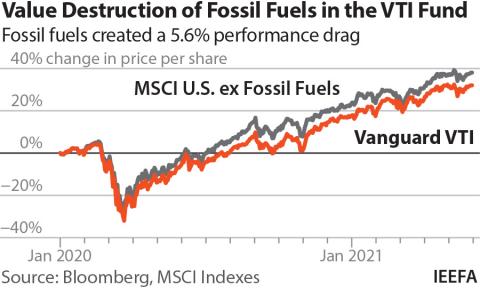

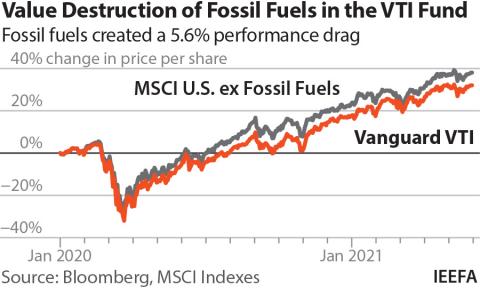

IEEFA: Vanguard funds destroy shareholder wealth with US$290bn in fossil fuels creating a 5.6% performance drag

June 22, 2021

Press Release

IEEFA: Snowy Hydro gas plant expansions likely to be fuelled with taxpayer funds

November 18, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.