IEEFA U.S.: The coal-to-renewables transition takes off

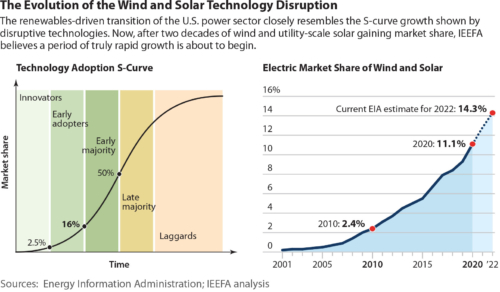

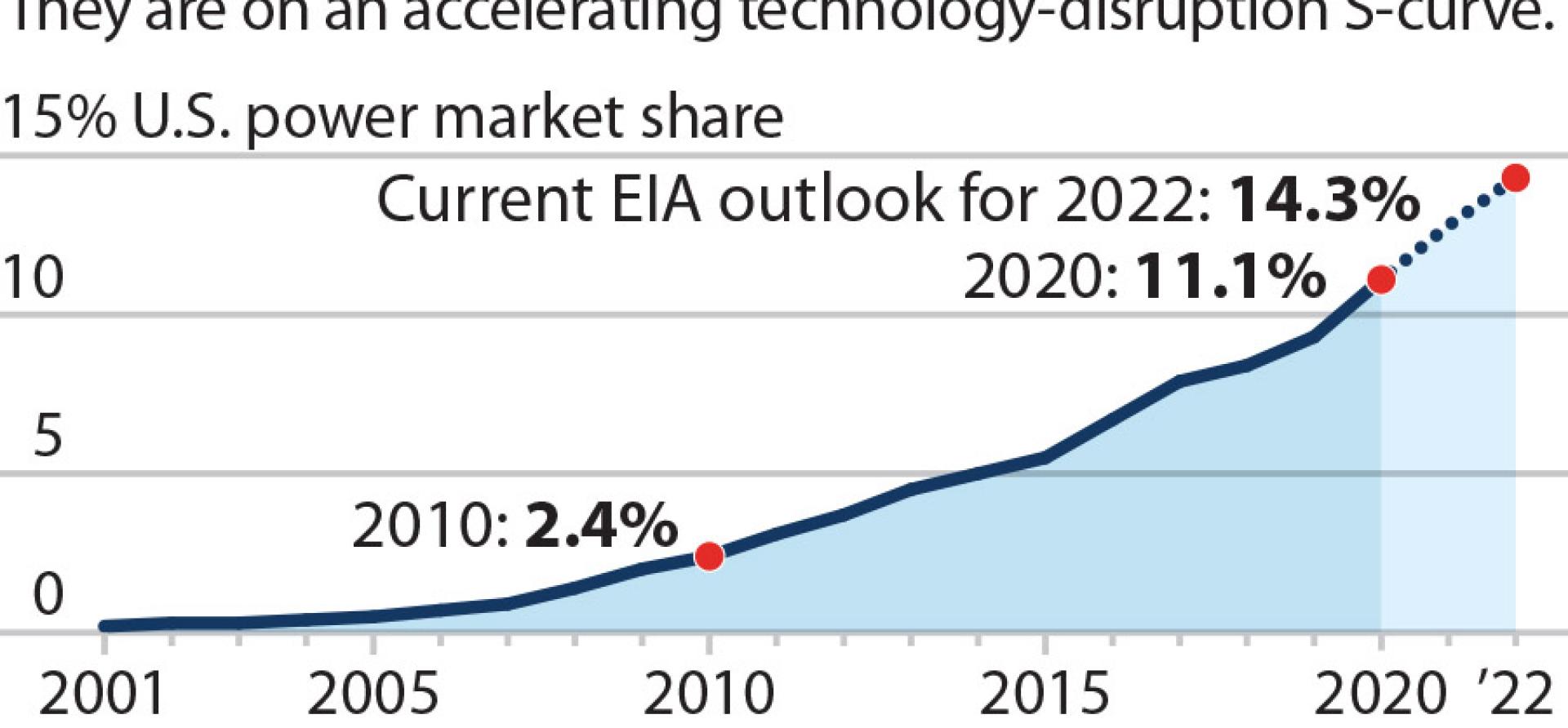

The traditional S-curve growth exhibited by disruptive technologies, often cited when game-changing consumer devices, such as smartphones, take over markets and rapidly push older products out, is just as valid to describe how wind turbines and solar PV generation are shaking up U.S. power markets.

This S-curve is marked by several key phases in the way a new technology gains market share—slowly at first, then with increasing speed as adoption broadens and it becomes dominant, then slowing again as the market matures. IEEFA believes the renewables-driven transition of the U.S. electric power sector has entered the steep upward slope at the center of this S-curve growth. First, the scale of wind and solar projects announced by a broadening array of big power-generation companies has surged in the past year. Second, that growth has been paired with a doubling, also in the past year, in the amount of coal-fired capacity set to close from 2021 through 2030, based on company announcements and regulatory filings tracked by IEEFA.

