UK

Latest UK Research

See more >

Oil supermajors are meeting climate goals by selling assets—but still increasing emissions

May 10, 2023

Tom Sanzillo

Analysis

New North Sea exploration licenses pose a threat to UK’s future energy security

February 08, 2023

Andrew Reid

Analysis

The UK’s new mine approval comes as steelmakers are accelerating the shift away from coking coal

December 08, 2022

Simon Nicholas

Analysis

Green finance has begun to flow into green steel funding

November 11, 2022

Soroush Basirat

Analysis

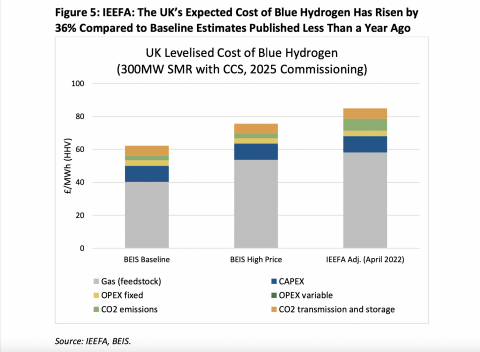

Fact Sheet: Blue Hydrogen in the UK

September 14, 2022

Arjun Flora, Ana Maria Jaller-Makarewicz

Fact Sheet

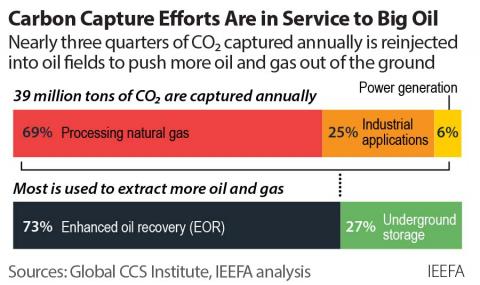

Carbon Capture: CCS | CCUS | CCU

September 12, 2022

Bruce Robertson

Slides

Carbon capture remains a risky investment for achieving decarbonisation

September 02, 2022

Bruce Robertson

Analysis

Carbon capture has a long history. Of failure.

September 02, 2022

Bruce Robertson

Analysis

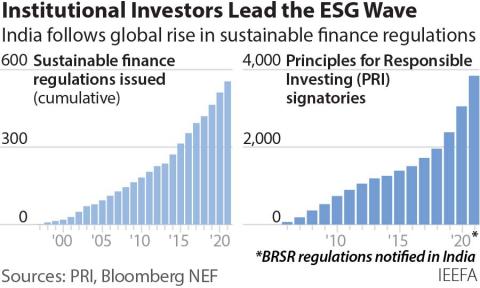

IEEFA: Climate change takes investors beyond the balance sheet to ESG

March 28, 2022

Shantanu Srivastava

Analysis

IEEFA: Wild price swings fail to satisfy either oil and gas industry or consumers

December 10, 2021

Clark Williams-Derry

Analysis

IEEFA: The Goldilocks predicament: For oil and gas, there are no “just right” prices

November 19, 2021

Clark Williams-Derry

Analysis

IEEFA: More clean energy investment will insulate against rising coal, oil and gas prices

November 04, 2021

Johanna Bowyer

Analysis

Latest UK Reports

See more >

UK carbon capture policy: Out of step with net-zero goals

November 15, 2023

Andrew Reid, Arjun Flora

Report

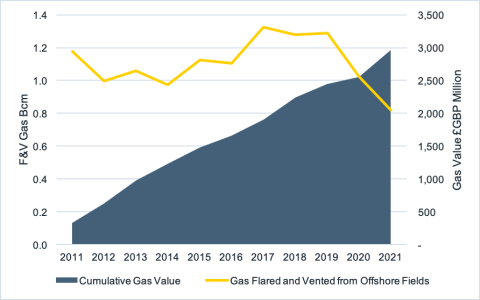

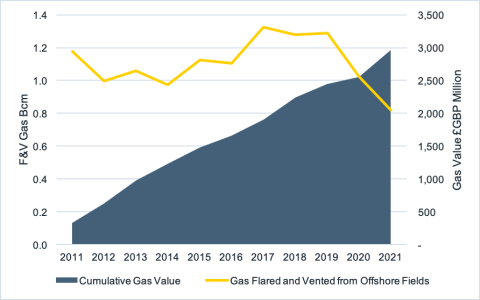

UK offshore flaring and venting

March 30, 2023

Andrew Reid, Arjun Flora

Report

European Pressurized Reactors (EPRs): Next-generation design suffers from old problems

