IEEFA: For emerging Asia, LNG volatility puts energy security and economic growth in jeopardy

The liquefied natural gas (LNG) bubble in emerging Asia is growing, with more than US$109 billion in proposed LNG infrastructure investments aiming for completion in the next five years.

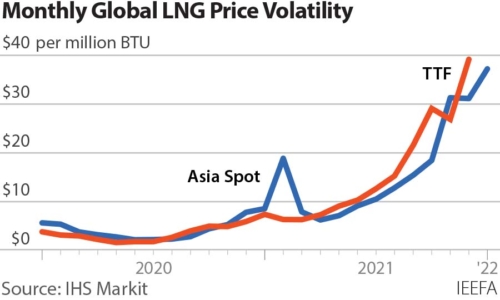

However, according to a recent IEEFA report, many proposals for import terminals and gas-fired power plants in seven emerging Asian markets could be hot air. The report found that more than 66% of LNG investments in the region—which many expect to drive global LNG demand growth over the next decade—are unlikely to be built. Countries that do increase LNG dependence will subject their economies to a highly volatile, foreign currency-denominated commodity that could strain government budgets, ruin credit quality, and undermine long-term growth.

So, what are the alternatives?

The liquefied natural gas (LNG) bubble in emerging Asia is growing

In short, the buildout of renewable energy, grid infrastructure, and battery storage technologies is critical for countries to reduce electricity prices, improve energy security, attract foreign direct investment, and improve prospects for economic growth. Gas pricing and subsidy reforms could also reduce demand for expensive LNG imports.

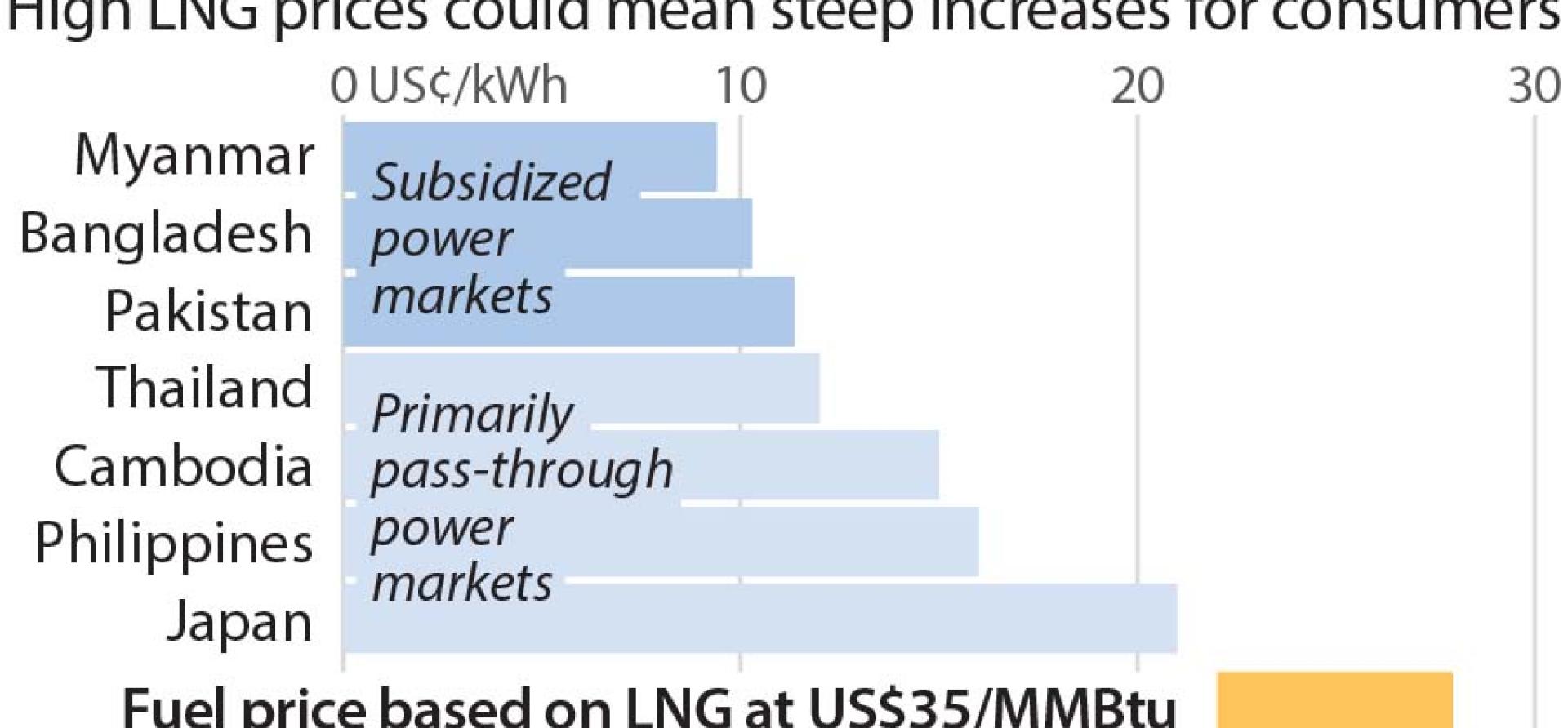

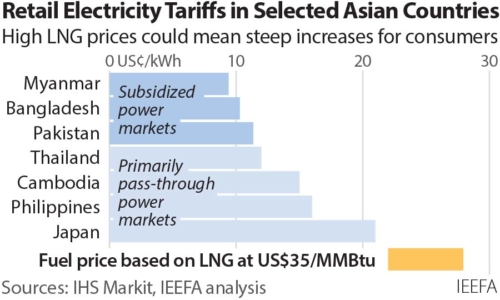

For perspective, consider current prices of LNG in Asian markets compared to recent renewable energy auctions in emerging Asian countries. LNG has recently traded for US$35 per million British thermal units (MMBtu), which translates to a power price of nearly US¢22-28/kWh for the fuel alone (depending on the efficiency of the gas plant). This does not include the capital costs of building a gas-fired power plant, and is already much higher than most households in Asia pay for power. LNG prices are expected to remain elevated through 2022.

