IEEFA Report: What’s Wrong With FirstEnergy, Part 1

By Tom Sanzillo and Cathy Kunkel —

We’ve published a report today that outlines profound shortcomings in the management and performance of FirstEnergy Corp., the publicly held Ohio-based utility company that provides electricity to more than six million customers.

We’ve published a report today that outlines profound shortcomings in the management and performance of FirstEnergy Corp., the publicly held Ohio-based utility company that provides electricity to more than six million customers.

Our report, “FirstEnergy: A Major Utility Seeks a Subsidized Turnaround,” describes an company trying to fight its way out of self-inflicted straits by saddling ratepayers with higher prices and by blocking the development of alternative forms of energy.

It also describes how the leadership of the company has betrayed shareholders, customers and the broader public with misguided policies rooted in a basic misunderstanding of today’s rapidly evolving energy industry.

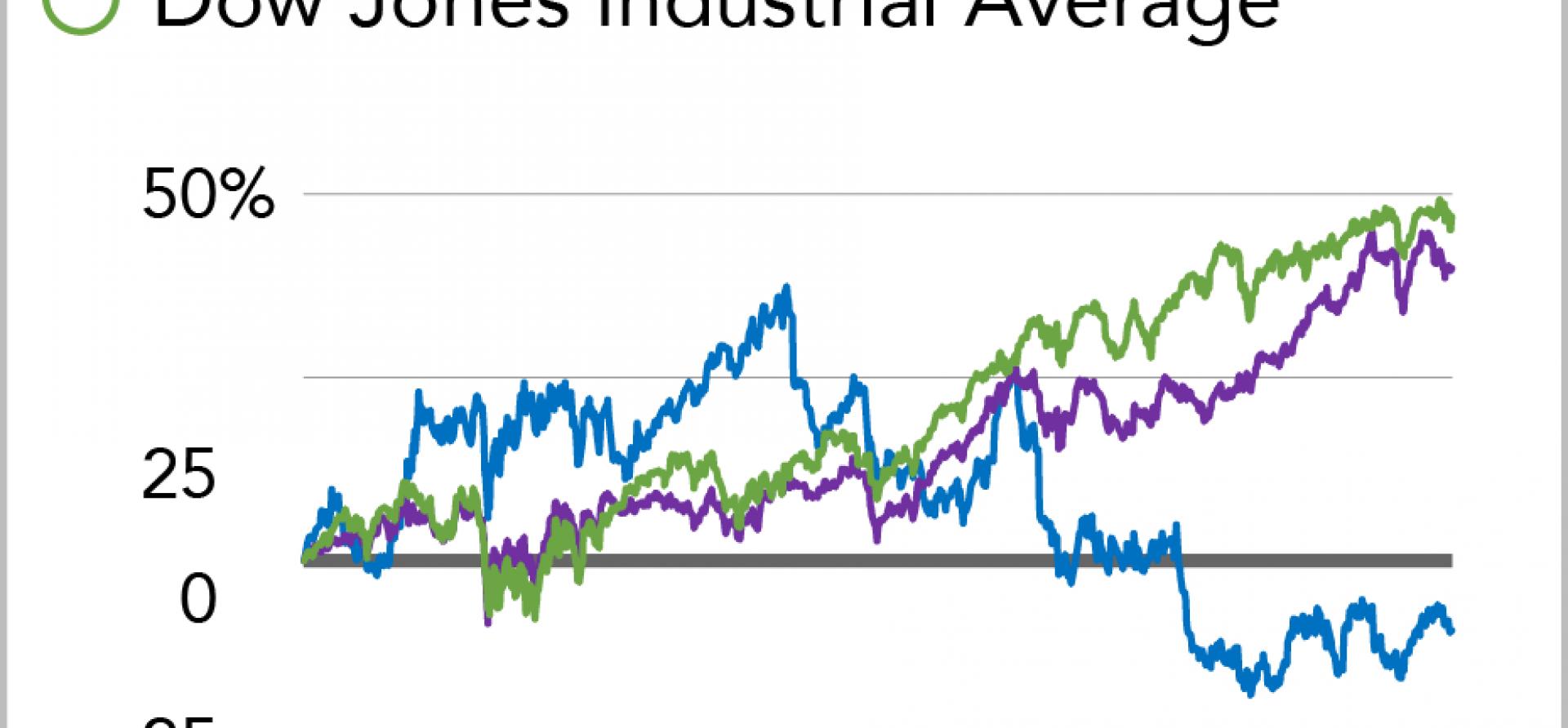

We highlight in our report a series of management missteps typified by FirstEnergy’s acquisition three years ago of Allegheny Energy, a mostly coal-fired electricity company vulnerable to better-diversified competitors. We document the company’s deeply poor financial metrics. We explore how the company is wedded to a failed strategy of long-term dependence on coal-fired generation. And we conclude, emphatically, that FirstEnergy’s financial condition is not likely to improve in either the short or medium term.

Our report describes also how the company’s leadership has resorted to a cynical business strategy that focuses on regulatory capture, on federal subsidies, and on campaigns to thwart good public-policy initiatives to increase the development of alternative energy and to support greater across-the-board energy efficiency.

Here are some excerpts:

- “FirstEnergy’s political strategy—calling for continued reliance on coal-fired and nuclear power generation and opposition to competing sources of power—is based on a mischaracterization of the fundamental challenge facing the utility industry. What worked in the past is unlikely to work in the future.”

- “FirstEnergy’s continued choice of coal as a fuel source, particularly for a utility in mid-Atlantic and Midwest markets, is increasingly risky in this new era characterized by low power prices, a glut of natural gas, rising importance of renewable energy and popular opposition to coal.”

- “While the industry as a whole is challenged by low power, natural gas prices, and the transition away from coal fired generation, most large investor-owned utilities are navigating these challenges.”

- “First Energy’s reliance on subsidies and bailouts—while costly to ratepayers—will not solve the underlying downward slide of the company’s financial performance.”

In tomorrow’s blog entry, “What’s Wrong With FirstEnergy: Part 2,” we’ll highlight some of the metrics on FirstEnergy’s deteriorating financial performances, including the company’s declining stock prices, its declining revenues, its declining net income, its rising debt levels, its reduced dividends, and its over-reliance on stop-gap, short-term measures.

As the week unfolds, we’ll be writing about different aspects of FirstEnergy’s flawed forward-looking strategy and its questionable political and regulatory tactics.

Stay tuned.

Tom Sanzillo is IEEFA’s director of finance. Cathy Kunkel is an IEEFA research fellow.