New South Wales

Latest New South Wales Research

See more >

Slides: ESB Capacity Mechanism Proposal and other options

June 27, 2022

Johanna Bowyer

Analysis

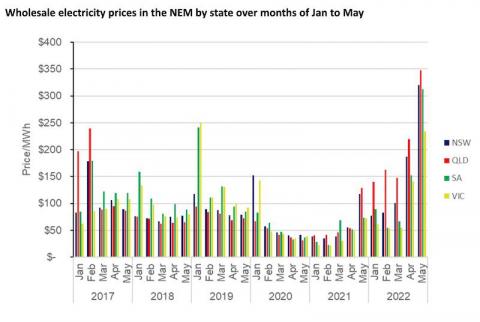

What is the real cause of Australia's energy crisis – and what should we do?

June 07, 2022

Tristan Edis

Analysis

Happy birthday to Snowy 2.0 in Australia

May 20, 2022

Owen Evans

Analysis

IEEFA Australia: Eraring’s 2025 exit and Mike Cannon-Brookes/ Brookfield proposed AGL takeover could reduce power bills

March 01, 2022

Johanna Bowyer

Analysis

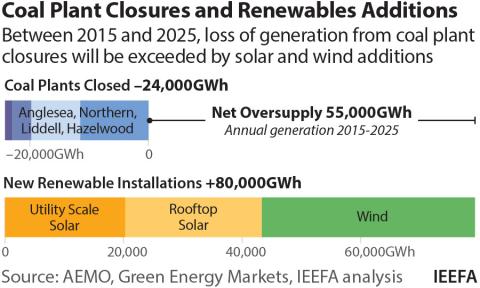

Early Eraring coal plant closure highlights future of energy system is renewables and storage

February 17, 2022

Johanna Bowyer

Analysis

IEEFA Update: Bylong Coal Project exhausts its last legal avenue

February 17, 2022

Simon Nicholas

Analysis

IEEFA: Deutsche Bank claims responsible climate leadership while bankrolling yet more thermal coal

December 16, 2021

Tim Buckley

Analysis

IEEFA Australia: Solar export tax is two steps forward, one leap backwards for electricity consumers

August 13, 2021

Gabrielle Kuiper

Analysis

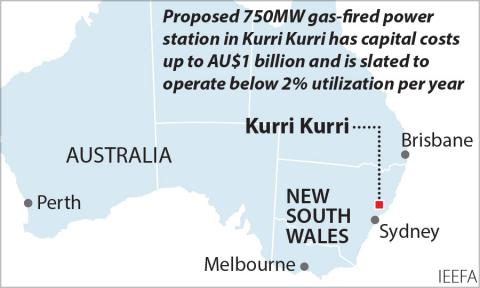

The Kurri Kurri gas-fired plant in Australia is A$1 billion white elephant

August 11, 2021

Owen Evans

Analysis

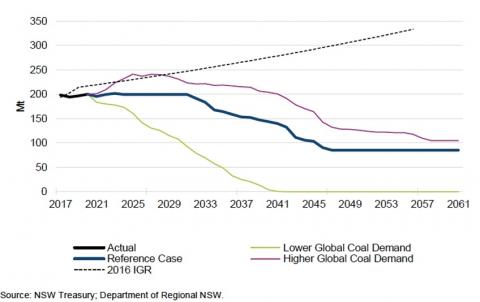

IEEFA Australia: NSW Government accepts that thermal coal is set for major decline

