IEEFA Update: In Emerging Economies, New Forms of Renewable-Energy Financing Are Taking Root

As the size and scope of renewable energy projects increase at an unprecedented rate across the global economy, traditional models of finance are being replaced by more innovative ones.

In the more developed markets of the world, yieldcos (dividend-driven spin-offs of larger parent companies) alongside green bonds and infrastructure funds are channeling investment capital into renewables.

In the more developed markets of the world, yieldcos (dividend-driven spin-offs of larger parent companies) alongside green bonds and infrastructure funds are channeling investment capital into renewables.

In less-developed markets, access to finance lags. Hurdles include currency risk, credit risk, local bank-sector risk, an inadequate pool of institutional investors, and a lack of technical expertise for such finance.

That said, more players are pushing for more ways to finance renewable energy in the developing world.

Traditionally, global corporate capital is drawn to developing countries by way of “foreign direct investment” (FDI) or merger-and-acquisitions activity. The Italian utility company ENEL, by taking an aggressive material interest in Latin American renewables, offers a good example of a traditional approach.

New forms of partnerships are developing, too, to support local banks that lack the technical capacity or financial muscle to enter into and manage such projects, which require expertise in risk assessment, loan origination and underwriting, equity and debt issuance, and analysis around project complexity and duration.

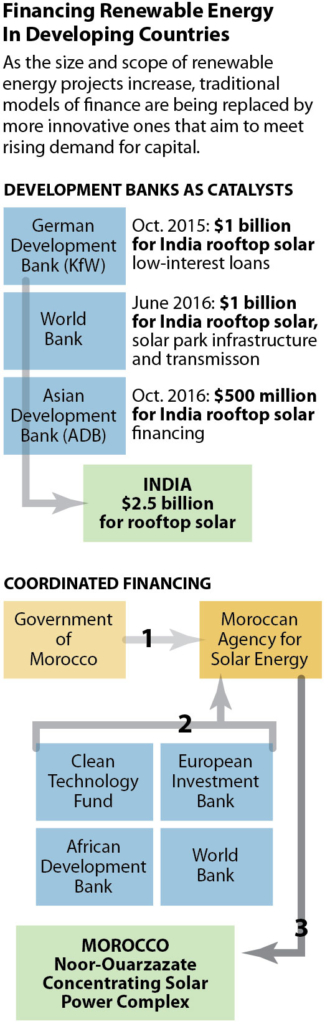

This is where more multinational developments banks are stepping up to act as catalysts, helping companies to get access to capital markets and to proceed with plans they might otherwise abandon. Banks among these ranks include the Asia Development Bank, the European Bank for Reconstruction and Development, the International Finance Corporation and, more recently, the New Development Bank and the Asian Infrastructure Investment Bank. These institutions are promoting loans with longer maturities, and in some cases are picking up the examples of peers. The World Bank this year agreed to invest €$1 billion in India’s fast-growing national solar energy economy, for instance, after KFW, the German development bank, agreed to low-interest loans of roughly the same amount to fund roof-mounted solar panels.

Cooperation between international development banks, private banks, and government agencies is creating more sophisticated local debt markets, as seen in recent work by Brazil’s development bank, Banco Nacional de Desenvolvimento Economico & Social.

Coordinated financing is emerging specifically for bigger utility-scale renewable projects, as with an example in Morocco, where a government agency, the World Bank, the European Union, and German and Saudi companies are working jointly on a solar project capable of generation electricity for more than 1 million people.

ENTIRE BOND AND EQUITY MARKETS ARE EVOLVING AS INSITUTIONAL INVESTORS, ESPECIALLY, SEE OPPORTUNITY in long-term debt or equity-backed securities associated with renewable energy. Such investors include pension funds, insurers and sovereign wealth funds that recognize how renewable trends are gaining momentum on the back of technology gains and competitiveness with fossil-fuel-fired generation.

The falling cost structure of the renewable energy market is creating demand in the green bond market, where issuance during the first 11 months of 2016 totaled US$70 billion.

China recently began an initiative to raise private capital through the sale of green bonds and is the top green bonds market in terms of 2016 issuance. Recent Chinese government guidelines include an ambitious road map for expanding markets that are hospitable to green bonds (these guidelines include environmental stress tests, public-private partnerships, and benchmarks to ensure credibility, disclosure requirements and public private partnerships).

India, although it has just started to tap the international green bond market, is the seventh-largest issuer in 2016, with cumulative issuance at $2.7 billion by the end of the third quarter. Even Masala bonds, which are issued outside India but denominated in Indian rupees and require investors to bear the currency risk, are now being used to finance private-sector investments in renewables. India is aiming to attract financing through public funds, one of which focuses primarily on renewable energy.

As these new channels of financing develop, country-by-country renewable energy sectors will create spill-over advantages that build a path toward sustainable broader development.

Demand for renewables is growing. Global investment opportunity is knocking.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia.

RELATED POSTS:

IEEFA Asia: Electricity-Sector Change Is Coming to the Philippines

IEEFA Update: The Global Energy Transformation Remains on Track