IEEFA India: Green lending criteria could improve the performance of power distribution companies

14 October (IEEFA India): To encourage change in high-carbon sectors, India’s power authorities could introduce a green rating when assessing financial support and bail-outs for power distribution companies (discoms), says a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

With lndia moving towards decarbonisation of its power sector, says report author and IEEFA contributor Saloni Sachdeva Michael, there is an urgent need to examine the financial risks of high-carbon portfolios, with a view to integrating green criteria into lending decisions and credit risk analyses applying to distribution companies.

“Establishing hybrid rating (green + credit) information systems is a fundamental task at the heart of green finance,” Sachdeva Michael says, “and is a necessary step to increase disclosure, transparency, and accountability of the Indian distribution sector.”

Establishing a hybrid (green + credit) rating is a fundamental task at the heart of green finance

In the current annual credit rating system for discoms employed by the Power Finance Corporation (PFC) and the Rural Electrification Corporation (REC), the sole green parameter, the renewable purchase obligation (RPO), carries the least weight – and this is not conducive to the development of green finance and a sustainable, low-carbon economy.

“Considering the time and effort required to re-engineer a separate green rating,” Sachdeva Michael says, “the more logical next step is to strengthen the existing integrated rating methodology, drawing learning from the environmental, social, and governance (ESG) framework used for corporate ratings. New parameters can be added in a phased manner.”

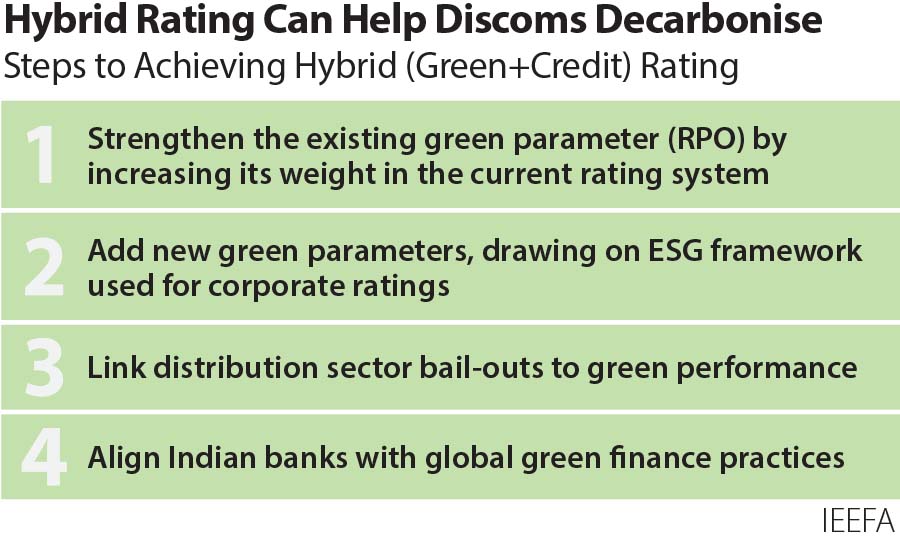

The report makes four key recommendations to improve the disclosure, transparency and accountability of the distribution sector:

- Increase the weighting of the RPO, the sole green parameter in the current rating mechanism

- Add new green parameters to track performance on renewable energy, electric vehicles and energy efficiency

- Link bail-out packages for discoms to green performance based on a hybrid credit rating

- Align domestic banking with global green finance best practices

In the report, the term ‘green’ is used to refer to the decarbonisation of India’s power sector, which trickles down to the discoms. The overall goal is to enhance renewable energy uptake; electrify the transport sector via electric vehicles; increase ‘tail-end’ generation and utilisation through decentralised renewable energy solutions; and boost use of energy efficiency equipment and design, including solar pumps for improving agricultural and energy efficiency.

To reach its target of 450 gigawatts (GW) of renewable energy capacity by 2030, India will need to deploy US$500bn in investments. Of this, US$300bn would be directed to wind and solar infrastructure, US$50bn to grid firming investments, and US$150bn to expanding and modernising transmission. For state utilities, financial stability is a significant challenge to attracting the necessary investment.

In an overall examination of the distribution sector, Sachdeva Michael says despite central and state government schemes and initiatives aimed at improving the discoms’ operations and financial health, the sector continues to be a resource drain on the national economy.

“Most distribution companies are making major losses as a result of expensive legacy thermal power purchase agreements, poor infrastructure and inefficient operations, among other factors,” she says.

The discoms have accumulated massive overdue payments to generators – Rs119,185 crore (US$16bn) as of June 2021 – creating a liquidity crunch across India’s entire power sector.

The rating needs to be updated to quantify green initiatives undertaken by the discoms

Looking ahead, she says, India is already making progress towards its aspiration to decarbonise and achieve energy independence. Critically, she reasons, making that aspiration a reality will depend strongly on the trajectory of the distribution sector.

Currently, tracking and monitoring of discoms’ decarbonisation plans and green performance is limited. The arrival of alternate financial instruments, such as green bonds, combined with massive decarbonisation goals, shows the need to update the rating methodology to include parameters that help quantify green initiatives undertaken by the discoms.

“A hybrid rating that incorporates both green and credit performance of discoms will provide a true picture of the sector’s green disclosure and readiness for the energy transition,” says Sachdeva Michael.

Read the report: The Green Disclosure of the Indian Distribution Sector

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Report contacts: Saloni Sachdeva Michael ([email protected]); Vibhuti Garg ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)