IEEFA Update: Push to Keep Navajo Generating Station Alive in Deal With Arizona Water Distributor Is Fraught With Risk

April 11, 2018 (IEEFA) — The Institute for Energy Economics and Financial Analysis published a research brief today that finds the financial outlook for coal-fired Navajo Generating Station is bleaker than it was when the plant’s utility owners announced last year it would be retired in 2019.

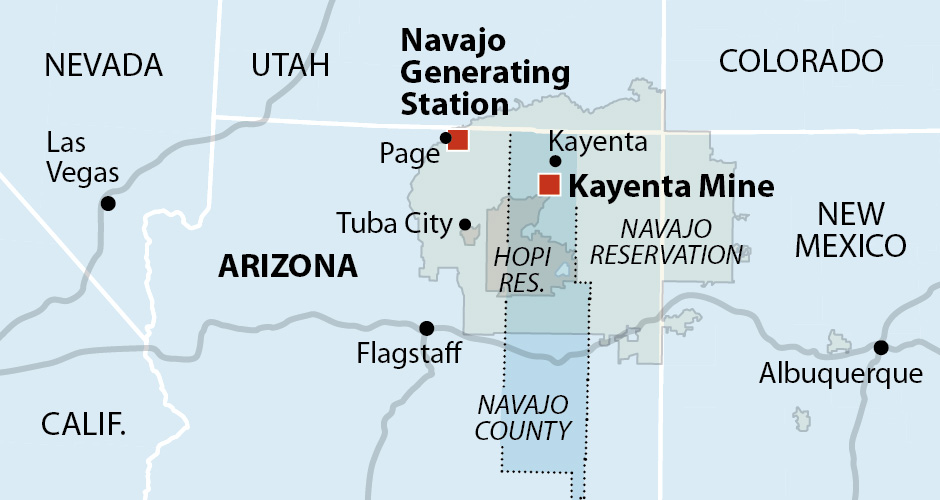

The plant’s owners—Arizona Public Service Company, the Salt River Project, Nevada Power and Tucson Electric—are closing NGS because the power it produces is considerably more expensive than power sold on the market. The federal Bureau of Reclamation also owns a portion of the plant, which is in northeast Arizona on land owned by the Navajo Nation.

IEEFA’s research note—“Economic Picture Worsens for Navajo Generating Station”—comes as Peabody Energy and other interests escalate a campaign to keep the plant open past 2019. IEEFA’s research refutes assertions by Lazard, a firm hired by Peabody Energy, that the plant’s largest customer, Central Arizona Project (CAP), could save money if it were to buy power from the plant from 2020 to 2030.

“Any new owner would be walking into a failing investment,” said David Schlissel, IEEFA’s director of resource planning analysis and author of the brief. ““If the Navajo Generating Station were to stay open past its planned retirement, all market trends point to even worse prospects for the plant than ever.”

“Who will be left on the hook when power from NGS turns out to be more expensive than the market price?” Schlissel said.

The IEEFA brief updates an IEEFA report published last year that concluded NGS has no economically viable future (“End of an Era: Navajo Generating Station Is No Longer Economic”).

The brief published today projects even steeper losses—of $2.2 billion to $3.4 billion over 10 years—for prospective NGS owners than what IEEFA found last year. The research repudiates recent claims from the “Yes to NGS” campaign being led by Peabody Energy, which owns Kayenta Mine, which supplies NGS. Peabody has hired Lazard to seek both new owners and customers in efforts keep the plant and the mine in business.

Central Arizona Project, a water delivery system for central and southern Arizona, accounted for 25 percent of the plant’s power purchases before announcing in 2017 that it could no longer afford to buy through NGS. CAP leadership estimates that if the agency had purchased power through the market instead of NGS in 2016, it could have saved $38.5 million.

Nonetheless Peabody is currently lobbying the board of CAP to commit to a long-term purchase deal to keep NGS open past its announced retirement date. “Yes to NGS” brought on a consultant called Energy Ventures Analysis to support the campaign through a report this week that says CAP would save $370 million by purchasing power through NGS rather than on the open market through 2030.

IEEFA’s analysis tells a different story: CAP would lose between $454 and $693 million, or an average of $41 to $63 million per year if it were to continue to purchase power from NGS instead of from the market between 2020 and 2030.

A combination of declining energy prices and increasing production costs have made NGS power more expensive than power available through regional market hubs.

“The claim that CAP would save money by signing with NGS cannot be substantiated,” Schlissel said. “Costs of generating power at NGS will likely be significantly higher than the price of power at the Mead and Palo Verde Hubs, which means that any future NGS owner will undoubtedly suffer large losses.”

A purchase commitment from CAP would leave NGS with a glut of high-priced power for which it would need to find a market, the research brief concludes. In 2017, NGS generated more than 13.8 million megawatt-hours (MWh) of power. If CAP were to continue purchasing at past rates beyond 2019, new NGS owners would have to find buyers for 11 million MWh of that power.

Full brief here: Economic Picture Worsens for Navajo Generating Station

Media contacts:

Karl Cates [email protected] 917 439 8225

Or Kate Sopko [email protected] 216 388 3457

RELATED ITEMS:

IEEFA Report: End of an Era for Navajo Generating Station

IEEFA Arizona: Perilous Talk of Turning Navajo Generating Station Into a ‘Clean Coal’ Plant

IEEFA Arizona: Fast-Track Opportunities Now in Navajo Community-Driven Solar Electricity Generation