Queensland

Latest Queensland Research

See more >

A move into Australian coal mining doesn’t change long-term outlook for Thungela

March 06, 2023

Simon Nicholas

Analysis

Is Japan’s biggest steelmaker really considering more metallurgical coal investments?

July 18, 2022

Simon Nicholas

Analysis

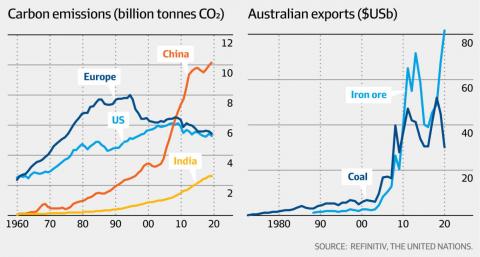

What is the real cause of Australia's energy crisis – and what should we do?

June 07, 2022

Tristan Edis

Analysis

IEEFA Australia: How fossil fuel subsidies are thwarting Queensland’s renewable energy ambitions

November 26, 2021

Tim Buckley

Analysis

IEEFA: The cash hit-list to counter climate change

November 09, 2021

Adrian Blundell-Wignall

Analysis

IEEFA Australia: Solar export tax is two steps forward, one leap backwards for electricity consumers

August 13, 2021

Gabrielle Kuiper

Analysis

IEEFA: Dalrymple Bay Infrastructure overvalued, overleveraged, over-promised, likely to under-deliver

December 07, 2020

Trista Rose

Analysis

IEEFA update: Dalrymple’s potential stock market debut

October 19, 2020

Trista Rose

Analysis

IEEFA: Grid scale battery costs have reached a tipping point

September 04, 2020

Bruce Robertson

Analysis

IEEFA: Dubbo’s new renewables zone shows the path away from fossil fuels

July 07, 2020

Bruce Robertson

Analysis

IEEFA update: One of NSW’s major coal customers is going through transition pains

June 10, 2020

Simon Nicholas

Analysis

IEEFA Australia: Investing in carbon capture and storage and relying on voluntary actions on emissions is like revisiting the olden days

May 19, 2020

Tim Buckley

Analysis

Latest Queensland Reports

See more >

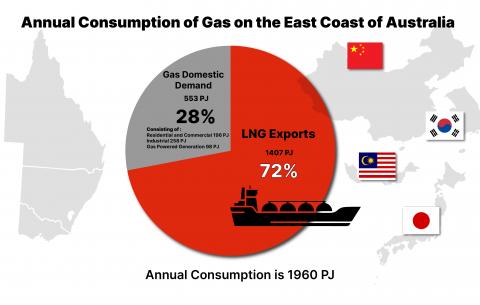

What’s a fair price for domestic gas? $12 per gigajoule is too high

December 07, 2022

Bruce Robertson

Report

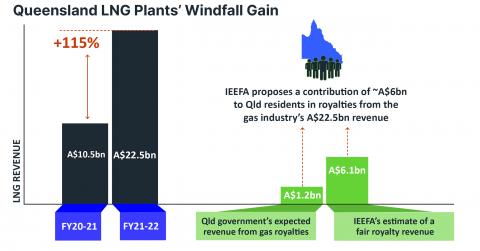

The extraordinarily profitable gas market should bring billions more royalties for Queenslanders

July 13, 2022

Bruce Robertson, Milad Mousavian

Report

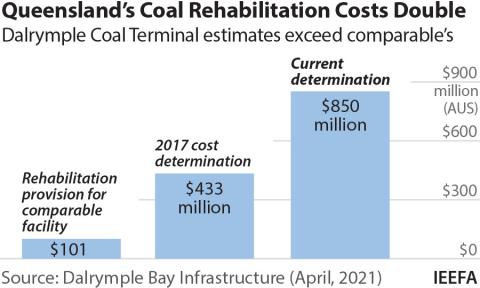

Queensland Competition Authority should exit Dalrymple Bay Coal Terminal pricing regulation

