IEEFA update: Business case weakens for Navajo Transitional Energy Company (NTEC) bid to purchase Montana-Wyoming coal mines

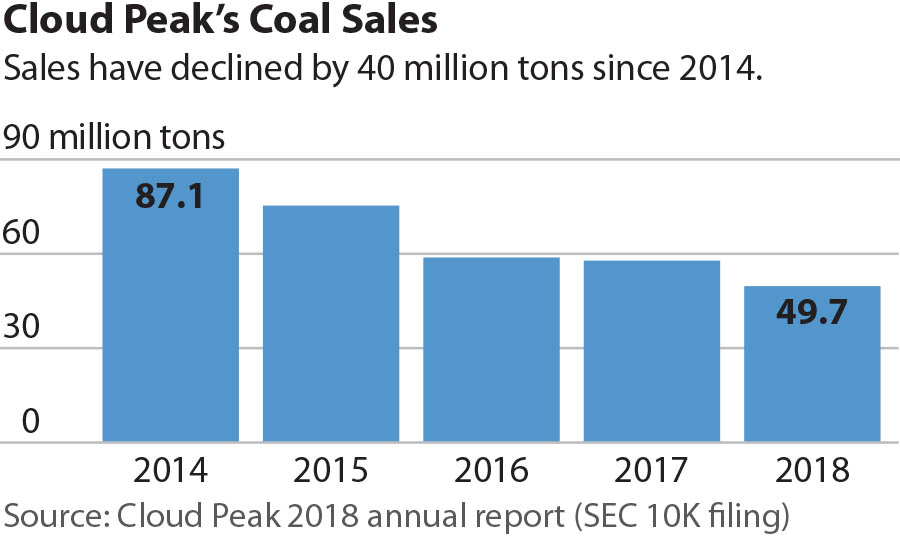

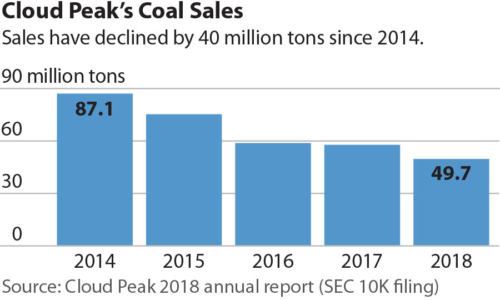

September 5, 2019 (IEEFA U.S.) — Production is down this year and the customer base is shrinking at three mines that Navajo Transitional Energy Company (NTEC) proposes buying in a bankruptcy-court bid for Cloud Peak Energy, according to a research brief published today by the Institute for Energy Economics and Financial Analysis (IEEFA).

September 5, 2019 (IEEFA U.S.) — Production is down this year and the customer base is shrinking at three mines that Navajo Transitional Energy Company (NTEC) proposes buying in a bankruptcy-court bid for Cloud Peak Energy, according to a research brief published today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The brief—NTEC Move to Buy Cloud Peak Mines Is an Increasingly Questionable Wager— updates regional and national trends in the U.S. coal industry and analyzes mine-by-mine difficulties facing the Cloud Peak assets NTEC has proposed purchasing, specifically: Antelope Mine and Cordero Rojo Mine in Wyoming and Spring Creek Mine in Montana.

The NTEC decision contradicts Navajo Nation energy policy

NTEC executives proposed the deal in August apparently without consulting with Navajo Nation leadership, although the company is wholly owned by the tribal government. The deal contradicts Navajo Nation energy policy, which calls for post-coal modernization and comes in the wake of a tribal decision to close the coal-fired Navajo Generating Station this year.

The report details three distinct risks in the NTEC proposal:

- Macro trends continue to move away from coal for electricity generation, which threatens the economics of almost all the coal produced in the Powder River Basin (PRB).

- Regional trends are placing financial stress on coal companies in the region trying to remain competitive, forcing even the two largest PRB miners into a joint venture to cut costs and retain market share.

- Mine by mine. Production at all three mines has dropped enormously in recent years—and has fallen in recent months. The Spring Creek Mine depends on highly cyclical exports. Production at the Cordero Rojo Mine, which has the lowest-quality coal of the lot, has slipped significantly. The biggest producer of the three, Antelope Mine, will be challenged simply to maintain existing production because there are too many tons of PRB coal today chasing too little demand.

“Navajo Transitional Energy Company, whose sole shareholder is the Navajo Nation government, would do well to reconsider its plans to purchase Cloud Peak’s PRB mines and to focus its growth plans instead on more robust segments of the energy sector,” the brief concludes.

Full brief: NTEC Move to Buy Cloud Peak Mines Is an Increasingly Questionable Wager

Author contacts

Seth Feaster [email protected] is an IEEFA data analyst.

Karl Cates [email protected] is an IEEFA research editor.

Media Contact

Vivienne Heston [email protected] +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

RELATED POSTS:

IEEFA op-ed: Navajo Nation bid to buy bankrupt coal company makes no economic sense

IEEFA: Proposed Navajo acquisition of bankrupt U.S. coal company is an ill-timed gamble