IEEFA update: Six real-world rebuttals to divestment naysayers

Academic arguments against divesting from the oil and gas sector are just that—academic—and those who make them ignore the underperformance of the sector and the array of mounting risks it faces.

The principal objections of divestment detractors—that divestment will either cause institutional investment funds to lose money or undermine their ability to meet their objectives—are based on dangerous forward-looking assumptions that ultimately represent a breach of fiduciary standards.

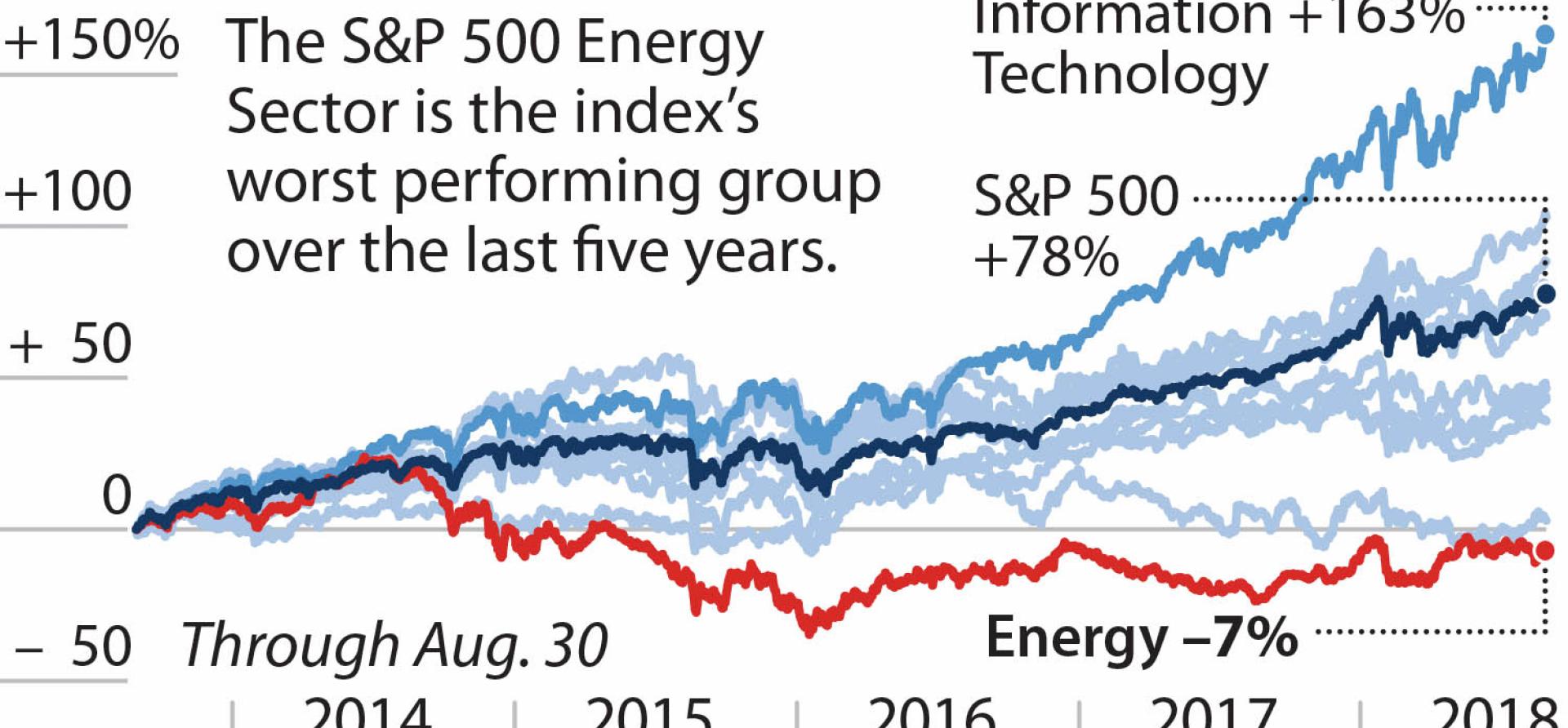

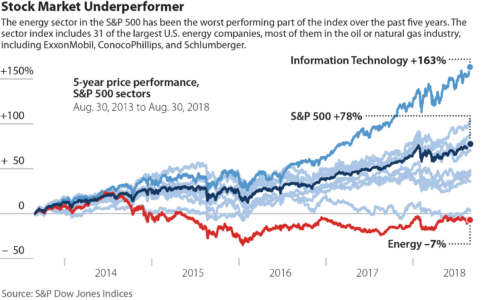

In fact, the argument for divestment from fossil fuels is compelling, as we laid out in a report we published a few weeks ago, “The Financial Case for Fossil Fuel Divestment,” which describes how the very sector that once drove the overall economy and led the market for decades now lags. Indeed, a growing body of evidence shows that funds perform better without fossil fuel holdings.

