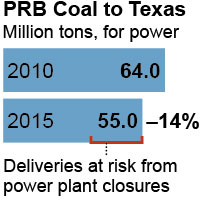

As Texas Coal-Fired Power Plants Close, Powder River Basin Mines Are Losing Their Largest Customers

CLEVELAND, Aug. 3, 2016 (IEEFA.org) — The Institute for Energy Economics and Financial Analysis today published a report detailing how Powder River Basin coal producers are losing their largest customers as Texas power producers turn increasingly to other sources of energy.

The report, “Texas’ Outsize Role in the Decline of the Powder River Basin Coal Industry,” by IEEFA Director of Finance Tom Sanzillo, describes how changes in Texas will probably force mine closures and complicate efforts by Powder River Basin coal producers Alpha Natural Resources, Arch Coal and Peabody Energy to work their way out of bankruptcy.

“Steep decline in demand from Texas has put pressure on PRB producers to close mines, and pressure to do so grows as the persistence of low prices dims future profitability,” the report says. “Spot PRB coal prices for both 8400 Btu and 8800 Btu are at their lowest ever: $7.15 and $9.60 per ton, respectively. Current spot prices do not cover the cost of production for any PRB producer. Contract prices for PRB coal are also under pressure as Peabody, Alpha and Cloud Peak have posted modest but unsustainable cash margins on their PRB mines. Arch is posting negative margins.”

In an accompanying commentary on IEEFA’s web site, Sanzillo wrote that changes in the Texas electricity market—the largest in the country—are emblematic of national trends but that Texas stands out “not only for its size but for its stature—as a national leader in energy policy and energy development.”

“As the state continues to turn its electricity grid into a model for renewable energy and as a proving ground that shows the affordability, reliability and abundance of alternatives to coal, it will most likely continue to serve as an example others will follow,” Sanzillo said. “And as more coal-fired plants in the Lone Star State face financial distress, Powder River Basin coal producers will lose more business, complicating how these companies will emerge from bankruptcy and raising questions about whether they can honor reorganization promises to investors, regulators and the public.”

Highlights from the report:

- The hardest-hit PRB mines are those that produce PRB 8400 coal. Texas consumption of this coal dropped by 29 percent from 2010 through 2015 and continues to fall. Peabody’s Caballo and Rawhide mines lost 20 percent of their Texas business. Cloud Peak’s Cordero mine has lost 50 percent of its business, and a smaller producer, Western Fuel Associations, has lost 100 percent of its Dry Fork mine business.

- Spot PRB coal prices for both 8400 Btu and 8800 Btu coal are at their lowest ever: $7.15 and $9.60 per ton, respectively, and current spot prices do not cover the cost of production for any PRB producer.

- Contract prices for PRB coal, while higher than spot prices, are producing at best modest, unsustainable operating margins for PRB coal producers.

“Overall, we see Texas demand for PRB coal continuing to fall, and to fall further than widely acknowledged as the state replaces its aging coal fleet with wind- and natural-gas-powered generation and as it develops a robust pipeline of solar energy projects,” Sanzillo said.

The report notes that the coal-fired share of the U.S. electricity-generation market has dropped to 33 percent today from 51 percent in 2007, and it likely to decline further.

Media contact: Karl Cates, [email protected], 917.439.8225

About IEEFA

The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.