IEEFA Report: Spain’s Outmoded Capacity Payment Structure Encourages Wasteful Subsidies for Coal and Gas, Thwarts Electricity-Sector Modernization

Dec. 13, 2016 (IEEFA.org) – The Institute for Energy Economics and Financial Analysis (IEEFA) published a brief today showing how Spain provides inflated subsidies to owners of coal- and gas-fired power plants through an expensive electricity-sector capacity market.

A dozen European countries, including France, Germany, Italy and the U.K., are either considering or already have similar capacity markets, mechanisms by which power plant owners are paid regardless of whether their plants generate power. Spain was one of the first countries to introduce such payments, in 1997.

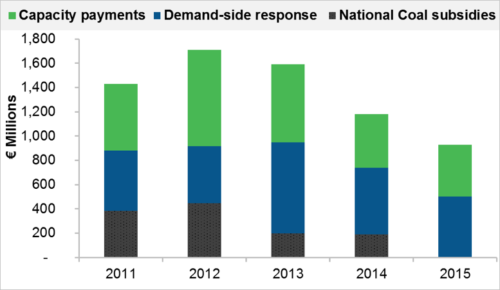

The IEEFA brief—“Spain’s Capacity Markets: Energy Security or Subsidy?”—notes that the main argument for such markets is that they are needed to preserve security of electricity supply when wind and solar are not available. IEEFA’s research suggests there are far more cost-effective ways to ensure energy security, however, and that capacity markets typically burden taxpayers and ratepayers unnecessarily and hurt economic growth (such payments average about €1 billion annually in Spain).

IEEFA’s main findings:

- Spain has massive over-capacity and a rather low price cap in day-ahead power markets. Taken together, these factors reduce price signal in energy markets and undermine returns to generators in regular power markets, leading to calls for additional capacity payments.

- The country’s capacity market could be made more efficient by replacing an administered price with a clearing auction and by allowing the participation of interconnection; capacity from neighbouring France and Portugal; battery storage; and smaller demand-response units.

- Spain’s energy regulator needs greater powers to crack down on market abuses and to fend off powerful lobbies that include utilities and energy-intensive industries.

“A more independent energy regulator could open Spain’s capacity market to more technologies, and introduce a competitive auction approach, as a first step to cutting costs,” said IEEFA energy consultant Gerard Wynn, lead author of the brief.

Wynn noted that Spain’s capacity scheme may over-pay large, energy-intensive industries for agreeing to reduce demand at times of system stress. IEEFA notes also that such demand-side response payments were three to eight times greater than corresponding payments in Britain.

“And Spain can go further,” Wynn said. “By cutting over-capacity, allowing the retirement of uneconomic power plants, reducing or eliminating price caps in its power market and reforming its balancing market, Spain can move toward eliminating a capacity mechanism altogether, and save billions of euros which it can spend instead on updating its grid infrastructure.”

Annual Capacity Payments in Spain

“While the original motive for capacity payments in Spain was to meet rapidly rising energy demand in the late 1990s, power demand peaked in 2007,” Wynn said. “Yet the capacity payments remain. Regulators estimate that about 80 percent of gas-fired power generators in Spain today would be unable to cover their fixed costs without capacity payments, and that most of its coal-fired electricity industry is similarly dependent on capacity payments and other subsidies.”

The IEEFA brief notes that the shift to a market that is based entirely on trade in energy, rather than one distorted by capacity payments, could be accelerated by more severely punishing imbalances and better rewarding fast-response generation in real-time balancing markets. Compared with capacity markets, such an approach would better address actual system scarcity, eliminate paying needlessly for swathes of unused generation, and reduce the influence of powerful special interests.

Full report: “Spain’s Capacity Market: Energy Security or Subsidy?”

Media contact: Karl Cates, [email protected], 917.439.8225

Authors: Gerard Wynn, +44 7990 560 525; Javier Julve (Spanish speaker), +49 157 8761 0566

About IEEFA: The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.