Call them what you will but “capacity payments” in the European utility industry today are looking more and more like subsidies to prop up a fading industry threatened by the rise of renewables.

It’s an expensive arrangement that often rewards decrepit coal- and other fossil-fuel-fired power plants for waiting in the wings—not for generating electricity.

Coal and gas utilities will argue that capacity payments are justified for two reasons: first, that they’re only fair because renewables are supported too (by long-term feed-in tariff structures), and second, that the grid could fail without capacity payments to support back-up power.

But capacity payments are supporting an increasingly uneconomic form of power that it on its way out as energy markets evolve and as climate change and air-quality regulations grow. Today there are more cost-effective ways to support the electric grid.

Capacity payments also send the wrong message to developing countries, that subsidizing coal-fired power is justified.

An illustrative case in point of capacity payments gone awry is the U.K., where such payments to coal-fired plants have risen lately, contradicting national policies that mandate a complete phase-out of coal power by 2025.

The U.K. has three types of non-energy payments to coal:

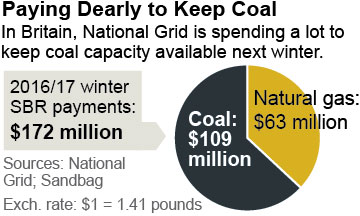

- First, under a new measure called the supplemental balancing reserve (SBR), the system operator, National Grid, pays aging, uneconomic fossil-fuel-fired power plants to be available during the upcoming winter, to address concerns about a narrowing supply-demand balance. National Grid this year will pay £122 million for 3.6 gigawatts (GW) of such capacity, a more than ten-fold increase over the £11 million it paid last year. The average payment rate is £34 per kW, or double last year’s. This increase in support is all about saving moribund coal plants. Coal power will receive £77 million this winter, under the scheme, from nothing last winter. The 50-year-old, 681MW Eggborough coal plant will receive £60 million for its standby capacity, nearly half the total National Grid allocation. Another aging coal plant, Fiddlers Ferry, will receive £17 million. These two coal plants will receive 63 percent of payments under the scheme this winter, while supplying just 31 percent of the capacity, according to research by the U.K.-based think tank Sandbag.

- The second type of U.K. capacity payment is made under a longer-running scheme where National Grid incentivizes new and existing generation four years ahead. Under this mechanism it has allocated £178 million to coal for delivery in 2018/19, and £144 million for delivery in 2019/20. That year-on-year drop suggests that coal may increasingly be too expensive to meet the clearing price set by competitors, especially gas.

- Third, National Grid pays thermal power plants to be available for so-called black-start services—to come on line from a standing start—should the electric grid collapse. For 2016/17, the total bill for such services will rise to £146 million, including some £113 million to Drax coal/biomass and Fiddlers Ferry coal power plants. That is up from a total £23 million for black-start services in 2015/16. Officials at the National Grid attribute that surprise increase to the recent closure of some uncompetitive coal plants, reducing the pool of available generation.

BRITAIN IS NOT ALONE IN WESTERN EUROPE IN CONTINUING TO KEEP COAL-FIRED POWER ON LIFE SUPPORTS LIKE THESE. Spain also has a capacity market and Italy is planning one. Germany recently introduced a “standby capacity reserve” dedicating some 230 million euros annually for seven years to pay for 2.7GW lignite-fired standby capacity— in advance of those power plants being permanently decommissioned.

Such subsidies are hard to justify given the falling cost of renewables. They are especially questionable in the European Union, whose emissions trading scheme allocated windfall profits to utilities of at least $10 billion cumulatively from 2005-12. The windfall was meant to help utilities transition to a low-carbon future, but these companies have since played almost no part in the growth of small-scale renewables that compete with coal- and gas-fired plants across Europe, and which have now led to the calls for additional capacity payments.

The Swiss grid system operator, Swissgrid, has promoted an alternative to capacity payments, based on a market-based model. Such an approach would seem prudent in the U.K., too, where a recent analysis of the British electricity system suggests that far from being vital, coal-fired power can be rapidly eliminated over the course of the next few years without hurting national energy security. Supports for coal-fired electricity can be systematically replaced, instead, with investments in efficiency, demand-response programs, storage and grid improvements.

Capacity-payment subsidies like those on display in the U.K. don’t just delay the inevitable. They set a terrible example.

The Turkish Parliament very recently approved a subsidy that will allow lignite-fired power plants to sell electricity at prices higher than current wholesale power prices. Proponents of this change have pointed to the U.K.’s out-dated capacity market as a model.

Gerard Wynn is an IEEFA energy analyst.