Melissa Brown

Former Director, Energy Finance Studies, Asia, Melissa Brown, a former securities analyst at JP Morgan and Citigroup, has played a leading role in various Asian investment organizations focused on mainstream and sustainable investment strategies for public and private equity investors over the past 25 years.

Research from Melissa Brown

See all Research from Melissa Brown >

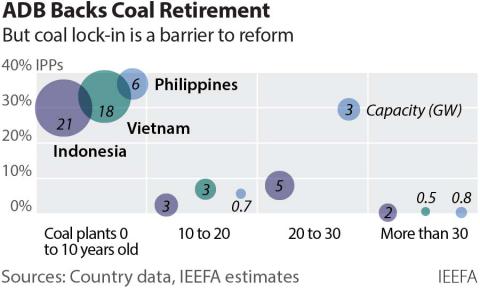

ADB backs coal power retirement in Southeast Asia

September 24, 2021

Melissa Brown, Grant Hauber

Report

New policy and market risks for U.S. LNG project sponsors in Emerging Asia

June 01, 2021

Sam Reynolds, Melissa Brown, Tom Sanzillo...

Report

Vietnam’s PDP8 pause is an opportunity to improve market structures

May 13, 2021

Melissa Brown

Report

Vietnam's PDP8 Pause Is an Opportunity to Improve Market Structures

May 01, 2021

Melissa Brown

Report

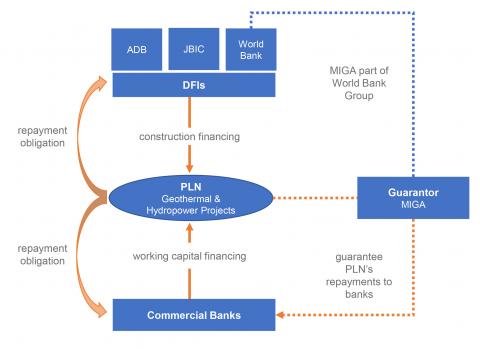

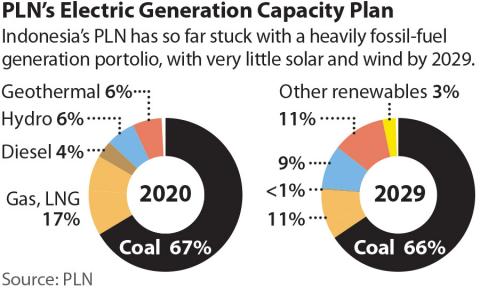

IEEFA: Who benefits from MIGA’s sustainable loan guarantee for PLN?

March 15, 2021

Melissa Brown

Analysis

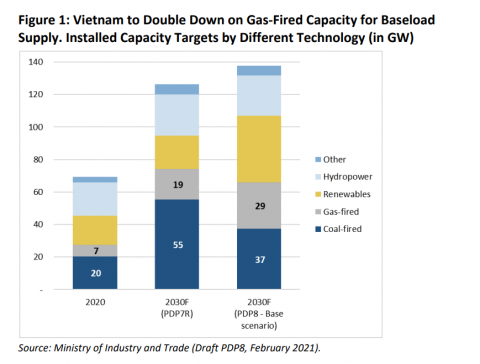

Vietnam's PDP8 should be a catalyst for innovation, not a barrier to change

March 01, 2021

Melissa Brown

Report

Philippines moratorium on coal projects will attract USD 30 billion in renewable energy investment

November 03, 2020

Sara Jane Ahmed, Melissa Brown

Report

Running out of options: Six questions for PLN

October 24, 2020

Melissa Brown

Report

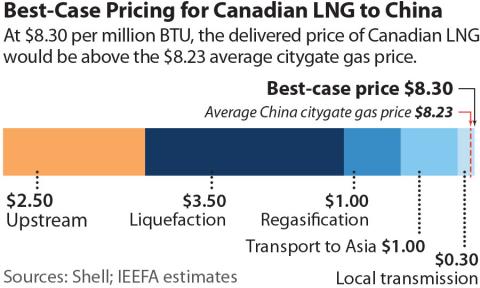

Conference Board of Canada doubles down on its losing LNG bet

October 19, 2020

Melissa Brown, Norman Waite

Report

Question Time for KEPCO's Board

June 01, 2020

Melissa Brown

Report

IEEFA update: What constitutes a good power system in a period of transition?

May 19, 2020

Melissa Brown

Analysis

PLN in crisis—time for independent power producers to share the pain?

April 07, 2020

Melissa Brown

Report

Posts from Melissa Brown

See all Posts from Melissa Brown >

High stakes for Asian Development Bank’s ambitious coal power retirement plan

September 24, 2021

Press Release

IEEFA: Uncertainty surrounds U.S. liquefied natural gas export projects in emerging Asia

July 09, 2021

Press Release

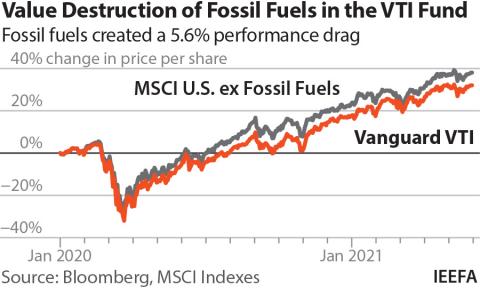

IEEFA: Vanguard funds destroy shareholder wealth with US$290bn in fossil fuels creating a 5.6% performance drag

June 22, 2021

Press Release

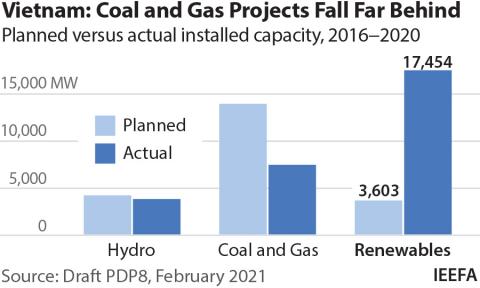

IEEFA: Vietnam’s PDP8 delay is an opportunity to unlock more cost-effective renewable energy

May 13, 2021

Press Release

IEEFA: Renewables should be focus of Vietnam’s Draft PDP8, not coal and gas

March 11, 2021

Press Release

IEEFA: Philippines coal moratorium highlights dramatic pivot to renewable energy investment for lower prices and power system resilience

November 03, 2020

Press Release

IEEFA: PLN still refusing to adapt, a move which will hurt investors, consumers, and the government purse

October 23, 2020

Press Release

IEEFA: Canadian assessment of LNG ‘rising tide’ would drown balance sheets in red ink

October 19, 2020

Press Release

IEEFA report: Question time for KEPCO’s board

June 02, 2020

Press Release

IEEFA Indonesia: Playing with matches—Who should take responsibility for PLN’s financial mess?

April 30, 2020

Press Release

IEEFA Indonesia: PLN in crisis—time for independent power producers to share the burden

April 07, 2020

Press Release

IEEFA South Korea: Doosan Heavy – time for a forensic audit

September 22, 2019

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.