IEEFA experts trace the fallout from Russia’s invasion of Ukraine on global liquefied natural gas markets

Prices expected to continue to be high, but LNG may be pricing itself out of global markets

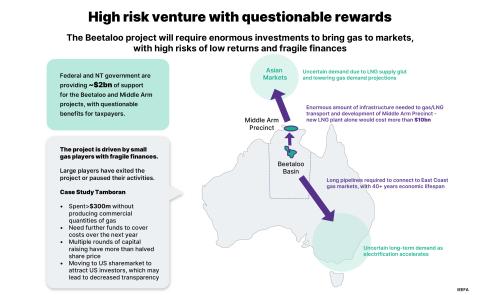

May 20, 2022 (IEEFA)—The fallout from the Russian invasion of Ukraine has disrupted the world’s liquefied natural gas (LNG) market, driving prices to record levels while likely positioning the industry for a significant downturn as emerging Asian markets are priced out of the market, according to a panel of IEEFA experts.

IEEFA’s analysts find that the disruption in the LNG markets has been truly global. Russia, which faces a series of international sanctions, is the world’s second-largest natural gas producer, its third-largest oil producer, and its sixth-largest coal producer. In addition, Russia provides Europe with more than one-third of its gas supply.

“Any geopolitical disruption can have a major impact on price volatility and global supply,” said Sam Reynolds, an IEEFA energy finance analyst. “We’re already seeing some of those disruptions start to play out in Europe.”

The European Union plans to reduce the amount of imported Russian gas by two-thirds by the end of the year, replacing it with LNG. This has meant that LNG originally destined for emerging Asian economies is instead being diverted to Europe, and high prices are squeezing out regional markets in India, Pakistan and Bangladesh.

“Prices are directing traffic,” Reynolds said. “We’re talking about a stark risk of energy insecurity in these emerging Asian economies. Ultimately, these price spikes and supply disruptions are undermining the economic case for LNG in the region. This could ultimately hurt the growth of the industry.”

Arjun Flora, IEEFA’s director of energy finance studies for Europe, said short-term demand is likely to remain high, even as the European Union takes steps to reduce its dependency on Russian gas that’s delivered via a sprawling network of pipelines.

“This has forced Europe to get serious about diversifying,” he said. “It’s been talked about for a long time, but it hasn’t happened. Europe is very exposed to this volatility, and the current reality really demonstrates Europe’s dependency on Russian gas.”

Weaning the continent from Russian gas will require new analyses of existing gas supplies. networks, and storage capacity, said Ana Maria Jaller-Makarewicz, an IEEFA energy analyst for Europe. She noted that two countries cut off from Russian gas for their refusal to pay in rubles are taking innovative steps to keep the supplies flowing. Poland, which usually sends gas through pipelines to Germany, is now receiving gas from Germany. Bulgaria is now getting gas from Azerbaijan and is considering Turkey and Greece as an LNG source.

Jaller-Makarewicz also noted that even as the flow of Russian gas from pipelines slows, Europe is still helping to ship Russian LNG throughout the world. Five of eight cargoes exporting LNG from Russia’s massive Yamal LNG operation were transshipped through the Zeebrugge LNG Terminal in Belgium.

“We have seen so far there has been a lack of planning as a whole continent,” she said. “So right now, we are seeing a lot of desperation.”

The desperation isn’t just limited to Europe. Since 2016, a growing amount of natural gas has been shipped from the U.S., said Clark Williams-Derry, an IEEFA energy finance analyst. The U.S. has been the world’s largest producer of natural gas since 2011. Williams-Derry noted that while politicians have billed the effort to export more LNG to Europe as a sign of political solidarity, it’s actually a sign of the markets seeking the highest prices.

“It’s really prices, rather than politics, that are directing traffic in the U.S. LNG market,” he said. “Unlike some parts of the world, the U.S. has a lot of destination flexibility. It’s just become a lot more profitable to ship U.S. LNG to Europe because prices are higher.

The increasing exports have helped push the price of gas to its highest level in a decade, he said. Since 2016, prices have risen from $1.96 per metric million British Thermal Units (MMBtu) to $8.04 per MMBtu, he said.

“Domestically,” he said, “the U.S. is exporting more gas and importing higher prices.”

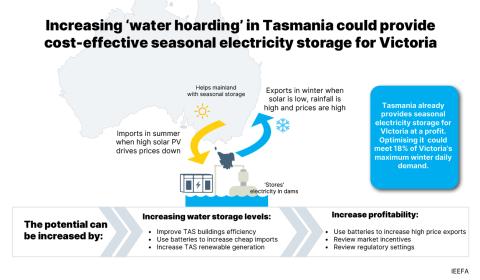

Panel members agreed that while the high prices are likely to spur continued production of LNG, they’ll also encourage more countries to seek cleaner alternative sources of electricity and heat, such as renewable power.

“There will continue to be short-term demand for LNG,” Flora said. “But in the medium term, gas demand will be going down.”

IEEFA Webinar: How is the Ukraine crisis and its fallout affecting global LNG markets?

Media Contact:

Susan Torres ([email protected]), +1 (908) 565-3451

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.