Canada is seldom considered a petrostate, but the northern nation produces 5.2 million barrels of oil every day, ranking fifth in global production. It’s also a major consumer of fossil energy, responsible for the fourth-largest amount of greenhouse gases among OECD nations. Western Canada's oil & gas sector produced a bulk of the 27% of total national GHG emissions in 2020. Onshore conventional and unconventional oil & gas production spreads across Northeast British Columbia to Southern Manitoba. The Oil Sands, focused in Alberta, are some of the highest emitting oil & gas projects on a per barrel basis. The Canadian Net-Zero Emissions Accountability Act, passed in 2021, commits the country to reach net-zero emissions by 2050.

Latest Canada Research

See more >

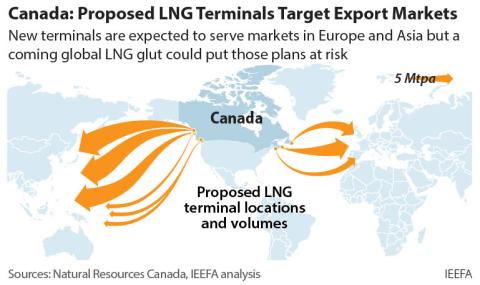

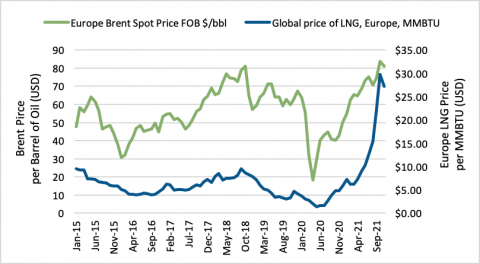

Canadian LNG expansion does not make sense, regardless of U.S. LNG pause

March 04, 2024

Mark Kalegha, Christopher Doleman

Analysis

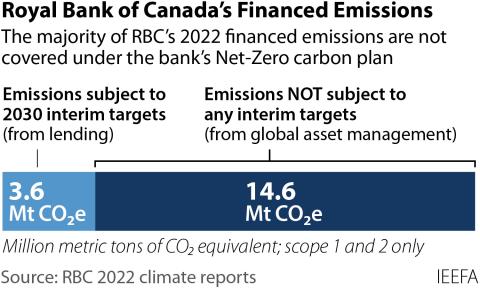

The Royal Bank of Canada’s climate policy has come under close scrutiny from its stakeholders

October 05, 2023

Mark Kalegha

Analysis

Stakeholder concerns about British Columbia Investment Management Company (BCI)’s fossil fuel investments do not appear to be letting up anytime soon

May 22, 2023

Mark Kalegha

Analysis

Carbon Capture: CCS | CCUS | CCU

September 12, 2022

Bruce Robertson

Slides

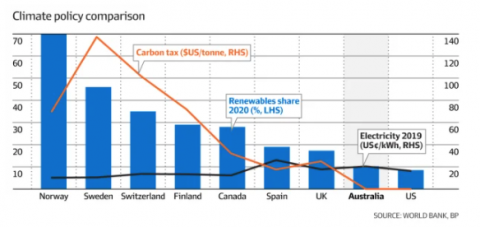

IEEFA Australia: The case for introducing a carbon tax

March 15, 2022

Adrian Blundell-Wignall

Analysis

IEEFA: India’s technology path key to global steel decarbonisation

February 14, 2022

Soroush Basirat, Simon Nicholas

Analysis

IEEFA: ExxonMobil management fails to manage environment, climate issues

January 26, 2022

Tom Sanzillo

Analysis

IEEFA Update: Financing the future of green hydrogen

January 26, 2022

Tim Buckley

Analysis

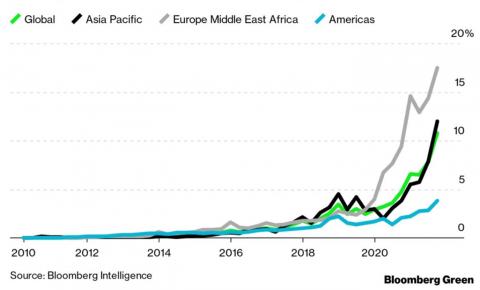

IEEFA: Skyrocketing EV sales in China spell a no-turning-back step change in global energy landscape

January 19, 2022

Tim Buckley

Analysis

IEEFA: Calls are mounting for a new direction and new chief executive for ExxonMobil

December 16, 2021

Tom Sanzillo

Analysis

IEEFA Update: COP26 is different to prior COPs

October 28, 2021

Tim Buckley

Analysis

IEEFA: Canada ban on shipping coal would equal scrapping as many as 3 million cars

October 27, 2021

Clark Williams-Derry

Analysis

Latest Canada Reports

See more >

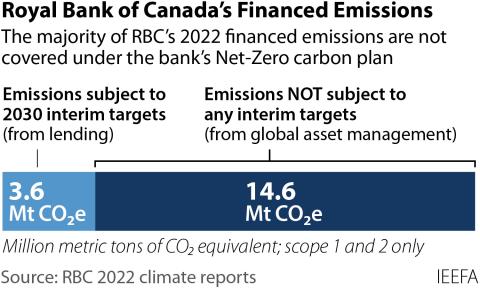

RBC net-zero engagement policy: A promising start that falls short on key element

February 13, 2024

Mark Kalegha

Report

Royal Bank of Canada: Falling short on climate change

August 29, 2023

Mark Kalegha, Tom Sanzillo, Suzanne Mattei...

