IEEFA: Russia’s invasion of Ukraine is affecting global gas demand with LNG unable to deliver energy security

Key Findings

Geopolitics, lack of competitive pricing, extreme price volatility and inability to supply point to the precarious position of gas/LNG as a fuel.

To be a viable source of power, a fuel must be available for forecast consumption and at an affordable price. Over the past nine months, gas/LNG has been neither available nor affordable.

Countries investing in energy independence will find homegrown renewable energy faster to deploy than any fossil fuel project. Energy security is the new priority.

You only need to freeze in one winter to be frozen.

In less than nine months, Europeans will be heading into another cold winter, this time presumably without the gas supplies they’ve previously relied upon.

Russia’s invasion of Ukraine has highlighted Western Europe’s addiction to Russian gas. It also highlighted the globe’s addiction to an unreliable and unaffordable fuel.

In the months leading into the conflict with Ukraine, Russia constrained gas supply

Around 44% of Europe’s gas comes from Russia. Germany is even more reliant with on occasion up to 75% of its gas Russian-sourced.

In the months leading to the conflict with Ukraine, Russia constrained gas supply, delivering only contractual minimums to Europe and no excess volumes beyond. Europe had grown accustomed to the luxury of summer spot purchases and when that gas did not materialize, there were no viable alternatives available.

Europe entered winter with its gas storages not filled.

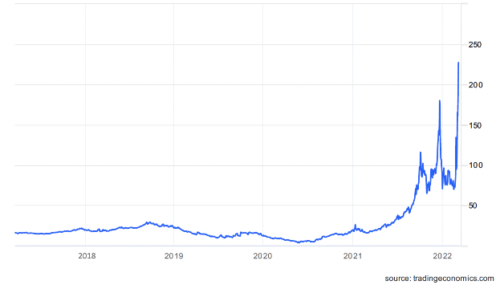

The global LNG market is finely balanced. Shortfalls meant prices rose to eye-watering levels. The Dutch TTF, the benchmark hub for gas prices in Europe, went from less than €5/megawatt hour (MWh) in mid-2020 to nearly €20/MWh early 2021. This week on 7 March 2022 prices closed at €227.20/MWh.

In less than two years, European spot gas prices have risen by more than 4500%. That’s quite a windfall for suppliers.

Natural Gas Prices EU Dutch TFF (€/MWh) 2017-2022

Is gas and LNG a fuel fit for purpose in Europe?

To be a viable source of power in an energy system, a fuel must be available for forecast consumption and at an affordable price.

Gas, or any energy commodity with such volatility, is not a viable fuel

Over the past nine months gas/LNG has neither been affordable nor available.

Its price volatility has been completely untenable and beyond the ability of rational buyers to manage. If purchased, the knock-on effects particularly in emerging economies such as Pakistan have been seriously damaging.

Gas, or any energy commodity with such volatility, is not a viable fuel.

With an eye on profit, many oil and gas companies have seen Russia’s incursion into Ukraine as an opportunity to increase sales of U.S. and Qatari LNG.

The LNG process is intrinsically expensive and adds to the cost of gas. Price aside, the flagged solution of building more LNG import terminals fails to consider one major issue: timing.

Timing is key

Europe, like a drug addict, is hooked on Putin’s gas. That gas – all gas – is now too expensive to buy or burn and supplies are limited.

There simply isn’t available LNG capacity globally to supply Europe with gas. Even LNG import terminals with excess import capacity have struggled to find supply from other sources. Gas prices in Asia have risen multiple times from mid-2021 as available LNG spot cargoes redirected to Europe.

New LNG terminals using Floating Regasification and Storage Units (FSRUs) would be relatively quick to construct if red tape could be cut. FSRUs can be leased on the international market and quickly relocated to Europe.

The problem however is not at the European end, it is at the supplier end.

Any new import terminals in Europe will have trouble accessing supply.

Can Qatar or U.S. LNG fill the gap?

Qatar, the world’s biggest LNG exporter until last year, is massively expanding its capacity from 77 million tonnes a year to 110 million tonnes a year by 2026. There are at least four European winters before and if any Qatari gas arrives.

