Ruling Is a Giveaway to FirstEnergy and AEP, and a Betrayal of Ratepayers

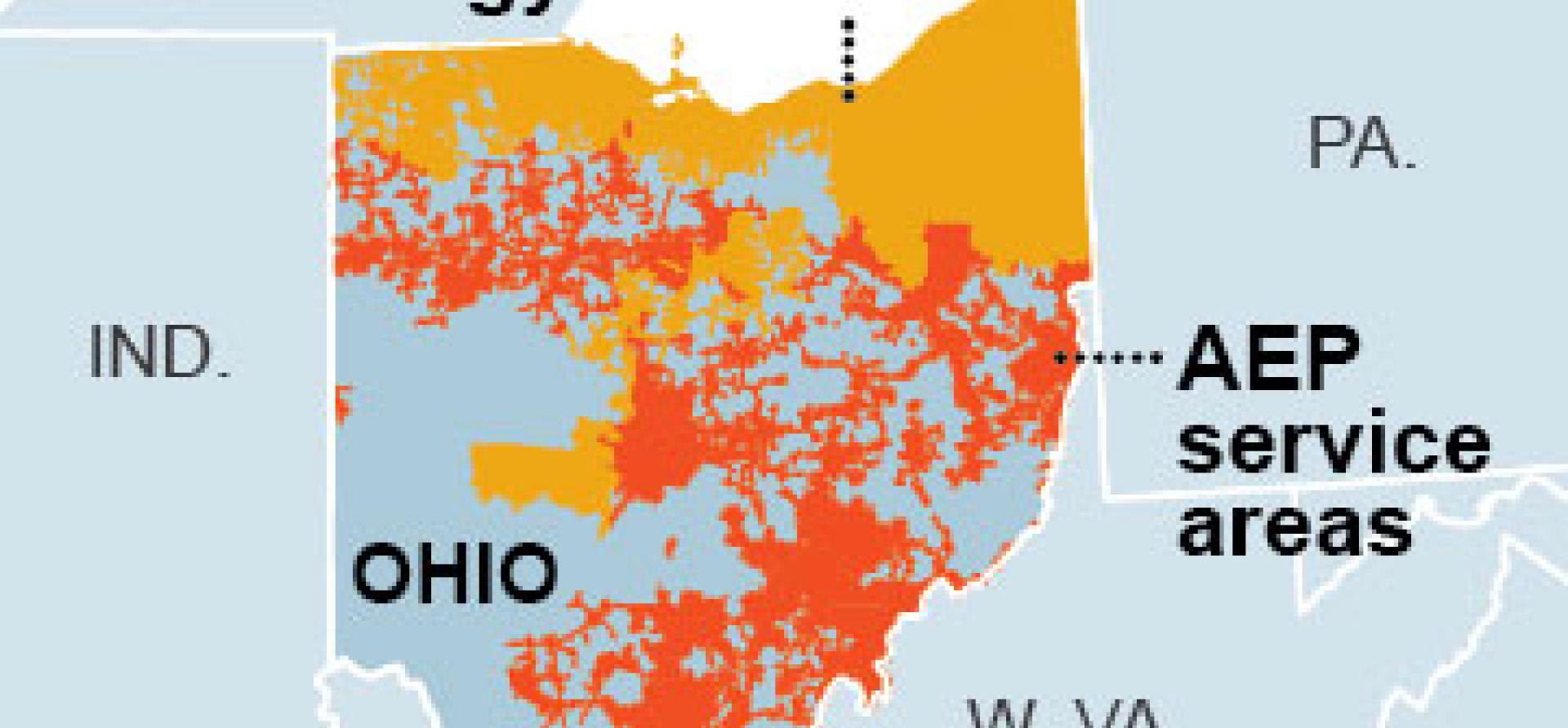

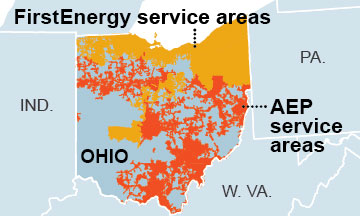

Yesterday’s ruling by the Public Utilities Commission of Ohio to allow for ratepayer subsidies of aging coal-fired power plants operated by First Energy and AEP proves that these plants aren’t competitive. Indeed, the ruling serves as a reminder that the only way the power plants can survive is through massive ratepayer bailouts.

Yesterday’s ruling by the Public Utilities Commission of Ohio to allow for ratepayer subsidies of aging coal-fired power plants operated by First Energy and AEP proves that these plants aren’t competitive. Indeed, the ruling serves as a reminder that the only way the power plants can survive is through massive ratepayer bailouts.

Yet the case is not over, since the Federal Energy Regulatory Commission has yet to rule on it and the PUCO decision will probably be appealed to the Ohio Supreme Court.

IEEFA’s analysis of the FirstEnergy plan in particular has shown that customers are likely to pay at least $4 billion extra for electricity from FirstEnergy’s aging coal plants, as well as the frequently troubled Davis Besse nuclear plant, over the eight-year life of the deal.

Here’s why the ruling is a bad one:

- Contrary to what PUCO claims, the decision does not balance consumers’ interests with those of shareholders. This is a straight give-away to the utilities and their shareholders. It will keep uneconomic plants operating for another eight years, and FirstEnergy in the process gets a guaranteed profit while bearing no risk.

- The ruling undermines electricity-market competition in Ohio, giving FirstEnergy especially an unfair advantage, a conclusion we happen to share with the Market Monitoring Unit of PJM Interconnection, the organization that manages the electricity grid in Ohio and 12 other states and the District of Columbia.

- PUCO claims the bailout will bring regulatory certainty and rate stability, but customer rates under the deal will vary depending on market prices—so there are no guarantees from a ratepayer point of view, and rate stability at very high prices is hardly a customer benefit.

- PUCO offers no credible evidence to support the assertion that the deal will provide a net credit to customers of $256 million. FirstEnergy’s projected natural gas and energy market prices for 2015 and 2016 already have proven to be way too high, an indication that the arguments for this deal are suspect.

In sum, customers—if PUCO’s ruling stands—will be paying to subsidize uneconomic electricity plants so FirstEnergy and AEP can profit.

David Schlissel is IEEFA’s director of resource planning analysis.

Related posts:

FirstEnergy’s Scheme to Protect Aging Power Plants in Ohio Will Cost Ratepayers $4 Billion

In Ohio, AEP and FirstEnergy Adopt an Audacious Strategy That Could Cost Ratepayers Dearly