IEEFA India: New record with renewable energy installations 40 times higher than thermal

SYDNEY–During the first nine months of 2018/19 renewable energy capacity was installed at a rate forty times higher than net new thermal capacity in India.

At this juncture certain adjectives come to mind, including historic, unprecedented, transformational, problematic and unsustainable. This post aims to detail what has changed in India, and why all of these descriptions are relevant.

The facts

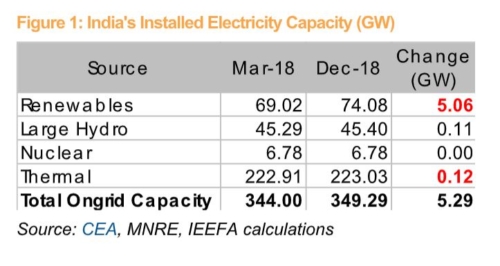

India’s Central Electricity Authority (CEA) has reported that in the nine months to December 2018 a net 120 megawatts (MW) of thermal power capacity was added to the Indian on-grid system. (See Figure 1) This is the lowest level of net thermal additions during any nine-month period in India over the last decade.

This represents a doubling of installed renewable capacity in less than three years.

A total of 2,130MW of new coal capacity was added to India’s grid in the same period. This was significantly boosted with 800MW from Unit 12 of the Kothagudem Thermal Power Station in Telangana (commissioned December 2018), and marginally ahead of 1,779MW of end-of-life coal plant closures, including NTPC’s 45-year-old 705MW Badarpur Thermal Power Station closure in October 2018. The gas-fired power sector saw one material capacity change in the December 2018 closure of the Basin Bridge Gas Plant in Chennai, Tamil Nadu of 200MW capacity.

In contrast, total renewable energy installs were 5,060MW for the first nine months, taking India to a cumulative total of 74,080MW by December 2018. This represents a doubling of installed renewable capacity in less than three years. In addition, there is another 3.3GW of rooftop solar behind the meter (off-grid) which has more than doubled in the last 18 months.

The doubling of installed renewable capacity in less than three years is a historical moment

It is unprecedented that India year-to-date has seen renewable energy installs running at forty times net thermal capacity adds (5,060MW vs 120MW). This is a historic moment, and particularly relevant for people focussed on resolving the crippling health impacts of India’s extreme air and water pollution and for national and international governments committed to delivering on the Paris Agreement.

India is successfully transforming its electricity system, diversifying away from expensive imported coal and gas to an ever larger share of domestic, lower cost and more sustainable wind, solar and hydro power. In accelerating the decarbonisation of its electricity sector, India is doing its unfair share. Under Prime Minister Narendra Modi’s leadership, India is almost a decade ahead of its Nationally Determined Contribution commitments to the Paris Agreement; a true world leader in this area.

Thermal and gas fired power utilisation rates have dropped

Each year from 2012/13 through to 2015/16 India added some 20 gigawatts (GW) of net thermal power capacity. As a result, thermal capacity expanded 12% annually, double the underlying electricity demand growth of only 6% annually. This disparity has driven down utilisation rates for the coal-fired power sector to a record low of 56.7% in 2016/17, a financially unstainable position for both power plant owners and Indian banks (particularly given lending rates of 80% of total project value, mostly on a non-recourse basis). Further, gas-fired power plants across India are averaging a utilisation rate of just 22-25% in the last three years.

IEEFA cautions that 2018/19 figures are those reported for the first nine months of the fiscal year ending March 2019. Like corporates worldwide, Indian firms tend to rush to commission capacity prior to financial year end, which is 31 March in India. Consequently, half of India’s new thermal power plant commissions occurred in the last quarter of 2017/18 (40% just in March), whilst only 10% of power plant closures occurred in the final quarter. Similarly, proponents of renewables are likely to exhibit similar behaviours, particularly following the unexpected policy-induced uncertainty during the first six months of 2018/19 (including import duties, GST inconsistencies, repeated ‘after the event’ tender cancellations, and the failure to approve land use applications).

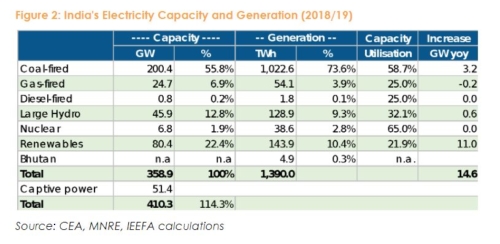

IEEFA forecasts 3.0GW of new net thermal power capacity in the 2018/19 fiscal year (3.2GW of new net thermal coal capacity less 0.2GW of gas closures), assuming 2.9GW are added in the last quarter. (See Figure 2) This would be a 35% decline in net power capacity added when compared to the 4.6GW installed in 2017/18, which itself was 40% below the previous year.

IEEFA has (what increasingly looks like) an overly optimistic forecast for renewable installs, to reach 11GW for the full year, a rate double that delivered in the first nine months. Despite this being 30% below the record 2016/17 renewable capacity installs achieved, it would still make India the third largest renewable energy installer globally behind China and America.