February 02, 2023

Frank Bass

Report

The UK offshore supply-chain dilemma

December 14, 2022

Andrew Reid, Arjun Flora

Report

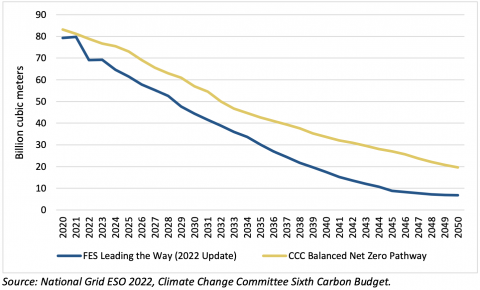

Continued reliance on gas will weaken the UK economy

September 26, 2022

Andrew Reid, Arjun Flora

Report

The carbon capture crux: Lessons learned

September 01, 2022

Bruce Robertson, Milad Mousavian

Report

Solving iron ore quality issues for low-carbon steel

August 09, 2022

Simon Nicholas, Soroush Basirat

Report

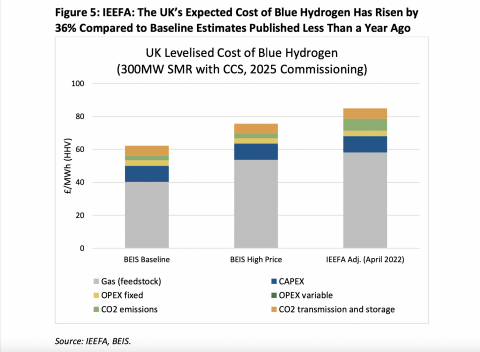

Russia sanctions and gas price crisis reveal danger of investing in “blue” hydrogen

May 23, 2022

Arjun Flora, Ana Maria Jaller-Makarewicz

Report

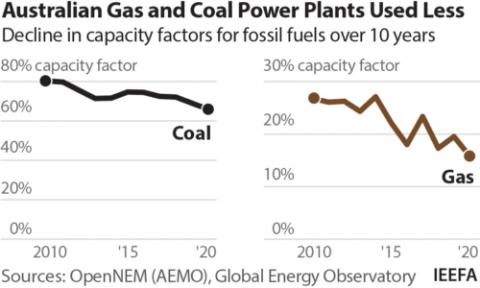

Australia's gas-fired recovery under scrutiny

June 24, 2021

Bruce Robertson, Milad Mousavian

Report

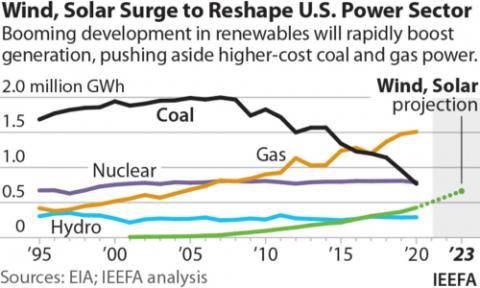

Energy transition to renewables likely to accelerate over next two to three years

March 01, 2021

Dennis Wamsted, Seth Feaster, David Schlissel...

Report

Hiding in plain sight — European gas pipeline companies’ greenhouse gas emissions

December 01, 2020

Arjun Flora, Gerard Wynn

Report

Time for AIA to prove their climate credentials

December 01, 2020

Norman Waite

Report

Latest UK Press Releases

See more >

Billions worth of UK gas reserves are going “up in smoke”

March 30, 2023

Press Release

European Pressurized Reactors: Nuclear power’s latest costly and delayed disappointments

February 02, 2023

Press Release

UK’s offshore wind targets at risk from renewed push for North Sea oil and gas extraction

December 14, 2022

Press Release

UK can save £100 billion by cutting dependence on fossil gas, study finds

September 26, 2022

Press Release

The UK risks repeating past policy mistakes, continued reliance on gas is pushing millions into fuel poverty

September 01, 2022

Press Release

Carbon capture: a decarbonisation pipe dream

September 01, 2022

Press Release

Blue hydrogen costs 36% higher than UK’s 2021 estimate, would increase gas import dependency

May 24, 2022

Press Release

IEEFA Europe: Zeebrugge terminal serves as hub for transport of Russian gas to non-European markets

March 21, 2022

Press Release

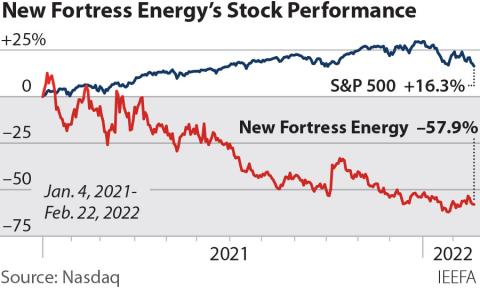

IEEFA: La expansión del gas de New Fortress Energy presenta mayores riesgos para los inversores

February 23, 2022

Press Release

IEEFA: New Fortress Energy gas expansion presenting increased risks to investors

February 23, 2022

Press Release

IEEFA Europe: Overcapacity and investment fever push costs to Spanish consumers, yet Enagás profits

September 16, 2021

Press Release

IEEFA Europa: El exceso de capacidad y una fiebre por invertir suben las facturas de los consumidores españoles, pero Enagás se lucra

September 16, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.