Any U.S. intention of filling Europe’s gas gap is feeding into short memories. Europe is beholden to a foreign power that has not treated it well. When President Trump was in power, relationships between some of Europe’s biggest powers and the U.S. were distinctly frosty. Does Europe really want to jump out of Putin’s gas into the lap of Uncle Sam?

Europe’s problem is energy for next winter

The fastest build of any greenfield LNG project so far was the Calcasieu Pass LNG project. Final investment decision to first gas delivered was just two and a half years, due to the plant’s design. Other U.S. LNG liquefaction developers have permits in hand but their designs and configurations indicate three to four years before commissioning.

Europe’s problem is energy for next winter, only nine short months away.

So how can Europe fill the energy gap?

The threat of Russian gas withdrawal is a concern to governments, individuals and businesses dependent on the fuel – it’s also an opportunity.

In the immediate future, households’ domestic heaters and industry’s low heat applications will likely be substituted with more efficient electric heat pumps.

And countries investing in energy independence will find homegrown renewable energy faster to deploy than any fossil fuel project without the attendant national security risks.

As German finance minister Christian Lindner recently said in an article on defence spending, energy security is the new priority – renewable energy is a freedom energy.

Energy security is the new priority

Last week the International Energy Agency (IEA) outlined a 10 Point Plan to cut reliance on Russian gas by one-third within 12 months. The plan relies on more LNG imports, heat pumps, energy efficiency, temperature control and more low emission generation.

A more ambitious plan proposed this week by EU Green Deal chief Franz Timmermans suggests the EU can cut two-thirds of its reliance on Russian gas by the end of this year and accelerate the rollout of renewable energy, biofuels and green hydrogen – if governments implement a raft of emergency measures to be proposed to the European Commission.

Europe’s choices will impact people locally and gas markets globally.

Linking Europe’s problems to the world

Europe is not the only region in the world to experience the disfunction of global gas/LNG markets.

Asia too has seen spot gas prices rise to unaffordable levels. On 4 March 2022, Asian LNG spot prices hit a record high of more than US$59/mmbtu, up nearly 1000% on cargoes delivered for the same period last year. Contract gas prices are more sedate in Asia trading between approximately US$10-15/mmbtu since mid 2021.

Emerging Asian markets have felt the brunt of these prices with no relief in sight.

European-based gas companies have made super profits by defaulting on long term contracts to supply Asia. LNG cargoes are being diverted to the high-priced European market. In the spot market, emerging Asian economies have been unable to secure LNG as high prices have drained the allocated subsidy money.

High prices have killed gas demand in emerging Asia

Pakistan has three contracts for long-term supply, one has been honoured and two are in default. European LNG companies saw the opportunity to break contracts to supply, pay default clauses, and sell the LNG into the high priced European market at substantial profits. Fed-up with ENI and Gunvor’s defaults, Pakistan is considering claiming damages for failure to meet their contractual obligations, depriving the country of essential fuel supplies.

The shortages led to disconnection of supply to industry, low gas pressures for residential consumers and power blackouts all over the country.

A similar story is unfolding in nearby Bangladesh where the country has only been able to procure 11 of the 20 spot LNG cargoes scheduled for 2020-21 and has run out of subsidy money to buy more.

High prices have killed gas demand in emerging Asia.

Gas/LNG an unreliable fuel

Globally, the position of gas/LNG as a fuel in the energy system is under extreme pressure from geopolitics, lack of competitive pricing, extreme price volatility and inability to supply.

Putin’s Ukrainian misadventure has forced Europe into ditching its addiction to gas.

Emerging Asia will quickly follow as affordability and volatility saps their ability to purchase an unaffordable fuel.

And a cold winter is just around the corner.

By Bruce Robertson, LNG/gas analyst, Institute for Energy Economics and Financial Analysis (IEEFA)

Related articles:

IEEFA: Renewable energy can insulate India against future fuel price shocks

IEEFA: Russia-Ukraine conflict adds impetus to Asia’s energy transition

IEEFA: PM Imran Khan’s ill-timed visit to Russia highlights the risks of Pakistan’s LNG investment

IEEFA: For emerging Asia, LNG volatility puts energy security and economic growth in jeopardy