More realistically, and foregoing its promise to become a world leader in renewable energy, India has gone backwards in the last two years. IEEFA notes the slowdown appears temporary given renewables are now the low-cost source of new capacity in India at less than half the cost of new imported coal or gas capacity. We also take optimism from the fact that 25-30GW of renewable projects have already been tendered and awarded over the last 18 months, and the government continues to promise tendering 40-50GW annually over the coming two years. Addressing India’s burgeoning energy security threat from its entirely unstainable fossil fuel import bill, exceeding US$240bn in 2018/19, is a logical move.

For the four years from 2012/13 to 2015/16 India expanded its electricity generating capacity at twice the required rate. For the last two years India expanded capacity at half the required annual rate. With decade low thermal power plant utilisation rates, this situation is sustainable for the next few years as per the National Electricity Plan 2018.

India’s target for closing 5GW annually of high polluting and/or end-of-life coal fired power plants points towards coal plant utilisation rates rapidly rising over the coming two years. This situation will be good for investors, and particularly the financial institutions sitting on US$100bn of non-performing loans to the power sector.

However, absent urgent action, the lack of new electricity capacity additions required of 20-30GW annually (or 30-40GW if this is predominantly renewables (because of their lower utilisation rate)) will prove to be a major constraint on India’s economic growth aspirations for a 7-8% per annum rise in gross domestic product (GDP).

India needs to rapidly accelerate investment in low-cost renewable electricity capacity

India needs to rapidly accelerate investment in its electricity capacity, and particularly in practical fast-buildouts of renewables including solar and wind. Building a nuclear plant takes one to two decades and requires massive government capital subsides. Hydro-electricity takes upwards of a decade. From planning approval, it takes upwards of four years to build a new coal plant. And while India has 10GW of gas-fired power capacity sitting idle, building a new plant is a moot point.

Building and installing renewable projects have markedly shorter timeframes. It takes only 1-2 years to commission a new wind or solar project following a tender awarded, only 4 hours for a skilled electrician to install residential rooftop solar, and up to three months for a commercial rooftop installation.

India could decide to again delay closures of its end-of-life coal plants to limit the generation capacity constraint that is looming. The problem with this strategy is the oldest plants are the smallest, least efficient and most polluting units. As evidenced in Australia, old coal plants repeatedly, unexpectedly and inevitably fail. Investors will not invest in upgrades / major structural repairs knowing a facility is beyond its useful life and increasingly unable to compete with low cost renewables.

India needs to urgently accelerate investment in new low-cost electricity capacity.

India has repeatedly tried to recapitalise and salvage the 100GW of coal plant proposals still sitting on investor / bank books despite most wearing the banner of a stranded asset, as witnessed recently in the 60% bank loan write-downs required to fire-sale seven already built but financially stranded coal plants.

There is no easy fix for these coal plant proposals. The banks are over-exposed and losing money ‘hand-over-fist’ to thermal power plants. The technology and equipment being employed in half-built plants is already decades out of date, therefore unbankable. The plants are located upwards of 1,000km from the source of coal thereby making the proposals unviable, being 40-100% more expensive in terms of purchase and travel costs relative to minemouth coal plants. Furthermore, legal cases over inequitable land acquisitions and/or in defence of India’s dwindling forest reserves are growing, not diminishing, as more people and communities realise private promoters have repeatedly mis-used opaque and contradictory laws in their self-interest.

While relying on a rapidly increasing share of variable renewables can be problematic in terms of grid stabilisation and meeting peak power demand, such issues can be collectively solved by engineers, technology, policy and finance professionals, and do not require the assistance of the banks and courts nor expensive government rescue schemes.

India needs to urgently accelerate investment in new low-cost electricity capacity. IEEFA notes that acceleration could include the removal of import duties on solar modules. If that occurred, the industry could quickly meet 30GW of solar tenders and 10GW of onshore wind annually while laying the foundations for 30GW of offshore wind by 2030. Acceleration could also include greater distribution of battery deployments, rooftop solar, grid transmission investments and pumped hydro storage, while deploying 30 million solar powered irrigation pumps for farmers by 2030.

Unlike the thermal power and nuclear sectors, domestic and global lenders and equity investors are queuing up to invest in Indian renewables. From Adani Green to Tata Power and NTPC, Coal India to India Railways, and from Renew Power to Hero Energies, domestic capital is clearly available. And with Softbank Group, ENGIE, Enel Group, Fortum, Masdar, Sembcorp, SGIC, Macquarie Group, CLP Group and more leading the global charge to find viable renewable energy infrastructure assets for capital recycling, the Indian renewable sector has virtually unlimited capital capacity with the right policy framework, transparency and stability.

Tim Buckley ([email protected]) is IEEFA’s director of energy finance studies, Australasia.

Kashish Shah ([email protected]) is an IEEFA research associate.

Related items:

IEEFA update: India on track to meet majority of Paris goals

IEEFA India: A case for accelerated deployment of renewable energy capacity in India