IEEFA U.S.: Booming U.S. natural gas exports fuel high prices

As fall utility bills start hitting people’s mailboxes, more households will start feeling the pinch of higher natural gas prices. The wholesale price of U.S. gas has roughly tripled from last summer’s lows, and utilities are passing on rising costs to their customers. But it’s not just householders who will feel the pinch. Businesses are complaining, too: In September, an industry trade group urged the federal government to take swift action to halt the rise in natural gas prices.

This raises a key question: Why have natural gas prices risen so high, so fast?

Why have natural gas prices risen so high, so fast?

First, a bit of context. Today’s gas prices may seem high, but that’s mostly because Americans have gotten accustomed to cheap fuel. Since 2011, natural gas prices have averaged about $3.50/MMBtu. Prices fell below $2/MMBtu last summer, in the depths of the COVID-19 crisis (One MMBtu, or 1 million British thermal units, has as much energy as about 8 gallons of gasoline). Yet in the first decade of the millennium, natural gas prices averaged nearly $8 per MMBtu, after adjusting for inflation. So today’s price—$5.52/MMBtu at press time—may seem exorbitant, but it would have seemed like a relief virtually any time from 2002 through 2009.

Still, a history lesson offers cold comfort to today’s energy consumers, who are looking for the reasons behind surging heating and power bills.

Supply and Demand

Prices rarely stray far from the fundamentals of supply and demand. When supplies dip or demand spikes, prices tend to respond. Energy prices are particularly sensitive to tiny imbalances between output and consumption. Even small shortfalls or surpluses can lead to dramatic price swings. The price spikes we’ve seen over the past several months suggest that either demand has ticked up or supply has dipped, or perhaps both.

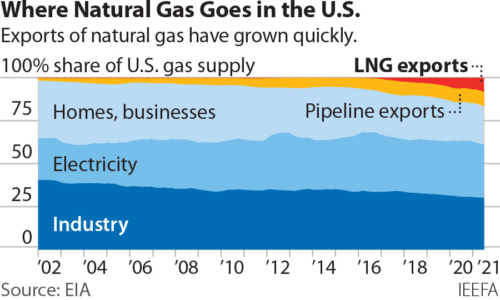

But within the U.S., gas demand has actually fallen a bit since pre-COVID days. For the 12 months leading up to July 2021—the most recent month for which U.S. data has been released—total gas consumption had fallen about 2% from its pre-COVID levels. So we can’t point to surging U.S. gas consumption to explain spiking prices.

The U.S. is exporting more and more natural gas, and importing higher prices as a result.

U.S. gas production has also dipped, and by just a smidge more than consumption. Most of that decline can be traced to a single month: February 2021, when the Big Freeze halved Texas gas output, depleting gas storage and setting the stage for a late winter price surge. Yet today, gas storage remains just a hair under the five-year average—nothing that would explain the dramatic price spikes in summer and fall.

If an event as momentous as the Big Freeze can’t explain sky-high prices, what can? What’s changed between last year and this year to cause prices to triple?

There is one trend that’s been big enough to explain rising gas prices: The U.S. is exporting more and more natural gas, and importing higher prices as a result.