LNG at current prices could yield power prices that are double, even triple, power tariffs for end-users in the region. For markets in which fuel costs are passed through to the end-user, households and businesses could bear these costs directly. In markets where the government subsidizes power, LNG prices could reap similar effects on budget allocations—costs that taxpayers ultimately bear. Either way, citizens of importing countries bear the brunt of high LNG costs. Exorbitant fuel prices can also accelerate inflation and hurt key domestic industries.

Meanwhile, the prices of renewables like wind and solar do not have fuel costs, which means no payments for fluctuating, foreign currency-denominated fuels. Renewables prices are typically quoted in all-in life-cycle costs, meaning that capital and operational costs are included in one straight price.

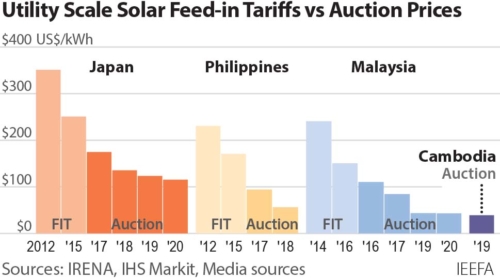

Renewable energy auctions represent the best method to determine this price, allowing suppliers to bid for project capacity and buyers to select the cheapest options. In contrast to feed-in tariffs, which award renewable energy developers a fixed price determined by the government, public auctions allow parties to reach a mutually agreeable transaction price. Cambodia’s 2019 auction for a 60MW solar facility produced a final tariff of US¢3.87/kWh—less than 20% of current LNG fuel costs. Throughout Asia, auctions have yielded lower prices than feed-in tariffs, while encouraging competition and boosting generation capacity.

Auctions are set to take place throughout the region, which could limit the need for expensive LNG assets. Malaysia has held auctions, resulting in 2,300 megawatts (MW) of new solar capacity since 2016. The Philippines government plans to auction 2,000MW of renewables capacity this year. The government of Pakistan is also envisioning a shift to renewable auctions to meet its renewables targets. To fully take advantage of low-cost renewables and reduce dependence on LNG, governments should accelerate this shift to renewable energy auctions.

Greater renewable energy supply requires grid capacity additions to improve power stability and mitigate renewable energy curtailment during times of excess production (e.g. strong winds or sunlight). In this sense, money for LNG infrastructure would be better spent on electricity infrastructure to unlock access to lower-cost domestic renewables.

Multilateral development banks can play a more supportive role in grid developments. Cambodia’s 60MW solar auction solicited 148 initial bids. Its success was partly due to the Asian Development Bank, which advised the transaction and provided a sovereign loan blended with climate finance funds for the transmission line and substation. Despite this success, the ADB dedicates greater financing to gas assets than grid infrastructure. From 2016-2020, the ADB provided US$4.7 billion for gas projects, compared to US$2.7 billion for grid projects. The focus of international finance must shift from continuing dependence on economically harmful fossil fuels to facilitating renewable energy growth in emerging markets.

As cheaper renewables are deployed more widely, the role of gas will diminish

To firm up renewable energy capacity and maintain system reliability, battery storage technologies are being deployed throughout Asia, driven by cost declines and increasing scalability. For example, batteries have helped South Australia demonstrate that 100% renewables generation is possible and can drive down wholesale power costs. The state aims to reach net 100% renewables by 2025, while the role of gas is expected to fall. In Southeast Asia, the Philippines has more than 1.5 gigawatts (GW) of battery storage capacity set to be completed by 2025. As battery costs fall, they may increasingly fill peaking roles historically occupied by gas-fired power plants, undermining arguments about the necessity of LNG-fired power generation.

Another alternative to LNG is tariff pricing reform, which can improve how efficiently gas is used in national energy systems. In Pakistan, roughly 15% of gas is leaked in transportation, partly because state-owned gas distribution companies are regulated on a cost-plus basis, which encourages the buildout of new gas transmission infrastructure, but does not incentivize maintenance and repairs of existing infrastructure. Similarly, gas subsidies in countries like Bangladesh can artificially inflate demand from gas-intensive sectors, which are shielded from paying volatile fuel costs.

LNG proponents will argue that gas is necessary to complement renewables. But as cheaper renewables are deployed more widely, the role of gas will diminish. Countries should therefore avoid contracts—e.g. power and LNG purchase agreements—that lock-in 20-plus-year dependence on a volatile, foreign currency-denominated fossil fuel.

Variable renewables like wind and solar accounted for just 2.4% of Southeast Asia’s energy mix in 2020. The priority for countries in the region should be to increase this percentage and take advantage of the inherent price hedging characteristics of low-cost domestic renewables, rather than simply replacing coal with another imported, foreign currency-denominated fossil fuel. The energy security and economic growth of emerging markets depend on it.

This commentary first appeared in South China Morning Post.

Sam Reynolds is an Energy Finance Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

Related articles