May 01, 2021

Owen Evans

Report

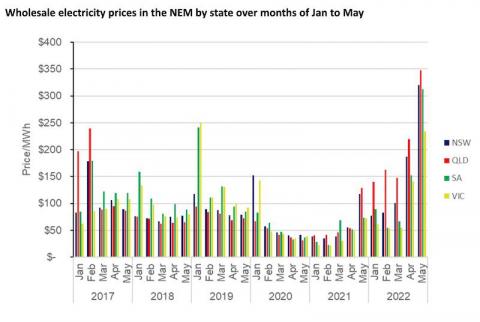

Fast erosion of coal plant profits in the National Electricity Market

February 24, 2021

Johanna Bowyer, Tristan Edis

Report

An aluminium-led energy and industry renewal for Central Queensland

September 14, 2020

Clark Butler

Report

Narrabri Gas Project in Australia - Supplementary Submission

September 01, 2020

Bruce Robertson

Report

Is the gas industry facing its Volkswagen moment?

March 01, 2020

Bruce Robertson

Report

CSG what is in it for Queensland

October 01, 2019

Bruce Robertson

Report

Adani Carmichael contractor risks

August 01, 2019

Tim Buckley

Report

Billionaire Adani Being Subsidised for Carmichael Thermal Coal Mine - Adani's Thermal Coal Mine in Queensland Will Never Stand on Its Own Two Feet

August 01, 2019

Tim Buckley

Report

Towards a domestic gas reservation in Australia

July 01, 2019

Bruce Robertson

Report

Conflating Queensland's coking and thermal coal industries

June 01, 2019

Tim Buckley, Simon Nicholas

Report

Latest Queensland Press Releases

See more >

Queensland is missing out on A$5 billion of royalty revenue while gas industry profits soar 115%

July 14, 2022

Press Release

IEEFA: QCA increase of Dalrymple Bay Coal Terminal’s remediation provisions to $850m concerning

May 10, 2021

Press Release

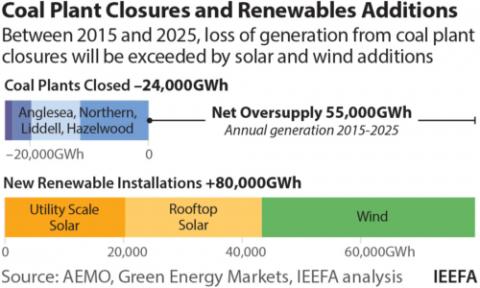

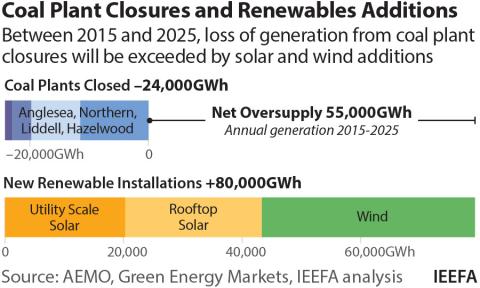

IEEFA: Coal plant closures imminent in Australia as renewable energy surges

February 24, 2021

Press Release

IEEFA Australia: Investing in renewable energy will repower aluminium and heavy industry sectors

September 14, 2020

Press Release

IEEFA Australia: The state of NSW should not sponsor a loss-making, wealth destroying industry

August 26, 2020

Press Release

BHP coal assets worth a billion less than just two years ago

August 10, 2020

Press Release

IEEFA: How aluminium smelters can help decarbonise Australia’s industrial economy

June 11, 2020

Press Release

IEEFA: Volkswagen lied about emissions from their vehicles, and the gas industry is also lying about their emissions

March 05, 2020

Press Release

IEEFA Australia: Adani Group to receive up to $900m in early Christmas present from Queenslanders

November 28, 2019

Press Release

IEEFA Australia: Oil and gas industry paying less tax than Telstra

November 25, 2019

Press Release

IEEFA update: Coal seam gas is high cost gas for Queenslanders

October 30, 2019

Press Release

IEEFA Australia: Australian taxpayers funding subsidies worth billions for Adani’s Carmichael thermal coal mine

August 29, 2019

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.