Galilee Basin, Queensland, AU

Latest Galilee Basin, Queensland, AU Research

See more >

IEEFA Australia: Captive insurers threaten an orderly coal exit

December 23, 2021

Nick Holmes

Analysis

IEEFA: The cash hit-list to counter climate change

November 09, 2021

Adrian Blundell-Wignall

Analysis

IEEFA update: The Adani juggernaut is expanding on all fronts, Australian coal needs not be one of them

October 29, 2019

Tim Buckley

Analysis

IEEFA Australia: Adani’s ‘Pit-to-Plug Strategy’ Is Fraying at Both Ends

June 12, 2017

Tim Buckley

Analysis

IEEFA Australia: Adani Can’t Seem to Get the Public Subsidies It Requires for Its Carmichael Coal Project

May 23, 2017

Tim Buckley

Analysis

IEEFA Update: An Increasingly Cursed Australian Coal Project

April 24, 2017

Tim Buckley, Simon Nicholas

Analysis

IEEFA Update: Adani Has Gone Quiet on Its Australia Coal Mega-Project

February 17, 2017

Tim Buckley, Simon Nicholas

Analysis

IEEFA Asia: More Bad Numbers for Adani; a Renewables Merger in India; Change of Note in China

January 24, 2017

Tim Buckley, Simon Nicholas

Analysis

IEEFA Asia: Adani, in Latest Report to Investors, Skips Mention of Its Australian Coal Project

October 25, 2016

Tim Buckley

Analysis

IEEFA Australia: The Zombie Australian Coal Project That Won’t Die

October 11, 2016

Tim Buckley

Analysis

IEEFA Australia: World’s Biggest Open-Cut Coal Proposal is Smaller Now, Less Ambitious, Still Unbankable

September 23, 2016

Tim Buckley

Analysis

IEEFA Australia: Adani’s Carmichael coal project remains unbankable

August 29, 2016

Tim Buckley

Analysis

Latest Galilee Basin, Queensland, AU Reports

See more >

Adani: Remote prospect: Carmichael status update 2017

April 01, 2017

Tim Buckley, Simon Nicholas

Report

Sub-critical Australia' risks from market imbalance in the Australian National Electricity Market

May 01, 2016

Timothy King

Report

An overview of Adani Enterprises’ corporate restructuring

May 01, 2015

Tim Buckley

Report

Galilee Coal Basin: Carmichael - A stranded asset?

May 01, 2015

Tim Buckley

Report

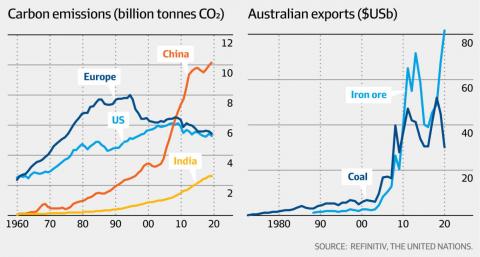

Global energy markets in transition

January 01, 2015

Tim Buckley

Report

The Narrabri Coal Seam Gas Project

December 01, 2014

Tim Buckley

Report

The outlook for financing for Australia's Galilee Basin coal proposals

October 01, 2014

Tom Sanzillo

Report

Fossil fuels, energy transition & risk

June 01, 2014

Tim Buckley

Report

Latest Galilee Basin, Queensland, AU Press Releases

See more >IEEFA Press Release: Adani’s Carmichael Idea Is More Unbankable Than Ever

April 24, 2017

Press Release

Carmichael Project: Downsized & Delayed Yet Again, and Still Unbankable

September 23, 2016

Press Release

New IEEFA Report: ‘Sub-Critical Australia’ East Coast Grid Needs an Electricity Market Plan

May 16, 2016

Press Release

Divestiture Movement, Deepening Distress of Coal Industry, Emerging Battles Over Solar, Overbuilding of Shale Gas Pipelines Highlight IEEFA Energy Finance 2016 Conference in New York City

February 29, 2016

Press Release

IEEFA Study: Corporate Restructuring at Adani Enterprises Enhances Shareholder Value; Marginalizes Australian Coal Project; Better Aligns Adani Group With Transformation of India’s Electricity Sector

May 04, 2015

Press Release

Global Energy Markets Transition Drives Thermal Coal Into Structural Decline

January 14, 2015

Press Release

Aussie Coal Advocates Solicit Global Banks; Oil-Price Drop Hurts Tar-Sands Prospects; More Coverage of IEEFA Port Report

December 01, 2014

Press Release

‘A Constellation of Risks’ on Tar Sands; Press Notes on IEEFA’s Galilee Coal Report; More on Prairie State-Paducah

October 28, 2014

Press Release

Galilee Mines Face Dim Future: IEEFA Analysts Highlight Major Investment Risk

October 22, 2014

Press Release

Press Release: Chinese Coal Import Tariffs Yet Another Blow to Australian Coal Exports

October 10, 2014

Press Release

Press release: Tide is turning against thermal coal – high cost new mines don’t make sense for investors

September 22, 2014

Press Release

Press release: Proposed Chinese coal regulations undermine Australian coal exports

September 17, 2014

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.