The World Bank’s Bad Energy-Policy Call in Kosovo

We’ve just published a study concluding that the proposed coal-fired New Kosovo Power Plant—if it’s built—would increase electricity prices by as much as 50 percent in Kosovo and damage the economy of the small country.

The study, “The Proposed New Kosovo Power Plant: An Unnecessary Burden at an Unreasonable Price,” ( also see Albanian version) urges the World Bank and the U.S. and Kosovo governments to reconsider their support for the project.

We see the New Kosovo Power Plant, or NKPP, as a social and financial step backward for Kosovo. It would put households across Kosovo in a bind and, as Visar Azemi, coordinator for the Kosovo Civil Society Consortium for Sustainable Development (KOSID), says, would mean “turning electricity into a luxury for many.”

The proposal is riddled with questionable assumptions and arrangements, not the least of which is a plan to build it after accepting just one construction bid, by New York-Based ContourGlobal. And it flies in the face of the stated mission of the World Bank whose aim is to reduce poverty and to promote sustainable, clean development.

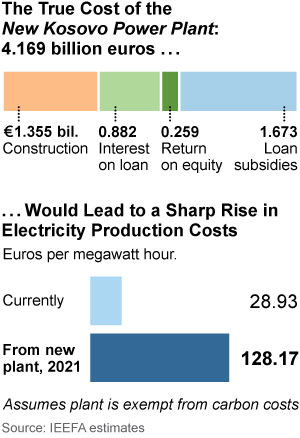

And our research shows that the cost of the New Kosovo Power Plant far exceeds the government’s projected cost of €1.0 billion. We think it would be close to €4.2 billion by the time the plant goes online as planned in 2021. And we think it would require massive subsidies.

Our calculations find that if the plant is built:

- The average Kosovar household would pay 12.9 percent of its annual income for electricity, twice what most European households pay.

- Low- to middle-income households in Kosovo would pay 18 percent of their annual income for electricity.

- Very low-income households would pay 39.7 percent of their income for electricity.

- Retail electricity costs would increase by 33 to 50 percent.

Kosovars already pay too much for electricity. This plant would be particularly harmful to low-income households, forcing people to choose between paying for electricity and other basic necessities.

Our report also raises several red flags around the financing behind the project:

- The plant would cost more than the government of Kosovo assumes, it may not operate as much as forecast, and/or its operating costs may be significantly higher than expected.

- The proposed debt burden of €945 million would put enormous pressure on the domestic banking system and crowd out new investment across the economy.

- By contemplating a single-bid project as costly as NKPP, the government is ceding domestic control of its electricity system, access to its revenues, basic organizational decisions like hiring and firing of employees and future rate increases.

- Plans for the new plant are based on optimistic economic growth assumptions; if the plant underperforms because the economy underperforms, its electricity will become even more expensive.

- No investment bank or group of investment banks has come forward to finance the project, an indication that neither Kosovo’s investment team nor the deal are creditworthy.

- Recent statements of support by the World Bank and the U.S. government contradict stated policies on climate change and poverty by the World Bank and the US. Government, and both increase the likelihood that the New Kosovo Power Plant project costs will soar as participants in the development process exploit political support for financial advantage.

We note also that details made public around the project are incomplete, and transparency is lacking.

A far better way forward for Kosovo is to invest wisely in much-needed energy-efficiency improvements and embracing the renewable-energy revolution. Buying into the New Kosovo Energy Plant would be the wrong move at the wrong time.

Tom Sanzillo is IEEFA’s director of finance. David Schlissel is IEEFA’s director of resource planning analysis.