Data Bite: The Shrinking U.S. Coal-Fired Electricity Map; Here’s a Snapshot From Ohio

Where better to get a picture of the coal industry’s rapidly declining share of the electric generation pie in the U.S. than Ohio, a battleground state for energy issues?

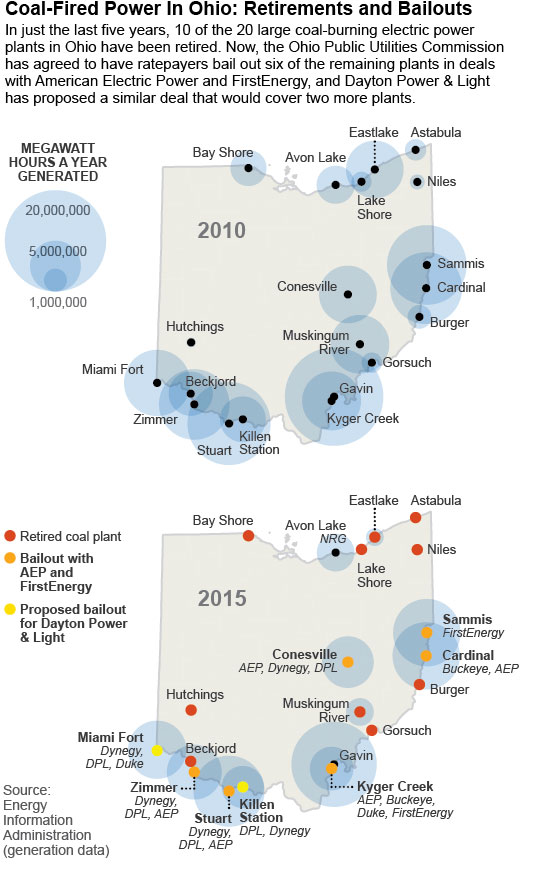

Coal historically has made up the lion’s share of electricity generation in Ohio, and the coal industry has wielded the political clout to match. Even at the beginning of this decade, in 2010, coal-fired power plants accounted for 82 percent of electric generation. With 20 plants that could produce over 200 megawatts each, Ohio had more coal-fired units than any other state in the country.

Coal historically has made up the lion’s share of electricity generation in Ohio, and the coal industry has wielded the political clout to match. Even at the beginning of this decade, in 2010, coal-fired power plants accounted for 82 percent of electric generation. With 20 plants that could produce over 200 megawatts each, Ohio had more coal-fired units than any other state in the country.

But things have changed in the past six years, for a couple of reasons:

- First, evolving energy markets—the growing abundance of cheap natural gas, the rise of renewables, and the increasing effects of energy-efficient programs—that have made coal-fired electricity less competitive than it used to be.

- Second, public opposition to highly polluting plants and decisions by utilities to close them rather than spend the money to upgrade controls for mercury and other hazards (Ohio utilities, particularly FirstEnergy, have successfully resisted putting modern pollution controls on most of their plants for the past 20 years).

Ten of those twenty coal-fired plants that operated in 2010 have closed—five owned by FirstEnergy, two by Duke Energy, one by AEP, one by NRG Energy, and one by American Municipal Power (which has also cancelled plans to build a new coal plant in the Ohio). Six others appear to be surviving only through bailouts by newly minted profit guarantee programs approved by the Public Utilities Commission of Ohio for FirstEnergy and AEP in highly controversial cases last week. And Dayton Power and Light has recently applied for bailouts that will also cover two more plants.

If the Dayton deal is allowed, that would leave just two of those original twenty coal-fired plants standing on their own two feet today. One, AEP’s Gavin plant, which because it is a very large facility with somewhat recently installed pollution control, is apparently more financially viable for AEP than the plants covered by the bailouts. The other, NRG’s Avon Lake plant, was slated for conversion to natural gas this year, although the company has recently postponed that change.

All told, coal’s share of Ohio electric generation declined to 59 percent by the end of 2015. The bailouts approved last week by the Public Utilities Commission of Ohio may help stem that decline, but only temporarily, as market forces are bound to catch up with them too.

Sandy Buchanan is IEEFA’s executive director. Seth Feaster is an IEEFA energy-data analyst.