IEEFA: The disconnect in the Indian gas sector

Union Budget 2022 did not mention gas related schemes or infrastructure – not even the city gas distribution (CGD) network despite the recent conclusion of the 11th round of CGD bidding.

Green hydrogen is the only clean form of hydrogen

Yet state gas utility GAIL (India) Ltd announced pre-Budget that it had commenced India’s first-of-its-kind project of mixing hydrogen into the gas system in Indore, Madhya Pradesh. This hydrogen-blended gas – known as grey hydrogen – will be supplied to a joint venture for retailing of compressed natural gas (CNG) to automobiles and piped natural gas (PNG) to households for cooking. The pilot project uses grey hydrogen with a view to subsequently use green hydrogen.

Green hydrogen is the only clean form of hydrogen as it is produced without harmful greenhouse gas emissions by separating hydrogen from water using electrolysis with renewable energy. Grey hydrogen, on the other hand, is produced by separating hydrogen from the fossil fuel gas (which is one part carbon and four parts hydrogen).

The details of GAIL’s proposed pilot have yet to be published, but proponents would need to be looking very closely at the investment risk of such a project due to recent global gas volatility and record high prices, making gas a very expensive resource.

Gas-using states such as Maharashtra, Gujarat and Delhi saw repeated upward revisions in CNG and PNG prices last year, especially after the bi-annual October revision of gas well-head prices which saw prices rise to 62% for regular fields and 69% for difficult fields. For instance, CNG and PNG prices were revised more than five times in 2021 by a gas utility in Mumbai leading to 34% and 31% increases, respectively.

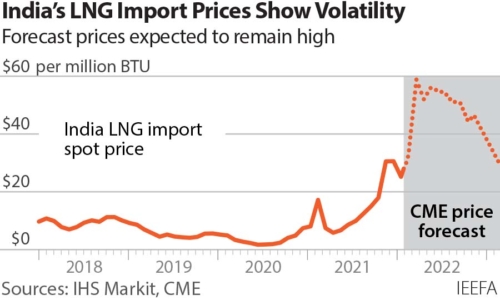

Indian spot LNG imports also increased last year, from US$8.21/MMBtu (metric million British thermal unit) in January 2021 to US$30.66/MMBtu in December 2021 – an increase of 270%.

The upcoming April 2022 revision in producer gas prices, to be calculated using the volume-weighted average price (VWAP) of four international benchmarks with data from January to December 2021, is expected to be much higher given recent peaks in international gas prices. It is being estimated that domestic gas prices from regular fields will double in April 2022 (from the US$2.9/MMBtu increase in October 2021) to US$6/MMBtu, and would further increase to US$8/MMBtu in October 2022.

This increase in producer gas prices would translate into increased prices for gas consumers in household, commercial and industrial sectors, making gas use extremely unaffordable, and dampening existing demand.

The disconnect between government policy and GAIL’s pilot illustrates an uncertainty

Further increases in gas prices would also make the production of grey hydrogen, which needs to use this expensive gas, an infeasible proposition.

The disconnect between government policy and GAIL’s pilot illustrates an uncertainty in India’s gas sector, which has been suffering from extreme price fluctuations having reached record highs and lows over the past two years.

As IEEFA noted in a recent report, gas price volatility is an abiding issue with the risk of stranded infrastructure assets. It is also however an opportunity for utilities such as GAIL and the gas sector to switch to cleaner, non-fossil fuel alternatives.

Gas price volatility dampens demand, as do high prices. With the onset of COVID-19, LNG demand fell, and prices tumbled. In April 2020, the Japan Korea Marker (JKM), considered a benchmark for Asian LNG spot prices, reached its lowest point at US$2/MMBtu. However, once the economic recovery began, gas supply couldn’t keep pace and prices started rising with the JKM peaking at US$35/MMBtu on 5 October 2021. In the past few months, the Indian import spot LNG price, on average, has been in the range of US$30/MMBtu. LNG spot prices are forecast to remain above US$50/MMBtu through to September 2022 and US$40/MMBtu until the end of the year.

Given the unprecedented and unexpected sharp rises in gas prices last year, and the soaring prices due to the Russia-Ukraine war, it seems highly unlikely that prices will stabilise at around US$19-20/MMBtu in 2022, as predicted at the start of December.

In October last year, prices were expected to settle at US$14-15 by May 2022 – an indication of the increasing unpredictability in gas markets. This itself is way beyond India’s affordability threshold of US$10/MMBtu.

LNG price volatility can have major implications for demand, capital and infrastructure

Such price volatility can have major implications for demand, capital and infrastructure, especially in price-sensitive emerging economies such as India – raising the operating costs of downstream projects in the industrial, power and city gas distribution (CGD) sectors, and harming product competitiveness, utilisation rates and returns on investment.

India is planning a massive expansion of LNG import infrastructure to spur gas demand. However, skyrocketing LNG prices and increased attention on the global warming potential of methane (the major component of ‘natural’ gas) will more than likely lead to a major risk of under-utilisation of this infrastructure with billions of dollars’ worth of investment becoming stranded, again demonstrating the policy disconnect.

As IEEFA has previously noted, global gas supply/price volatility will likely continue to increase due to reduced drilling activity, financial instability in the oil and gas industry, and lower industry investment.

An industry analysis shows that between 2016-2020, while Asia LNG spot prices averaged 27.2% lower than Brent-linked prices, the volatility of LNG prices was much higher at 51% compared to the Brent-based contract prices.

Peak gas prices are challenging for producers and consumers and highlight a major problem with relying on gas as a “bridge fuel” to a lower carbon economy. Further, they adversely affect India’s import bill and current account deficit (CAD) – already deeply impacted by the pandemic – and put the nation’s energy security at risk, making it a matter of urgency for the government to explore cleaner alternatives to gas.

Peak gas prices highlight a major problem with relying on gas as a ‘bridge fuel’

As consumers contemplate substituting polluting fuels, the focus should be on developing renewable energy alternatives that would not only be more affordable but also help India transition to a low-carbon economy. Biogas and biomethane, options approved by the U.S. Renewable Fuel Standard program, are equivalent in quality to gas for cooking and transport and industrial use, respectively.

For the Government of India, the current market mayhem presents an opportunity to enable cleaner, non-fossil alternatives for gas-dependent sectors such as CGD and industry.

In a nutshell, to strengthen energy security, there is an urgency for investment in alternatives to gas to insulate India from balance of payments risks and from the fuel’s inflationary pressure – and, most importantly, to meet low-carbon goals.

By Purva Jain, energy analyst, Institute for Energy Economics and Financial Analysis (IEEFA)

This article first appeared in the Hindu Business Line.

Related articles:

IEEFA: Renewable energy can insulate India against future fuel price shocks

IEEFA: Impact of LNG Price Volatility on Gas Demand in India