The renewables transition has been under way for two decades. Between 2001 and 2010, wind and utility-scale solar’s market share grew slowly but steadily to 2.4%. Coal’s share of annual electric-sector generation remained dominant, only falling from 53 percent in 2001 to 46 percent in 2010. By 2020, however, the list of companies becoming early adopters had rapidly expanded, and included a few major power companies like NextEra Energy and Xcel Energy. Wind and utility-scale solar’s market share began to rise faster, to more than 11 percent in 2020. Coal’s market share, on the other hand, fell to less than 20 percent. Undercut first by gas generation that benefited from falling prices from fracking, and now by a relentless buildout of lower-cost renewables (both resources posted record-high shares of the generation market in 2020), the share of power from the aging coal sector slumped to what may have been the lowest level since the dawn of the electric age in the U.S., 140 years ago.

2021-2030: The coming decade of renewable growth, coal retirements

Last year’s increase in wind and solar generation was driven by record-setting levels of new capacity installed during the year, despite the Covid-19 pandemic. Almost 14 gigawatts (GW) of utility-scale solar (another 5 GW of rooftop solar was also installed), 16.9GW of wind and 1GW of battery storage (also a record) were added to the grid in 2020. While impressive, these numbers pale in comparison to the massive green energy buildout looming through 2030:

- Solar ⎼ current estimates show 69GW of new capacity already under development, with the expectation that 324GW of capacity could be built by 2030.

- Wind ⎼ 34.7GW of new capacity is in the near-term development pipeline with half already under construction. In addition, the Biden administration has set a goal of having 30GW of offshore wind installed by 2030, up sharply and due online sooner than the capacity currently being developed.

- Battery storage ⎼ annual installations are expected to top 7.8GW by 2025, with cumulative totals climbing to roughly 30GW, of which three-quarters will be utility-scale applications.

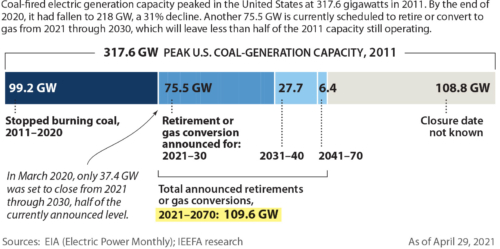

Yet, renewables and storage represent just half of the equation. The other half is the clear turn away from coal by U.S. utilities and independent power producers. Data compiled by IEEFA shows that the amount of coal-fired capacity scheduled for retirement by 2030 has more than doubled in the past year. In March 2020, announced coal-fired retirements for the 2021-30 totaled 37.4 GW. By April 2021, that total had climbed to at least 75.5 GW.

Those retirements, in turn, have pushed the cumulative amount of coal capacity that will have closed by 2030 to 175 GW—55 percent of the coal-fired capacity that existed at its peak in 2011.

It is important to point out this rapid acceleration occurred largely prior to the Biden administration’s climate change summit and its embrace of a 2035 no-carbon emissions goal for U.S. power generators. With those developments now rippling through the sector, IEEFA expects a significant increase in the number of coal plant retirement announcements in the months and years ahead as utilities and independent power producers revise their resource plans and business models.

Even after 100 GW of capacity had closed, the overall coal capacity factor was down to 40%

The actual retirement numbers only tell part of the story, however. The plants still online are also operating less and less, with the average annual capacity factor of the installed coal plants falling from 62.8 percent in 2011 to 40.2 percent in 2020. This collapse belies the common coal industry refrain that as the older, less efficient plants were retired, the performance of the remaining units would improve; even after nearly 100GW of capacity had closed, the overall coal capacity factor was down sharply last year.

Another way of measuring the S-curve ramp is to look at individual utilities. Here, recent announcements from American Electric Power, one of the largest utilities in the U.S., are indicative of the rapidly quickening pace of change. Six months ago, the utility was touting its plan to add roughly 8,000 megawatts (MW) of new renewable energy capacity to its 11-state system by 2030. Earlier this month, during its first quarter 2021 earnings call, the company literally doubled down, saying it now planned to build 16,595MW of new renewable capacity by 2030. AEP CEO Nick Akins said 10,000MW of that total would be online by 2025. Coupled with that buildout, the company now plans to retire another 4,979MW of coal-fired capacity by 2028, with an additional 595MW slated for 2030.

AEP still has a way to go, as these plans do not address the company’s three large coal-fired plants in West Virginia—the single unit, 1,299MW Mountaineer station; the three-unit, 2,900MW John Amos plant and the two-unit, 1,560MW Mitchell station. However, IEEFA believes the company’s recent moves represent a shift that should be applauded, with reservations.

In his opening remarks on the quarterly call, AEP’s Akins outlined the company’s next steps: “It has been a very busy quarter for AEP, but the work really starts now regarding the execution of our plan to transform this company from what was the largest coal-fired utility to one of the largest regulated renewable companies in the U.S.”

His statement reflects neatly why the market share of wind and solar in the power sector is set to rise so fast this decade: The heart of the disruption S-curve is arriving.

Dennis Wamsted ([email protected]) is an IEEFA analyst/editor.

Seth Feaster ([email protected]) is an IEEFA energy data analyst.

Related items:

IEEFA: Birchwood coal facility closure/redevelopment highlights transition from coal to renewables

IEEFA U.S.: Coal plants close as renewable energy construction rises