June 11, 2021

Simon Nicholas

Analysis

NSW government sensibly resists temptation to tax electric vehicles

June 11, 2021

Owen Evans

Analysis

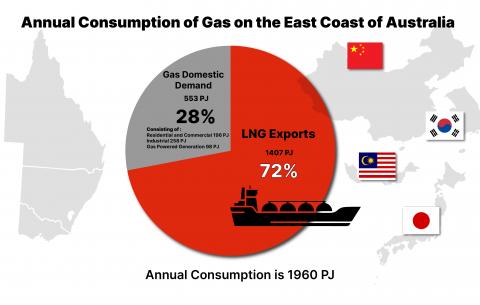

IEEFA Australia: Why ‘gold-plated’ gas plan makes zero sense

May 20, 2021

Bruce Robertson

Analysis

Latest New South Wales Reports

See more >

What’s a fair price for domestic gas? $12 per gigajoule is too high

December 07, 2022

Bruce Robertson

Report

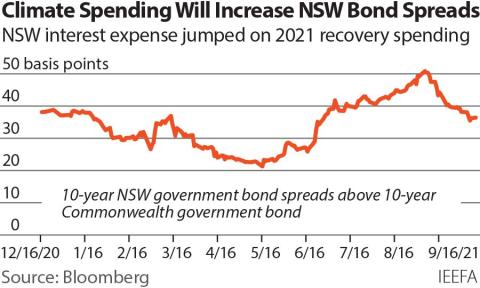

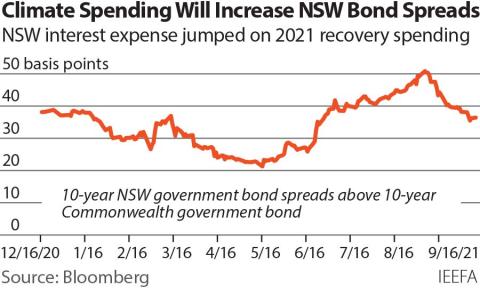

Climate risk and the cost of capital in NSW

October 01, 2021

Trista Rose

Report

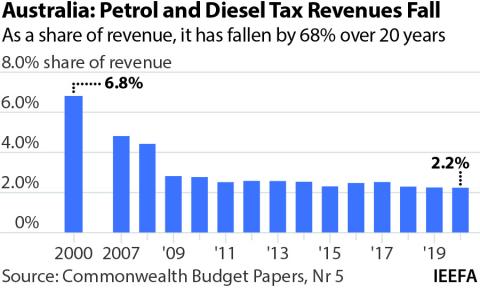

Perceived road revenue and excise tax gap not a barrier to EVs

June 01, 2021

Owen Evans

Report

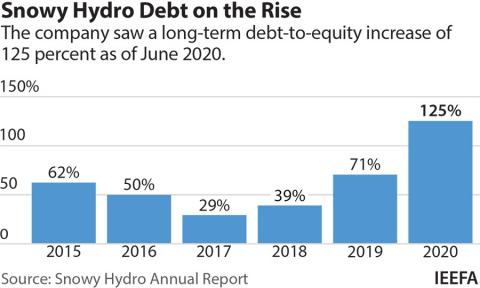

Snowy Hydro's cash drain

November 01, 2020

Tim Buckley, Trista Rose

Report

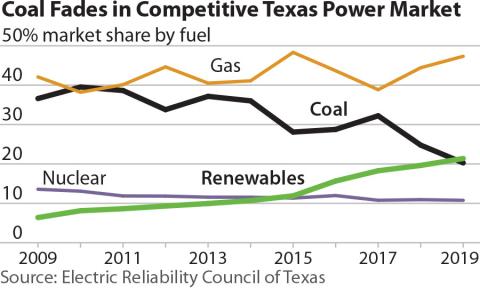

In U.S. oil country, renewables reign

October 01, 2020

Clark Butler, Clark Williams-Derry

Report

Narrabri Gas Project in Australia - Supplementary Submission

September 01, 2020

Bruce Robertson

Report

Divestment vs sterilisation: What to do with BHP’s stranded coal assets

August 10, 2020

Tim Buckley

Report

Reviewing key proposals by the COVID-19 Advisory Board to subsidise the gas industry

August 01, 2020

Bruce Robertson

Report

Why aluminium smelters are a critical component in Australian decarbonisation

June 11, 2020

Clark Butler

Report

Gas cannot stimulate the economy, reduce emissions or provide cheap power

June 01, 2020

Bruce Robertson

Report

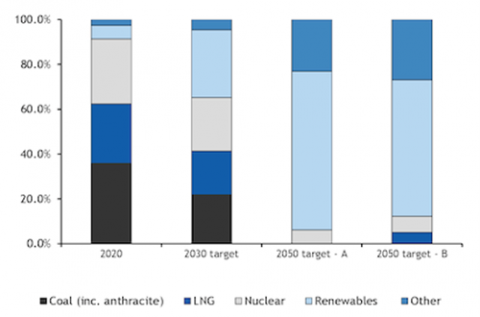

Southeast and East Asia catching up in global race to exit coal

April 01, 2020

Tim Buckley

Report

Is the gas industry facing its Volkswagen moment?

March 01, 2020

Bruce Robertson

Report

Latest New South Wales Press Releases

See more >

IEEFA: Australia’s climate policies could push New South Wales into a debt spiral

October 20, 2021

Press Release

A loss of excise tax revenue should not stall the uptake of electric vehicles in Australia

June 08, 2021

Press Release

IEEFA: Coal plant closures imminent in Australia as renewable energy surges

February 24, 2021

Press Release

IEEFA: Snowy Hydro gas plant expansions likely to be fuelled with taxpayer funds

November 18, 2020

Press Release

IEEFA: What Australia can learn from Texas’ embrace of clean energy

October 19, 2020

Press Release

Gas and electricity prices will rise if Narrabri gas fields in Australia approved

September 29, 2020

Press Release

Australia's COVID-19 Advisory Board wants government to subsidise failing gas industry

August 27, 2020

Press Release

IEEFA Australia: The state of NSW should not sponsor a loss-making, wealth destroying industry

August 26, 2020

Press Release

BHP coal assets worth a billion less than just two years ago

August 10, 2020

Press Release

IEEFA: How aluminium smelters can help decarbonise Australia’s industrial economy

June 11, 2020

Press Release

IEEFA: Australia’s gas industry was already failing before COVID-19

June 04, 2020

Press Release

IEEFA Australia: Auditors take note – Santos’ accounts misleading since 2014

March 31, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.