Changes sweeping the electricity sectors in Japan and China suggest a hugely uncertain future for coal-fired power and a rapidly increasing risk of stranded assets.

New research shows growing over-capacity in these markets, likely complications from regulation and rising competition from lower-cost renewable power. Coupled with massive recent write-downs in coal-generation assets in Europe and with plans in the U.S. to close more than 102 gigawatts of coal-fired power plants by 2020, the findings serve as a global warning: Coal power expansion is dicey.

The very concept of stranded assets—investments whose value falls unexpectedly or that are written off altogether as a result of new economic circumstances, whether from government policy or technology change—is on potentially vivid display here.

Over-capacity is highly evident in China and looming in Japan, and coal-fired generation in both countries is imperilled in two ways:

- First, by competition from renewables and nuclear power, both of which have either much lower marginal operating costs (or no marginal operating costs at all), and both of which generally have priority grid access.

- Second, by regulatory risks that arise from the fact that coal-fired energy is the biggest source of water pollution, air pollution and carbon emissions—risks that favor increases in capital market flows to renewables.

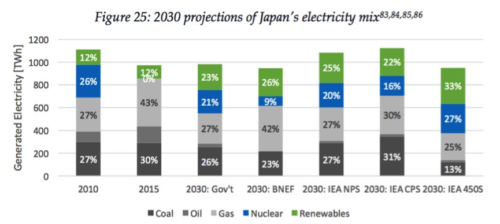

In Japan, where the country’s 2014 “Basic Energy Plan” would add new coal capacity equivalent to three times the amount due to retire over the next 10 years, coal-use growth is driving its own over-capacity, according to report published this month by Oxford University’s Smith School (“Stranded Assets and Thermal Coal in Japan”).

Additional drivers for the likelihood of stranded assets include five years of negative electricity demand growth; the falling cost of renewables (supporting a massive recent expansion in solar power in which the Japan is adding 9-10 gigawatts annually); and the post-Fukushima restart of some of the country’s mothballed 43-gigawatt nuclear fleet. Rooftop solar raises the risks of a “utility death spiral,” too, according to the report, in which a ramp-up could reduce the customer base of utilities.

The report notes also that regulatory risk is growing. The Japanese government’s projections for coal-fired power in 2030 (at 26 percent of total generation) are about double what the International Energy Agency estimates is acceptable under global initiatives to limit climate change (“IEA 450S”, in chart below).

The report puts potential impairment losses at $76 billion, in a scenario of stranding of coal assets over the next five years. And should electricity demand continue to decline at 2.5 annually as seen over the past five years, risk will grow materially faster than the market is currently anticipating.

A telling excerpt from the report:

“Stranded coal assets would affect utility returns for investors; impair the ability of utilities to service outstanding debt obligations; and create stranded assets that have to be absorbed by taxpayers and ratepayers.”

SEPARATELY, A CREDIT SUISSE REPORT, “BEGINNING OF A MULTI-YEAR DOWN-CYCLE,” PAINTS AN EQUALLY STARK PICTURE OF COAL-POWER UTILITIES IN CHINA.

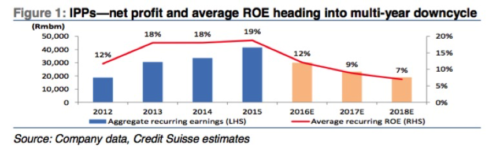

China, under market reforms launched last year, is in the process of liberalizing wholesale power prices. Because of a glut in coal-fired power, that means lower tariffs and returns. Producers must also compete now in an emerging price war with renewables. Credit Suisse analysts see falling coal-power utilization, reduced tariffs and a possible halving of leading coal utility net return on equity over the next three years.

China’s coal power glut is nothing short of astonishing—even as coal plant electricity sales and utilization fell last year, the country added 70 gigawatts of new coal capacity.

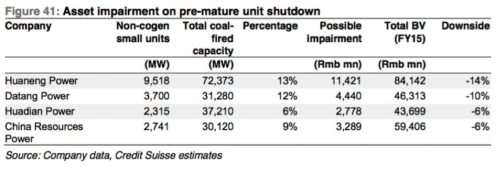

The Credit Suisse report focuses on four coal-fired independent power producers (IPPs) whose profits declined by 11-22 percent in the first quarter of this year, a trend that “should mark the start of a multi-year earnings down-cycle with mounting oversupply and pricing pressure.”

Industry consolidation could see these four IPPs write down smaller coal units, leading to losses equivalent to 6 to 14 percent of total book value, or 22 billion renminbi ($3.3 billion), the Credit Suisse analysts estimate.

Meanwhile, China is tilting the balance further in favor of renewables with must-run targets, for example, to boost the use of existing wind and solar assets. And the country may add a new twist on the “utility death spiral” concept, by forcing utilities to generate a certain minimum of their thermal output from renewables.

The drivers of change outlined in the Credit Suisse research are similar to those seen in Japan, and the shifts seen in both countries reveal the wider trend.

They reflect what is already happening in Europe, where lower wholesale power prices in response to rising renewable power capacity have led to costly write-downs of gas and coal-fired power plant assets. New data compiled by analysts at Jefferies investment bank showed this week that 12 of Europe’s biggest electric utilities cut the value of their assets — many of them power stations — by a collective 30 billion euros in 2015. That brings the total value of write-downs in the sector to 104 billion euros since the beginning of 2010.

Progressive utilities are looking to avoid repeating such mistakes. A case in point is First Philippines Holdings Corp., which produces 23 percent of Philippines electricity, and whose chairman announced this week “unequivocally and for the record that FPH and its subsidiaries will not build, develop or invest in any coal-fired power plant.”

That news follows a similar policy move earlier this year in Vietnam, and adds to the growing acknowledgement globally that stranded-asset risk is real.

Gerard Wynn is an IEEFA energy finance consultant.

Related posts:

Coal Decline Steepens in 2016 in India, China, U.S.

Mitsui Joins Japanese Financiers Fleeing Coal

Energy-Sector Advances: India and China