Certain academic researchers promote studies—some published with the support of the fossil fuel industry—that dispute this increasingly accepted point of view. These academics continue to be seen as credible, mostly out of habit, by portfolio managers at universities, pension funds, and endowments.

Ivory-tower assumptions out of step with the truth.

Such studies share a fundamental set of assumptions we consider implausible, including their embrace of potential investment outcomes that are not supported by actual market results, their failure to discuss market factors that can alter the outcomes of the models they employ and their mischaracterization of the nature of investor relations with money managers.

They also rely on analysis that no professional money manager or fund administrator would endorse. Contrary to their avowed purpose to support responsible fiduciary behavior, these studies actually do the opposite.

THE SIX PRINCIPAL ASSERTIONS USED BY ACADEMIC OPPONENTS of fossil fuel divestment are summarized below—accompanied by a rebuttal of each one (see our complete report for more detail):

THE SIX PRINCIPAL ASSERTIONS USED BY ACADEMIC OPPONENTS of fossil fuel divestment are summarized below—accompanied by a rebuttal of each one (see our complete report for more detail):

Assertion: A portfolio that divests from fossil fuels will lose money.

Fact: This argument, advanced most famously by Daniel R. Fischel, emeritus professor of business and law at the University of Chicago, relies on the fact that fossil fuel investments performed prodigiously for most of the past 50 years and assumes that this performance will continue. But past performance is no indicator of future results, and indeed any fiduciary who says otherwise is violating Securities and Exchange Commission standards.

Assertion: The cost of converting a fund would lower returns, particularly at small funds. This argument is advanced most forcefully by Hendrik Bessembinder, a finance professor at Arizona State University who notes that many endowments and funds are commingled or part of mutual funds, and that to unwind them would mean incurring transaction fees and other costs.

Fact: This argument is based on a largely mechanistic theory of price for transaction services that overlooks the fact that fee structures are settled by negotiation. This is especially so when demand for a new service increases. Further, endowments and small funds already pay fees for a basket of services, a basket that can be adjusted to include portfolio rebalancing.

Assertion: Small funds cannot afford to monitor fossil fuel industry changes in a way that would allow them to make informed choices around which companies to invest in.

Fact: This assertion supports our view that fossil fuel stocks are too risky for smaller funds to hold. Gone are the days when such stocks were considered ‘blue chip’ equities with performance results that met criteria for passively managed indexes—low risk and steady, stable growth. Today, such holdings are speculative and must be actively managed. These stocks are more trouble than they are worth, especially for small, passive-index-oriented investors.

Assertion: Fossil-fuel divestment movements have no impact.

Fact: Divestment movements are supported by a host of other strategies and tactics aimed at reducing fossil fuel use. Moody’s, for one, now characterizes the continued operation of old, inefficient coal plants, for instance, as credit negative and the closing of such plants as credit positive. Many companies now include in their official filings statements that the movement is a material risk to the plans of the company.

Assertion: Institutional investors large and small will underperform their benchmarks or historical performance if they divest their fossil fuel holdings.

Fact: Times have changed. Over the past five years, fossil-free indexes performed better than those with fossil fuels.

Assertion: If a fund divests its fossil-fuel holdings, it will reinvest those assets in a way that will keep it from meeting its return targets.

Fact: This argument has been advanced most notably by Global Analytics, a financial services company that conducted a study concluding that divesting from fossil fuels would create losses for the New York State Common Retirement Fund. Global Analytics based its finding on certain misleading assumptions, among them that existing fossil fuel investments yielding 8% annually would be replaced by investments with 6% returns. A second scenario put forth by Global Analytics assumes that existing fossil fuel investments yielding 8% annually would be replaced by investments with 3% returns. This assertion ignores the fact that the fund has an investment return target of 7% annually, and that it is unlikely to retain any money manager unwilling to honor that target.

Tom Sanzillo is IEEFA’s director of finance. Kathy Hipple is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA report: Fund trustees face growing fiduciary pressure to divest from fossil fuels

IEEFA update: The investment rationale for fossil fuels falls apart