Search

Duke Energy and costs of coal ash cleanup

Duke Energy and its subsidiary Duke Energy Carolinas are well-positioned to provide the needed …

Report

Key shortcomings in Duke Energy's North Carolina IRPs (Part 1)

Plans rely heavily on gas-fired plants, give short shrift to renewables

Report

Memo- Duke Energy and Costs of Coal Ash Cleanup

Memo on Duke Energy and Costs of Coal Ash Cleanup (pdf

Memo- Duke Energy and Costs of Coal Ash Cleanup

IEEFA update: Duke Energy’s costly Edwardsport coal-gasification project …

Duke Energy’s costly Edwardsport coal-gasification project …

Analysis

Energy Efficiency

Topic

Energy Markets

Topic

Energy Policy

Topic

Energy Security

Topic

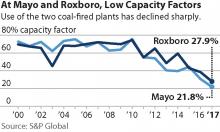

IEEFA U.S.: Two of Duke Energy’s plants in North Carolina reflect national trend …

U.S.: Two of Duke Energy’s plants in North Carolina reflect national trend …

Analysis