Report

A strategic fossil fuel divestment policy would strengthen the British Columbia Teachers' Pension Plan

March 17, 2023

Mark Kalegha, Tom Sanzillo

Report

ArcelorMittal: Green steel for Europe, blast furnaces for India

February 16, 2023

Simon Nicholas, Soroush Basirat

Report

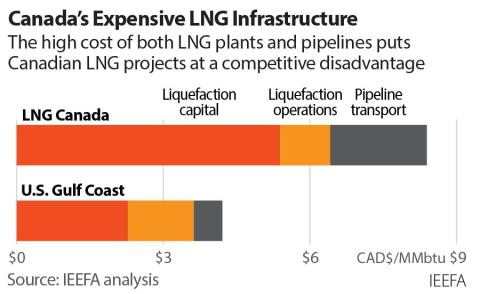

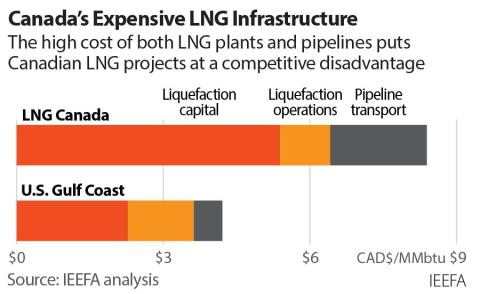

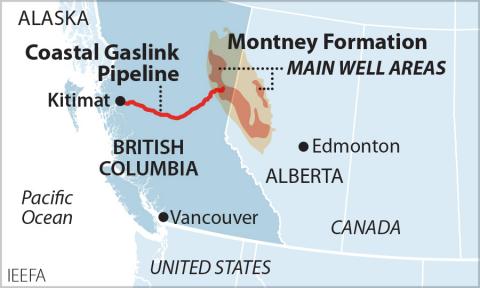

British Columbia LNG project costs rising again

February 01, 2023

Clark Williams-Derry

Report

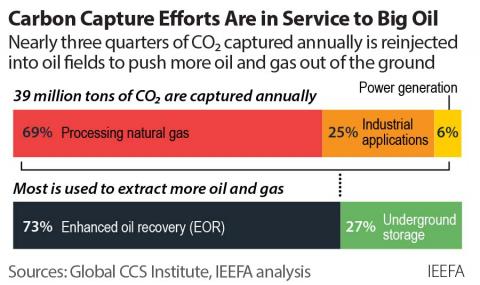

The carbon capture crux: Lessons learned

September 01, 2022

Bruce Robertson, Milad Mousavian

Report

Why the now-abandoned Keystone XL Pipeline was troubled from the start and today would not serve its purpose

June 24, 2022

Omar Mawji, Suzanne Mattei

Report

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

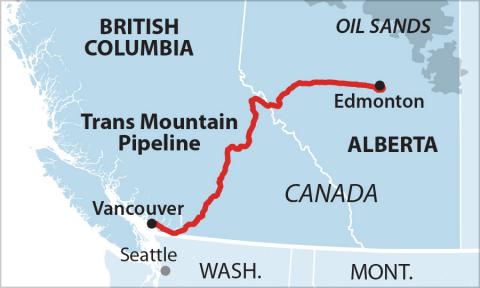

Trans Mountain expansion could never return the expected $26.1 billion spent by taxpayers

March 09, 2022

Tom Sanzillo, Omar Mawji

Report

Review of LNG Canada Project: Delays, Policy Changes, and Rising Costs

February 16, 2022

Omar Mawji, Brad Williams

Report

ExxonMobil: Permian leader or just another fracker?

June 10, 2021

Clark Williams-Derry, Tom Sanzillo

Report

Two years behind schedule, Boundary Dam 3 coal plant achieves goal of capturing 4 million metric tons of CO2

April 21, 2021

David Schlissel

Report

Latest Canada Press Releases

See more >

IEEFA Canada: Royal Bank of Canada falls short on client engagement strategy

February 13, 2024

Press Release

IEEFA Canada: Royal Bank of Canada is falling short on climate change pledges

August 29, 2023

Press Release

Divesting is the correct path for the British Columbia Teachers’ Pension Plan

March 20, 2023

Press Release

IEEFA North America: British Columbia LNG project costs rising again

February 01, 2023

Press Release

Carbon capture: a decarbonisation pipe dream

September 01, 2022

Press Release

Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

May 25, 2022

Press Release

IEEFA: Trans Mountain (TMX) pipeline ($17 billion+) will require even more Canadian taxpayer dollars to prop up

March 09, 2022

Press Release

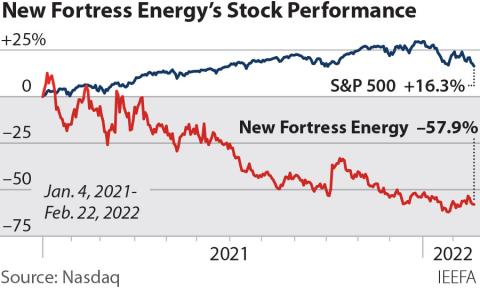

IEEFA: La expansión del gas de New Fortress Energy presenta mayores riesgos para los inversores

February 23, 2022

Press Release

IEEFA: New Fortress Energy gas expansion presenting increased risks to investors

February 23, 2022

Press Release

Federal blue hydrogen incentives: No reliable past, present or future

February 08, 2022

Press Release

IEEFA: LNG Canada’s BC project likely last for country’s liquefied natural gas industry

November 24, 2021

Press Release

IEEFA Europe: Overcapacity and investment fever push costs to Spanish consumers, yet Enagás profits

September 16, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.