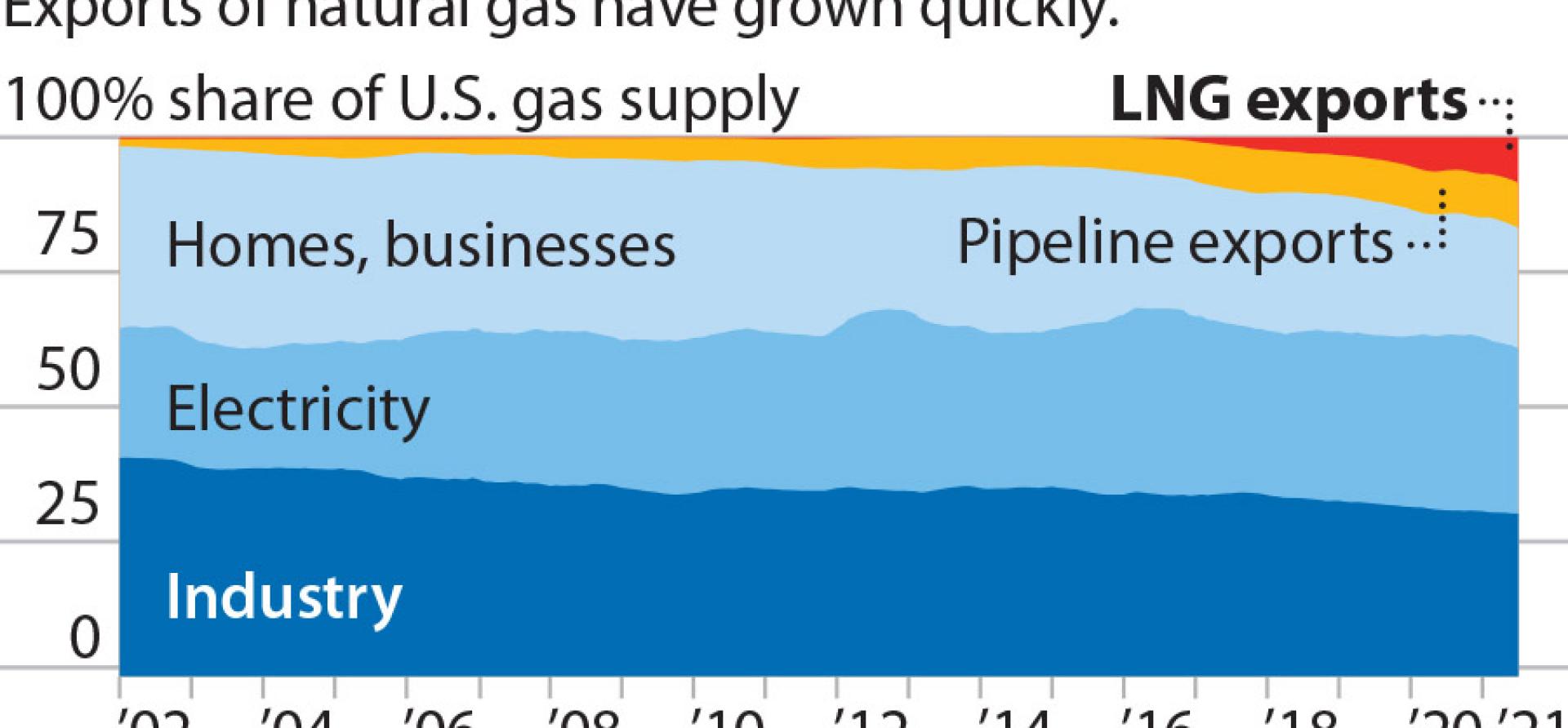

Over the past five years, U.S. exports of gas by pipeline, primarily to Mexico, have grown modestly. But that increase was dwarfed by the growth in shipments of LNG (liquefied natural gas) from six newly-commissioned facilities in Texas, Louisiana, and the East Coast. LNG is just ordinary gas chilled to -162° Celsius and pressurized so that it can be shipped in specialized ocean-going vessels. Five years ago, the U.S. exported essentially no LNG. But so far this year, LNG exports amounted to about 10 percent of total U.S. gas production.

Over the past five years, U.S. exports of gas by pipeline, primarily to Mexico, have grown modestly. But that increase was dwarfed by the growth in shipments of LNG (liquefied natural gas) from six newly-commissioned facilities in Texas, Louisiana, and the East Coast. LNG is just ordinary gas chilled to -162° Celsius and pressurized so that it can be shipped in specialized ocean-going vessels. Five years ago, the U.S. exported essentially no LNG. But so far this year, LNG exports amounted to about 10 percent of total U.S. gas production.

Combining both pipeline exports and LNG shipments, exports now account for almost one-fifth of all U.S. gas demand. That share is only slated to grow as new LNG facilities come online over the next few years, and as gas exports to Mexico through existing pipelines ramp up.

For now, U.S. LNG is quite profitable. Spot LNG prices have spiked above $30/MMBtu, reaching all-time highs in both Europe and Asia. Even with U.S. wholesale gas prices above $5/MMBtu, it’s still quite profitable to liquefy U.S. gas and ship it to gas-hungry overseas markets.

The reasons for spiking international gas prices are myriad: Rising global LNG demand; a combination of global supply disruptions and bad weather; shortfalls in Chinese coal production; and reputed Russian manipulation of European gas markets, reportedly to speed the approval of the new Nord Stream 2 pipeline. But regardless of the specifics behind the international LNG price spikes, buyers in Europe and Asia are now bidding up the price of U.S. gas, and U.S. consumers are paying more as a result.

Buyers in Europe and Asia are now bidding up the price of U.S. gas, and U.S. consumers are paying more.

Don’t expect U.S. gas producers to come to the rescue. America’s gas industry has been losing money for so long that Wall Street has lost patience with it. In the past, oil and gas companies would respond to high prices by boosting output—and the resulting oversupply would lower prices and kill profits. Investors are refusing to play that game again. They’re keeping their money on the sidelines, withholding money from publicly traded gas drillers that threaten to overproduce. Companies that have spare cash from gas sales are using it to pay down debts or reward investors, rather than boosting drilling. We can see this clearly in the data for Appalachia, America’s biggest gas-producing region. Drilling in the region has stayed roughly flat since February, despite rising prices.

For America’s fossil fuel industry, high natural gas prices are a feature, not a bug. In fact, fossil fuel interests predicted long ago that rising LNG exports would boost domestic gas prices. In 2016, just before the first wave of LNG projects was competed, the late coal magnate Bob Murray urged then-candidate Donald Trump to support LNG exports. As one writer put it, “The hope is if more natural gas can be exported, it might reduce the glut in the U.S., which has driven prices so low that it’s killing coal.”

If that was the strategy all along, it seems to be working. U.S. markets are no longer saturated with gas, prices have risen, and some utility companies have switched, albeit modestly, from gas back to coal. U.S. gas companies are making profits from the LNG they sell to Asia—but they’re making even bigger profits from higher prices they’re charging U.S. consumers.

The idea that LNG exports are boosting U.S. prices has now become something close to conventional wisdom among energy analysts. In late September, RBN Energy argued that LNG exports hitch U.S. gas markets to soaring international prices, and the problem is likely to get worse as more LNG export facilities come online. “The U.S.’s LNG export capacity ceiling is likely the only thing reining in Henry Hub prices from following European and Asian gas/LNG prices to the moon,” the energy analytics firm said. (That ceiling will rise early next year as facilities in Texas and Louisiana expand their operations.)

Industrial gas users made the same argument, recently urging the U.S. Department of Energy to place a hold on all existing, pending, and prefiling permits and approvals on LNG export facilities in the continental U.S. to stem increases in domestic prices. A report by Natural Gas Intelligence suggested that gas exports would increase 16 percent to 18 percent this winter, while production was slated to grow only 4 percent, setting the stage for higher gas prices. The Center for Strategic and International Analysis piled on, arguing there was now “strong evidence that exports are the primary demand driver for U.S. gas and thus the increase in prices.”

But what’s good news in the short term for the gas industry’s bottom line could be bad news for the industry’s long-term future. High and volatile gas prices are making renewables—whose costs keep falling—all the more attractive. Utilities, businesses, and industries making long-term decisions about their capital budgets can no longer be certain what gas prices will look like in five to 10 years. The price uncertainty of gas weighs in favor of the predictability of wind and solar. Sure, the sun doesn’t always shine and the wind doesn’t always blow, but when they do, they’re completely free.

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Related items

IEEFA. The U.S. Push for LNG in the Philippines Is Based on Dubious Assumptions.

IEEFA. Australia’s Offshore Industry: A Half-Century Snapshot.

IEEFA. Despite Hype, Tellurian’s LNG Plans Face an Uphill Battle.

IEEFA. New Policy and Market Risks for U.S. LNG Project Sponsors in Emerging Asia.